How accurate are Latvijas Banka's inflation projections?

Latvia's consumer price inflation stood at 2.7% in 2019, 0.1 pp. lower than expected in the December Macroeconomic Developments Report and 0.2 pp. lower than projected at the end of 2018.

The European Central Bank (ECB) regularly assesses the accuracy of the inflation projections for the euro area countries provided by the respective central banks. Latvijas Banka also closely monitors the accuracy of its macroeconomic projections compared to those prepared by other private and public sector institutions and international organisations. In this article, we continue to analyse Latvijas Banka's Short-Term Inflation Projections (STIP) model by assessing its forecast accuracy (previous articles looked at the impact of global food commodity prices, domestic labour costs and oil prices on consumer prices). This series of articles is based on a recent working paper published by Latvijas Banka.

Why are inflation forecasts so important?

Price stability is a key monetary policy objective in the euro area. Monetary policy decisions affect inflation with a lag; therefore, ECB decisions are based not only on the current but also on the future inflation. Hence, accurate inflation forecasts form the basis for appropriate monetary policy. In practice, each central bank in the euro area produces inflation forecasts for its respective country and reports them to the ECB four times a year[1]. Further, the individual country inflation projections are aggregated to obtain the euro area inflation projections which serve as the basis for the ECB monetary policy decisions.

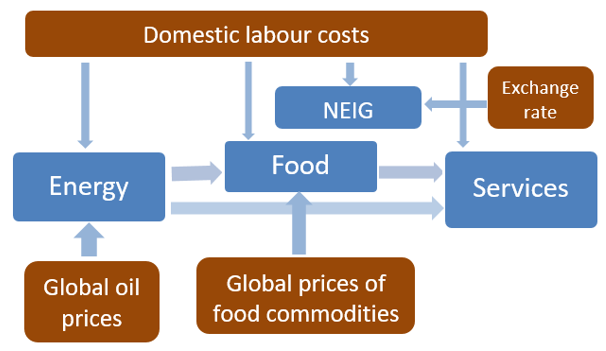

Latvia's inflation forecasts are produced using the STIP model developed by Latvijas Banka's economists. The STIP model assesses the direct and indirect effects of the four key factors behind inflation:

- global oil prices directly affect energy prices and, through fuel prices, they also indirectly affect the consumer prices of food products and some services;

- global prices of food commodities affect food consumer prices and, indirectly, the consumer prices of the catering services which form part of services prices;

- the impact of the exchange rate is mainly reflected in the consumer prices of non-energy industrial goods (NEIG) which are to a large extent imported from non-euro area countries;

- domestic labour costs affect almost all consumer price components both directly and indirectly (Figure 1).

Figure 1. Schematic overview of the Short-Term Inflation Projections (STIP) model

Notes. The blue and orange boxes represent HICP components and their main determinants respectively. The food component represents both unprocessed and processed food prices.

Since the consumer prices of various goods and services are affected by different determinants, each of the 34 consumer price components[2] is estimated separately. In this article, we look at the accuracy of inflation forecasts for 5 components: prices of unprocessed food, processed food, energy, industrial goods and services.

How to assess the accuracy of inflation forecasts?

Any economic forecaster would agree that forecast errors are inevitable. This is simply because any model is a mere approximation of reality and cannot describe the real processes perfectly. The same holds true for inflation forecasting models. First, consumer prices can be affected by a number of factors that cannot be predicted in advance (for example, extension of sale discounts by a retail store chain or poor vegetable harvest due to bad weather conditions). Second, even if the model describes the dynamics of past inflation accurately, it does not necessarily mean that it will accurately predict the future inflation as the impact of determinants on inflation may change over time.

Nevertheless, inflation forecast errors can and should be reduced, and this is exactly what the economists of the euro area central banks are concerned with. The development of inflation forecasting models is a "never-ending story", with new improvements continuously introduced into the models. Two criteria were set for the STIP inflation forecasting model:

- the errors of the STIP model shall be lower than those of a simple benchmark model. In this case, the simple benchmark model is a random walk, i.e. current inflation depends solely on the past inflation;

- the errors of the STIP model shall be lower than those identified in current Latvijas Banka's forecasting.

To test the predictive accuracy of the STIP model, we first establish the relationships between consumer prices and their determinants. Next, we set up an out-of-sample forecasting exercise and assess the accuracy of the STIP inflation forecasts for 2014–2018 compared to both the benchmark model and the previous inflation forecasts of Latvijas Banka conducted during the official Eurosystem’s projection exercises in 2014–2018.

In other words, we go back to the beginning of 2014 and forecast inflation for 12 months ahead. We repeat this exercise 20 times, thus simulating the official inflation projection rounds carried out every 3 months (i.e., in February 2014, May 2014, August 2014 and so on until November 2018). We collect the historical vintages of inflation forecasts and compare them to the actual outcomes to examine whether the STIP model constitutes an improvement on the benchmark model and the current inflation forecasting practice at Latvijas Banka in terms of its forecasting accuracy. The STIP model also requires assumptions, i.e. forecasts of inflation determinants. We set the assumptions based on the historical data available at the time (the only difference being the new STIP model).

How accurate is the STIP forecasting model?

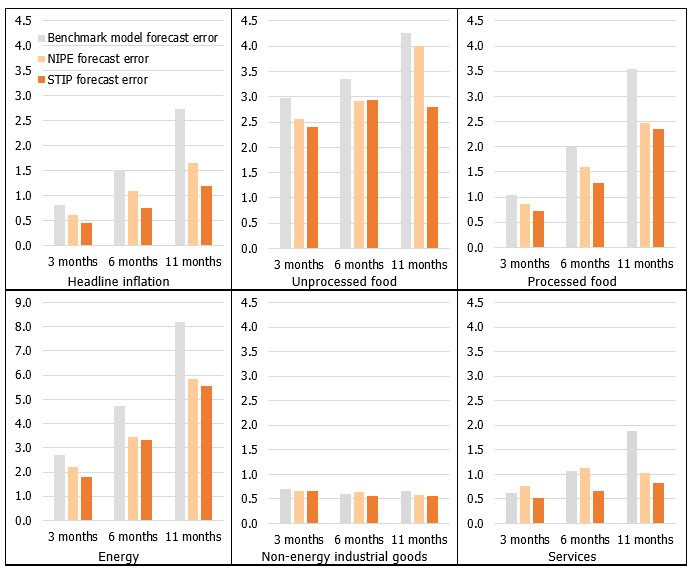

As a result of the forecast evaluation exercise we have found that the accuracy of the STIP model-based inflation forecasts is greater compared to the forecasts based on the benchmark model. Moreover, the STIP inflation forecasts are more accurate than Latvijas Banka's inflation forecasts submitted to the ECB during the official projection exercises in 2014–2018[3] (Figure 2; Figure A1). This finding highlights the importance of improvements in the modelling and forecasting practices of Latvijas Banka.

The analysis of forecast errors also shows that:

- short-term inflation forecasts are always more accurate than the medium-term ones. It is easier to forecast inflation a couple of months, rather than a year, ahead. This conclusion holds for both headline inflation and its components;

- some components of inflation can be forecasted more accurately than others. High volatility of consumer prices leads to large forecast errors. For example, the forecast errors of non-energy industrial goods and services prices are relatively small compared to those of other components owing to relatively rigid price formation (think of "menu" costs). On the other hand, high volatility in consumer energy prices is driven by daily fluctuations in crude oil prices and their rapid transmission to consumer fuel prices. Meanwhile, the high volatility in unprocessed food prices by and large can be attributed to volatility in harvests and changing weather conditions;

- the inflation forecasts of the benchmark model are quite accurate at very short horizons (one to two months). However, since the transmission of the main inflation determinants, i.e. labour costs and global food commodity prices, to consumer prices takes several months, the STIP model significantly outperforms the benchmark model, particularly in the long run.

Figure 2. Inflation forecast errors of the benchmark model, STIP model and NIPE in 2014–2018

Notes: Inflation forecast errors are expressed in terms of the root mean squared forecast error. The benchmark model is a random walk. NIPE forecasts are official Latvijas Banka's inflation forecasts submitted to the ECB in 2014–2018. The STIP forecasts are inflation forecasts obtained using the STIP model in a real-time setup (i.e., projections are obtained based on sets of quarterly data for 2014–2018).

Why cannot inflation be predicted disregarding other economic indicators?

The inflation forecast accuracy depends not only on the identified relationships between consumer prices and their determinants, but also on the accuracy of the projected inflation determinants themselves. For instance, if domestic labour costs rise faster than expected, inflation is likely to be underprojected.

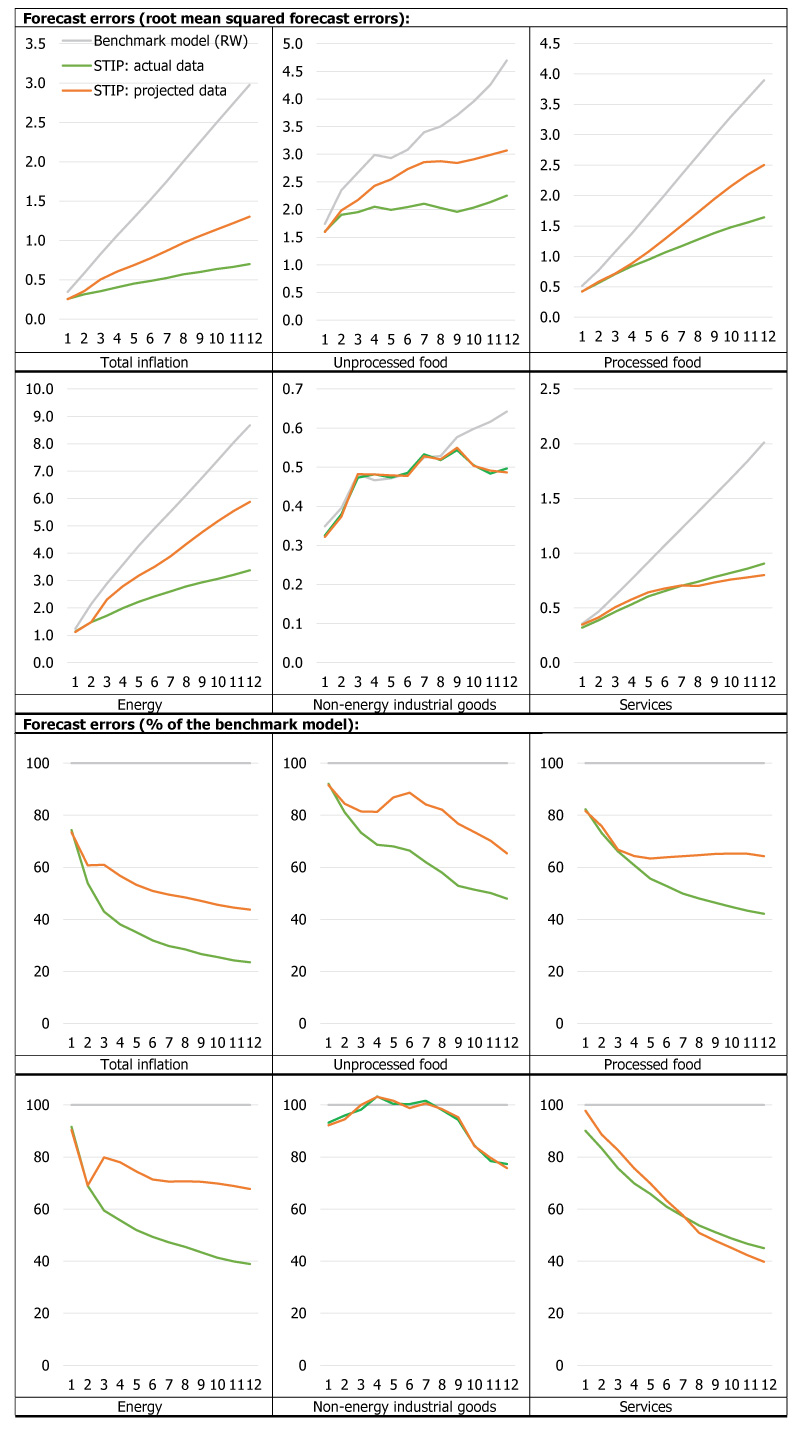

To what extent are inflation forecast errors caused by under- or overprojections of the developments in inflation determinants? To answer this question, we have simulated a real-time projection exercise using inflation determinants at their actual values, i.e. assuming we can accurately predict the path of inflation determinants.

Our assessment shows that accurate predictions of inflation determinants would reduce the forecast errors for energy prices by 30% and those for food prices by 20% (12 months ahead; Figure A2). This insight shows that the accuracy of forecasting the development of inflation determinants is as important as the accuracy of forecasting inflation itself - the more accurate the forecasts of inflation determinants, the more accurate the forecasts of inflation.

Conclusions

Latvijas Banka's economists have built a new STIP model which projects inflation developments in Latvia over a short-term horizon. The STIP model establishes relationships between 34 consumer price components and their determinants, with the domestic labour costs, crude oil prices, global food commodity prices and exchange rates being the most important ones.

The forecasts of the STIP model are more accurate than those of the benchmark model as the inflation determinants help to enhance the accuracy of inflation forecasts[4]. Furthermore, the forecast accuracy of inflation determinants is as important as the accuracy of forecasting inflation itself. The more accurate the forecasts of inflation determinants, the more accurate the forecasts of inflation.

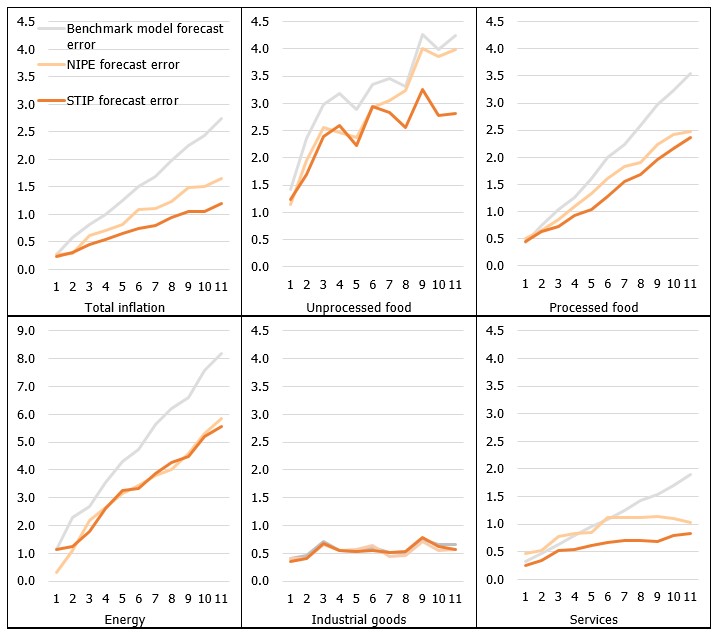

Figure A1. Inflation forecast errors of the benchmark model, STIP model and NIPE in 2014–2018 (forecast horizon: 1–11 months)

Notes. Inflation forecast errors are expressed in terms of the root mean squared forecast error. The benchmark model is a random walk. NIPE forecasts are official Latvijas Banka's inflation forecasts submitted to the ECB in 2014–2018. The STIP forecasts are inflation forecasts obtained using the STIP model in real-time setup (i.e., projections are obtained based on sets of quarterly data for 2014–2018).

Figure A2. Inflation forecast errors of the benchmark model, the STIP model based on actual data and the STIP model based on projected data (forecast horizon: 1–12 months; 2014–2018)

Notes. Inflation forecast errors are expressed in terms of the root mean squared forecast error. The benchmark model is a random walk. The STIP forecasts based on projected data rely on projected inflation determinant values. Meanwhile, the STIP forecasts based on actual data rely on actual inflation determinant values.

[1] Under the framework of BMPE and NIPE forecasting rounds. For more information on the euro system macroeconomic forecasts, see "A guide to the Eurosystem/ECB staff macroeconomic projection exercises", European Central Bank (2016).

[2] Of which 5 are unprocessed food prices, 12 – processed food prices, 6 – energy prices, 3 industrial goods prices and 8 groups of service prices.

[3] These projections were based on the previous version of the STIP model.

[4] Compared to situation when inflation depends only on the previous period inflation.

Textual error

«… …»