What are the direct effects of oil price developments on Latvia's inflation?

For Latvijas Banka Monthly Newsletter, In Focus, January, 2016

Demand and supply factors have caused global oil prices to decline by 35% in euro terms in 2015. As the oil price is a significant cost component in the prices on certain goods and services, a change of such a magnitude has quite significant implications for Latvia's inflation. The plunging oil prices have a direct effect on fuel prices in Latvia. Nevertheless, there are some nuances as to the way and extent of this influence.

Several economic and political developments have had significant implications for the global oil price dynamics in the last two years. In 2015, demand and supply factors caused oil prices to decline by an average of 35% in euro terms. The plunging oil prices had a fairly notable effect on petrol and diesel prices in Latvia as well as affected the harmonised index of consumer prices (HICP).

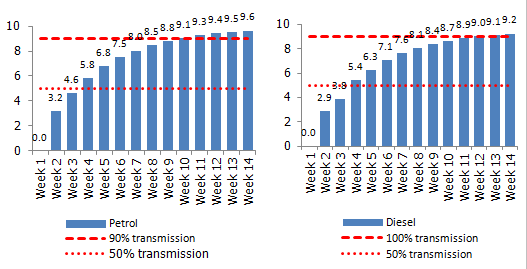

Oil is refined into fuel and distributed to final consumers via gas stations. The econometric estimates of Latvijas Banka show that the transmission of oil prices to the prices of petrol/diesel before taxes is complete. This means that the refining and distribution margins (i.e. the costs and margins from refining crude oil and distribution of fuel) do not respond to the oil price developments in the long-term, despite elevated volatility of the oil prices in the recent past. On average, fuel producers and retailers do not have excessively high profit margins from the rises and falls of the oil prices in the long-term. However, there are some deviations in the short-term. The speed of transmission is quite high: 50% of the oil price increase/decrease is passed on to consumers already within four weeks, whereas 90% within the span of 10 to 12 weeks (see Chart 1). The transmission of oil prices into petrol prices is slightly quicker than that into diesel prices. Moreover, our estimates show no evidence of the asymmetric effect in Latvia's case. This means that the response of fuel prices in Latvia to both rises and falls of the global oil prices is overall similar.

Chart 1 Transmission of oil price changes (of 10 euro cents) into petrol and diesel prices before taxes (left-hand and right-hand panels respectively)

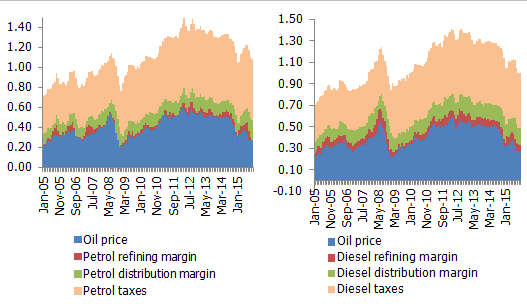

Oil products are subject to indirect taxes: excise tax and VAT account for a major share of the final price of fuel (see Chart 2). The rate of the excise tax is fixed per 1 litre of fuel and does not depend on the fuel price before taxes. This means that the excise tax share in the final consumer price increases/decreases along with the falling/rising of oil prices. The contributions of the oil prices also decrease/increase accordingly. Where the oil price changes by, e.g. 10%, the percentage change of the fuel price (i.e. fuel price elasticity) is also a variable depending on the oil price contribution. The bigger the contribution of crude oil to the fuel price, the higher the percentage change of the fuel price. Currently, taxes account for more than a half of the petrol and diesel prices, while the contribution of the oil price has been lower at about 30% in 2015.

Finally, we could also examine the degree of the fuel price elasticity to changes in oil prices and thus also estimate the extent of the impact from the plummeting oil prices on Latvia's HICP in 2015. The elasticity of fuel prices after taxes depends on the contribution of oil prices to the consumer prices of fuel. In 2014, contribution was around 37%. This means that a 10% year-on-year decline in oil prices as compared to 2014 would translate in a 3.7% reduction of fuel prices. Oil prices fell by an average of 35% in euro terms in 2015, resulting in a downward effect of 13.2% on fuel prices and a 0.8% decrease of the HICP (i.e. the contribution of the declining oil prices to HICP inflation amounted to 0.8 percentage point). The beginning of 2016 saw further declines in oil prices. If this trend persists, oil prices may continue having a significant negative impact on inflation this year as well.

Chart 2 Decomposition of fuel and diesel prices (left-hand and right-hand panels respectively)

Source: Bloomberg, European Commission and authors' estimates.

Textual error

«… …»