Mortgage lending: what is going on in Latvia's regions?

In short

-

Residential lending is concentrated in Riga city and Riga region (Pieriga);

-

Regional disparities in residential lending have increased significantly over the past few years, and it can be said that interbank competition is insufficient in regions;

-

Lending conditions vary across regions. The most stringent conditions governing lending can be observed in Latgale, but in Riga city, Riga region and Zemgale they are more favourable;

-

The regional dimension should be incorporated in the state support programme for house purchase for families with children (providing more support to regions outside Riga city and Riga region).

As of the second quarter of 2018, the Credit Register maintained by Latvijas Banka provides information on the real estate collateral location, which makes it possible to carry out the analysis of lending for house purchase by Latvia's regions. This article analyses loans for house purchase in regions between the second quarter of 2018 and the second quarter of 2021.

The first conclusion drawn from the Credit Register data: residential lending is concentrated in Riga city and Riga region (see Chart 1). In June 2021, loans to households for house purchase secured with the real estate registered in the above regions constituted 82.1% of all housing loans. By contrast, the share of real estate registered in Latgale constitutes only 1.5% of housing loans.

Chart 1. Loans to households for house purchase by region in late June 2021 (%)

The housing loan stock and gross domestic product (GDP) ratio is higher in Riga city and Riga region. Although the loan-to-GDP ratio in Riga city and Riga region is close to the country's average ratio (16.0% in 2018 and 15.9% in 2019 ) and is considered low, it is much lower in all other regions. The loan-to-GDP ratio in Latgale was only 4.3% in 2018 and 3.7% in 2019.

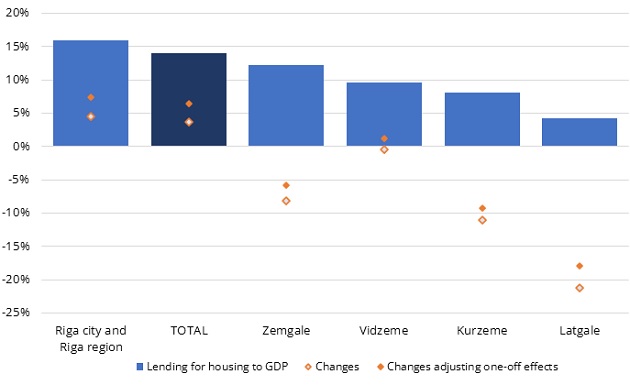

Moreover, the recent years have seen regional disparities in lending for housing increase considerably (see Chart 2). This leads to another conclusion: competition between commercial banks is insufficient in regions. Following the prolonged period of weak lending experienced for ten years after the previous crisis, lending for house purchase in Latvia has generally picked up substantially from the beginning of 2019. However, this increase is limited to Riga city and Riga region only, with loans expanding by 7.5% by June 2021. One large market participant experienced a notable contraction in loans for house purchase in all regions, which could be attributed to the fulfilment of its strategic objectives. This drop was more than offset by other banks operating in Riga city and Riga region and sufficiently compensated by banks in Vidzeme. By contrast, lending activity in Latgale and Kurzeme, where it was already very low before, continued on a sharp downward trend and contracted by 17.9% and 9.3% respectively over two and a half years. All largest banks saw loans for house purchase decrease in these regions.

Chart 2. Changes in loans to households for house purchase in June 2021 compared to late 2018 and the ratio of these loans to GDP in 2018

Sources: Central Statistical Bureau of Latvia and Latvijas Banka's estimates.

The analysis of new loans for house purchase granted between July 2018 and June 2021 provides a better picture of lending trends by region. Riga city and Riga region heavily dominate with regard to new loans, i.e. 88.3% of all loans for house purchase were granted in Riga city and Riga region in the first half of 2021. On the contrary, only 11.7% of loans for house purchase were granted in all other regions despite the fact that the share of these regions in the country's overall GDP constituted 28.4% in 2018 and 30.3% in 2019. The share of Latgale in new loans was only 0.8% (the region's share in the country's GDP stood at 6.4% in 2018 and 6.6% in 2019).

Chart 3. New loans to households for house purchase by collateral region (millions of euro)

Source: Latvijas Banka's estimates.

Although new loans for house purchase followed an upward path in most of the regions in late 2020 and in 2021, it was dynamics in Riga city and Riga region that almost entirely determined the overall increase in new loans (see Chart 3). It should be noted that Riga region is a statistical region, but geographically it is a relatively vast region that covers all former territories of Ogre, Tukums and Limbaži districts

With demand for larger housing expanding, the average size of a loan is gradually growing. On average, a state guarantee is used to obtain larger loans (see Chart 4). In the first half of 2021, the number of loans exceeding 100 thousand euro rose most notably and, moreover, 60% of them involved a state guarantee. The average size of housing loans is expanding in all regions, but that of loans involving the state guarantee experiences a faster upswing (since late 2019, by 24% as regards loans with a state guarantee and by 15% – without a state guarantee). The average size of a housing loan with a state guarantee exceeded 100 thousand euro in Riga region (in late June 2021, it was 104 thousand euro, while in Latvia as a whole – 84 thousand euro).

Chart 4. Average size of new housing loans (thousands of euro)

Source: Latvijas Banka's estimates.

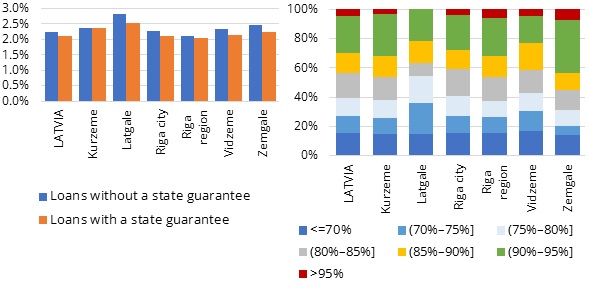

Lending conditions also vary across regions (see Chart 5(a)). The most stringent conditions prevail in Latgale, while Riga city and Riga region enjoy lower interest rates. In the first half of 2021, interest rates were only slightly higher in Vidzeme and Zemgale (0.1 percentage point (pp) and 0.2 pp respectively), but the difference was more pronounced in Kurzeme and Latgale (higher by 0.4 pp and 0.6 pp respectively). Interest rates on loans with a state guarantee are lower, and this is a further incentive for borrowers to seize this opportunity if they meet the conditions set out in the programme.

The highest loan-to-value (LTV) ratio for new loans is observed in Zemgale, since borrowers of this region used state guarantees (68% of all housing loans granted in the region) more often than borrowers in other regions, and LTV very often exceeded 90% in cases where they were employed. LTV distribution for loans granted in Latgale is the most conservative one (see Chart 5(b)).

Chart 5. Lending conditions for new loans for house purchase granted in the first half of 2021

(a) interest rates (b) LTV distribution

Taking account of the increase in housing prices and the accommodative impact of the state support programme on housing prices, as well as other undesirable side effects of the programme (e.g. reduced effectiveness of the LTV restriction in mitigating risks related to borrowers' creditworthiness, the possible impact on the state's potential liabilities as regards the guarantees provided), the conditions of the state support programme could be revisited. In order not to impair the already low level of lending in regions, it is the programme conditions relating primarily to Riga city and Riga region (where lending for housing is peaking) that might need revising.

If implemented, the proposal would benefit the housing market in regions, where it suffers from underdevelopment and where competition between commercial banks is currently lower, and borrowers have limited access to funding.

Textual error

«… …»