Latvian "golden visas": a short-term solution. What comes after?

For quite some time now, temporary residence permits (TRP) have remained topical in Latvia. The opinions are quite polarized – from the support for immediate and complete abolition to the view that the existence of the TRP programme is a corner stone of the entire Latvian economy.

Usually such issues are outside the competence of the central bank. Yet, upon noticing how fast the Latvian economy is cooling down, it seems that all available instruments should be used to abate this process as much as possible. As a result, TRP as one of the potential instruments for heating the economy has become another concern of Latvijas Banka. We have conducted a TRP analysis from the point of view of macroeconomic impact and have to conclude that the programme has both positive and negative aspects.

On the benefit side, calculations by Latvijas Banka indicate that the TRP programme accounts for about 1.5% of gross domestic product (GDP), contributing revenue in the amount of 30-40 million euro annually to the budget. At the same time, however, the TRP programme gives rise to some medium- and long-term risks that may have an adverse effect on the growth potential of the Latvian economy. If liberal conditions for the programme persist in the long term, there is a risk that economic activity and labour may be increasingly directed towards the real estate and construction sectors, depriving more competitive sectors of resources.

Therefore, from the macroeconomic point of view, the most important task in the context of the TRP programme is to change the emphasis and promote investment in the industrial sector. Support for real estate and construction sectors, by relaxing the TRP preconditions for a time, can be only a short-term solution to be used in the cool-down phase of the economic cycle and in no way can serve as a factor ensuring long-term growth of the Latvian economy. In the long term, the main precondition for Latvia's growth will still be development on knowledge-based goods and services and that, in turn, will depend on the existence of a quality education system in the country.

What is TRP?

Temporary residence permits, sometimes also known as golden visas [1], provide foreign investors with the opportunity to reside and freely move about Europe (the 26 Schengen countries). Even though TRP was meant as an additional bonus that an investor may gain, it often serves as the main goal of making an investment. Similar residency schemes for foreign investors have long since been used in the USA, Canada, the United Kingdom and other countries, but in Europe they became more popular after the financial crisis because they provided the countries affected with a means for attracting additional financing from foreign investors and thus faster recovery from the recession.

Investors are interested in acquiring a residence permit that will be accepted in as many countries as possible, thus making travelling easier, guaranteeing a safe place of residence and allowing to perhaps save some tax money. Where there is demand, must be supply as well, and many countries are willing to create it because foreign investors are ready to part with substantial sums of money to obtain these permits. The golden visas of the European Union member states are particularly attractive to investors not only because of the wide opportunities they offer but also because of their relatively low price.

With Latvia still in recession, on 1 July 2010, a TRP programme was introduced with the goal of regaining positive growth.

Latest amendments to the immigration law

Since 2010, the conditions on which foreign investors are issued TRPs have become increasingly stricter. The latest amendments to the Immigration Law were adopted by the parliament in May 2014 and they became effective in September 2014. The amendments mostly applied to the real estate sector, stipulating that at the moment of purchase, the value of one functionally related real estate property with buildings must be no lower than 250 000 euro with the minimum cadastral value of 80 000 euro. The law additionally stipulates a payment of 5% of the property value into the national budget.

According to previous regulations, TRP could be obtained against an investment into real estate on much more favourable conditions, i.e. by purchasing one or several real estate properties in the value of at least 142 300 euro (100 000 lats) in Riga or in the value of 71 150 euro (50 000 lats) outside the Riga region.

It is also possible to receive a TRP, by making a 35 000 or 150 000 euro investment in a company. The lowest threshold of minimum investment applies to a company employing not more than 50 people and whose turnover or annual balance does not exceed 10 million euro. A TRP is issued also against investment in a credit institution of the Republic of Latvia in the amount of at least 280 000 euro, as well as for purchasing special state securities in the amount of 250 000 euro with a 0% interest rate. In both such cases, the investor additionally has to make a 25 000 euro payment into the national budget, in order to obtain the first TRP.

How much interest has there been in our TRP before the latest legislative amendments?

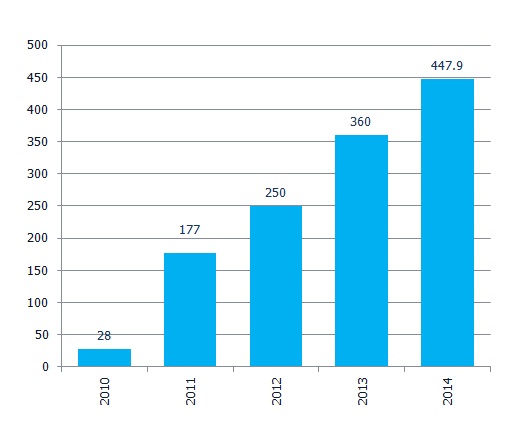

The statistics at the disposal of the Office of Citizenship and Migration Affairs (OCMA) indicates that by January 2015, 6,645 applications for short term residence permits had been received with the total amount of investment at about 1.26 billion euro.

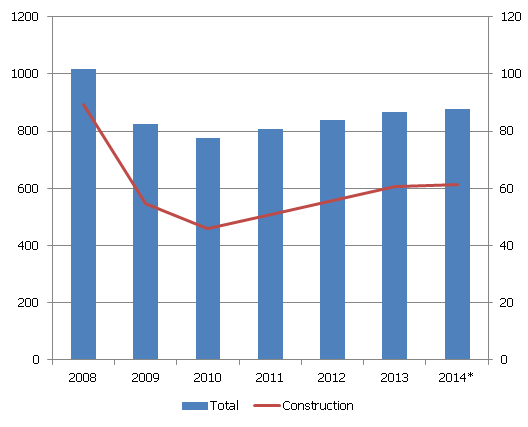

Fig. 1. Investments for the purpose of receiving a TRP (mil. euro)

Data source: Office of Citizenship and Migration Affairs

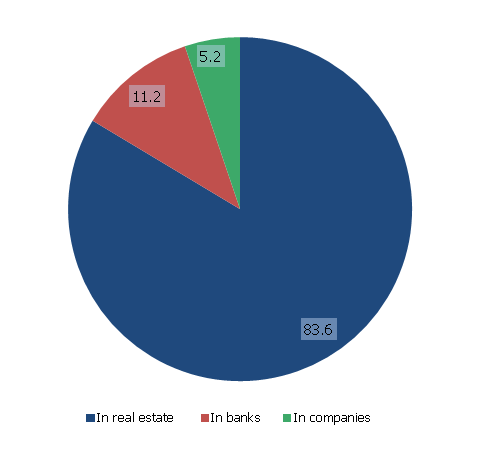

Fig 2. Distribution of investments, % (2010-2014)

Data source: Office of Citizenship and Migration Affairs

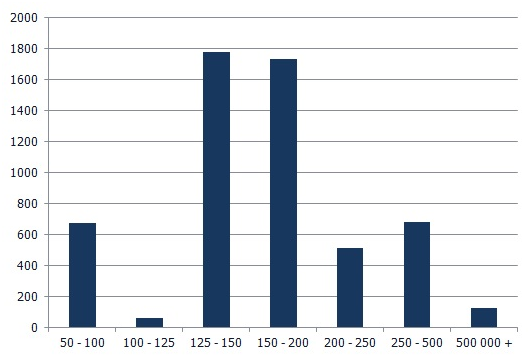

From the beginning of the TRP programme, the kind of investment most in demand was investment in real estate, and the demand for it increased with each passing year. Investment in real estate totals 83.6% of all investments. Approximately 63% of all investments in real estate have been in the range of 125 to 200 thousand euro. Only 5.2% of all investment has been in companies, which is a worrying trend, in view of the significance of this programme in ensuring long-term competitiveness of the country.

Fig. 3. Number of investments in real estate by price group (2010-2014)

Data source: Office of Citizenship and Migration Affairs

* Price groups are indicated in thousands of EUR

Real estate has been mostly purchased in Rīga and Jūrmala, followed by Ozolnieki, Cēsis, Babīte, Mārupe and Saulkrasti. Most of the applicants come from Russia (70%). The reason may be the close geographical proximity, the relatively attractive TRP price and practically nonexistent language barrier. Second are residents of China (8%), slightly ahead of residents of Ukraine (7.5%). However, with the amendments of the Immigration Law taking effect last September, interest in Latvian TRP seems to have almost completely vanished.

How competitive are we in the visa market?

The main conclusion we can draw from the situation in other countries is that there is an existing market for residence permits and the most important question is whether we want to participate in this market and whether we will be able to return to it with a competitive product.

Many European countries offer residence permits or citizenship for investments, the only differences are in conditions on which the permit is granted and in the number of countries in which one can freely travel with it.

In most of these aspects, Latvia is attractive relative to other countries: as a European Union member state, we are attractive in terms of security; the five-year term for which the TRP is granted is optimal; the application is processed quickly enough; we do not demand that investors spend a certain amount of time in Latvia and we are in the high 14th place by the number of countries in which we can travel without restrictions (The Henley & Partners Visa Restriction Index). We are relatively competitive also in terms of price, if we consider investment in companies (35 000 euro in small businesses). Here we outperform both such major countries as the United States, United Kingdom, Canada and many European countries.

We can consider Lithuanians our direct competition. Lithuania offers TRP for one year for investment in the starting capital of a business in the amount of about 15 000 euro. Lithuanians offer a better price, yet their offer is less attractive because investment has to be made in a new enterprise. We might benefit from at least reviewing this Lithuanian experience, however.

If we consider investment in real estate, then we are less competitive. For the same 250 000 euro a TRP can be received purchasing real estate in Greece. The conditions in Greece are even more favourable, because there is no 5% contribution to the national budget. In all likelihood, an investment of 250 000 euro in real estate in Greece is more attractive not only because of the geographical location of the country, but also because it is easier to rent out than in Latvia.

The positive aspects of TRP

Impact on the economy and budget

According to Latvijas Banka estimates, the TRP programme directly contributes 0.4-0.5% of GDP a year to Latvia's economic growth, but, taking into account the indirect impact, the total contribution is about 1.5% of GDP or 350 million euro. This estimate has been calculated for the impact until the coming into force of the amendments in the Immigration Law on 1 September 2014.

The investors programme leaves a positive effect also on tax revenue. The TRP programme ensured at least 30 million euro or 0.5% of tax and tariff revenues per year in the national budget. The amount of taxes and tariffs paid is actually greater because the calculations do not include taxes that are paid for legal, financial and other services shortly before and after the transactions are conducted. Also not included is the contribution of the income and ensured jobs of the service providers to the economy and budget, as well as the multiplicative effects.

The positive impact on the economy and taxes has possibly been even greater because of the statistical methodology of OCMA. Both the number of applications and the amount of investment is registered at the moment when OCMA receives a TRP application and not at the moment when the investment is made. Therefore it is difficult to calculate how great the impact on the economy has been in a particular period. For instance, if an investor purchased real estate in Riga for at least 142,300 euro, then this investor has the right to apply for TRP also after September 2014.

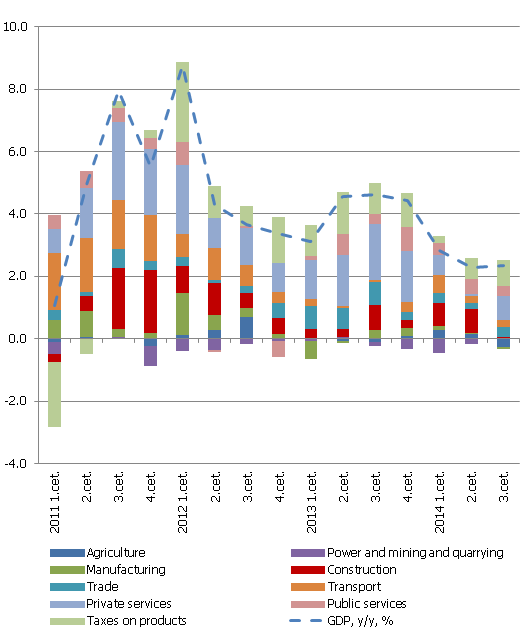

Because of the geopolitical background, investors have grown cautious. As a result, investments are contracting even in the previously fast growing construction sector. The contribution of construction to real GDP is dropping and in recent quarters, so is the rate of growth of real GDP. For 2015, Latvijas Banka has reduced the projected rate of growth to 2%, but there is a risk that growth could be even lesser. Right now, two European fund programmes are in effect (for 2007- 2013, which will be taken up by the end of 2015, and for 2014 – 2020), and, if these funds were not available, the situation would be even worse.

Fig. 4. Contribution of sectors in the y-y changes in real GDP, percentage points

Data source: Central Statistical Bureau (CSB), Eurostat

Impact on the labour market

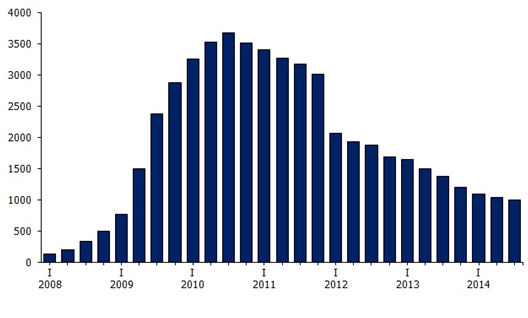

The demand of foreigners for real estate has a direct positive and significant effect on the labour market. During the crisis, many people lost their jobs in the construction sector and many of them were forced to look for employment abroad. As of 2010, the situation in construction has improved and the number of people employed in this sector is growing year after year. There is a possibility that some of the emigrated labour may have returned to Latvia because of job opportunities here. The demand for TRPs creates jobs both in industries related to construction that employ architects, designers, gardeners etc. and in more remotely related industries that employ nannies, guards, chauffeurs etc. If, in addition to investment in real estate, non-residents invest also in business, new jobs may result in various industries. All these additionally created jobs may very well allow someone to return to Latvia or not to leave it in the first place.

Fig. 5. Number of employed, thousands

Data source: CSB

Impact on business

TRP has a positive impact on businesses in industries that suffered particularly hard during the crisis: real estate and construction. Real estate transactions result in healthy activity in the real estate market. The existing real estate properties, renovated properties and newly constructed properties alike are sold. Renovation of existing housing as well as construction of new properties not only promotes development in the construction sector but also encourages improvements in the old buildings, which, without a demand by foreigners, would possibly not be made.

It should be kept in mind, however, that too great a shift in resources toward these sectors is not a sustainable solution. If this aspect is not controlled and we do not promote long-term shift of resources toward the productive sectors, it can cause a situation similar to the one in the pre-crisis years.

Impact on financial stability

The construction of dwellings began to grow faster in 2013 – before the existing housing fund was on offer. The demand for real estate created by TRP facilitated the sales of properties that was not on sufficient demand by the local population and also allowed people to repay their debts. Repayment of debts has made a significant contribution to the improvement in the financial stability of both financial and nonfinancial enterprises.

Fig. 6. Loan payment delays over 180 days, mil EUR

Data source: Financial and Capital Market Commission

Negative aspects of TRP

State security

An essential risk associated with the TRP programme is the threat to state security. Inadequate control over foreign investors may lead both to increased organized crime and to other threats to domestic security. Recent geopolitical developments may give rise to concerns about the external security of the country as well. Since the central bank is not an expert in matters of state security, a detailed analysis of this aspect should be left to the Security Police. For this purpose, an additional payment into the state budget of 5% of the real estate transaction amount came into effect last September. If this 5% payment is kept, there is a chance to improve the TRP aspects even further. However, if the Security Police, even after it has been granted additional funding, admits that it cannot control all applicants to a sufficient degree, then our analysis of the potential gains and losses associated with the programme also loses its validity: security of the state is undoubtedly more important than any macroeconomic gain.

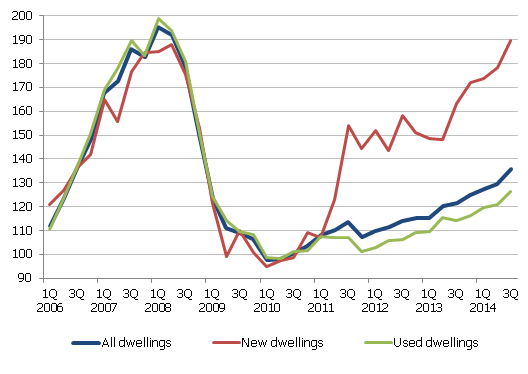

Rise in real estate prices

Since 2010, a rather substantial rise in prices has been observed in the real estate market, which may make it more difficult for the local population to obtain quality housing. It is evident, however, that under the impact of TRP, it is mostly prices of new dwellings that are on the rise and to an even greater extent is the case for new construction in Vecrīga and the centre of Rīga. This invites the conclusion that price rises are mostly observed in the luxury segment, which hitherto has had a lesser impact on the chances for a middle-income family to purchase housing. With the possible lowering of the threshold, however, this negative impact could increase.

Fig. 7. Housing price index (2010=100)

Data source: CSB

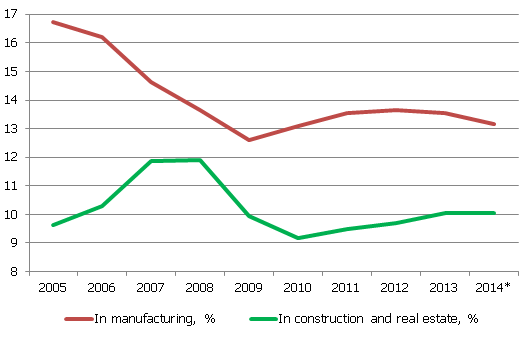

Changes in the structure of the country's economy

Under the impact of TRP, there arise risks that are related to the redistribution of economic resources from the industrial sector to the construction and real estate sectors. As of 2010, the number of people employed in construction and real estate is growing and accounting for an ever increasing proportion of all the employed. The number of people employed in manufacturing meanwhile has been dropping in recent years. The result has been a redirection of human resources to less productive sectors that is unfavourable for a sustainable economy. If such a trend continues for a longer period of time, Latvia's chances to catch up the developed European countries in terms of standard of living may be compromised.

Fig. 8. The number of the employed by the chosen sector (% of all employed)

Data source: CSB

* 3 quarters

Conclusion: the Latvian economy currently needs the TRP programme, but long-term solutions must be found

In view of the above arguments and the unfavourable situation abroad (developments in Russia and the slow recovery in Europe) we can conclude that Latvia needs instruments to heat its economy.

A wise move in economic policy at this juncture would be the implementation of counter-cyclical policies. For example, if the government had previously accrued fiscal reserves in the budget, this would be the right moment to spend these reserves by injecting funds into the real economy, but such reserves have not been accrued. As a result, in the shorter term, we do not have very many options other than continue with the TRP programme, even relaxing its conditions for a certain period of time to increase its competitiveness in Europe and thus increasing the demand for our product. Along with using the European funds and resuming lending, these are the few growth stimulating instruments that are currently available.

From the point of view of macroeconomic analysis, our suggestions with regard to TRP would be the following:

- First, in order to stimulate economic growth, the TRP conditions should be relaxed for the time being. In order to avoid a less than effective use of resources in the longer term, however, it should be stipulated that the relaxed conditions will be in effect only for two years. These two years should be used as productively as possible, by conducting the necessary reforms in education and investing in human capital.

- Second, since it is in the country's interest to promote investment in the industrial sphere, the opportunity to invest in companies within the framework of TRP programme should be made more attractive. In addition, differentiation of the minimum threshold for investment in companies should be considered depending on the region where the company is operating. Conditions for attracting investors should be made particularly attractive in the depressed regions of the country where development would be particularly important.

By following these suggestions, the Latvian economy would be supported at a moment where its growth rate is slowing. Moreover, we would gain time to implement the structural reforms that would help put the Latvian economy on a path of sustainable development, which is the one true goal of economic policies. .

[1] Temporary residence premits are also called "golden visas" because like gold credit cards they have been created to attract wealthy people. This designation became popular in 2012 when Portugal developed its residence permit scheme giving it the name of "vistos dourados".

Textual error

«… …»