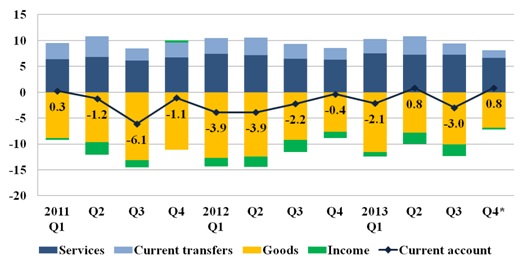

A surplus in Latvia's current account in the fourth quarter of 2013; a small deficit in the year overall

In Latvia's current account in the fourth quarter of 2013 a surplus of 53.6 mil. euro formed (0.8% of predicted GDP). In 2013 overall, the current account deficit was smaller compared to previous years (191.1 mil. euro or 0.8% of predicted GDP). The shrinking deficit in 2013 was fostered by a drop in the goods' external trade deficit and a rise in services' external trade surplus.

Illustration. Main components of the current account, % of GDP

*calculated on the basis of Bank of Latvia GDP prediction.

Goods and services external trade deficit dropped to 18.4 mil. euro (0.3% of predicted GDP) in the fourth quarter. Quarter-on-quarter, goods exports grew faster than goods imports, but both the exports and imports of services dropped. In the fourth quarter the export of transportation continued to fall, whereas construction services and information and computer services posted better results quarter-on-quarter.

The negative balance of the income account dropped in the fourth quarter to 22.1 mil. euro (0.3% of predicted GDP), for the profits of foreign direct investors gained in Latvia shrank slightly. The positive balance of current transfers dropped to 94.1 mil. euro (1.5% of predicted GDP), and that of capital account went down to 140.9 mil. euro (2.2% of predicted GDP). The current transfer account and capital account flows are mostly influenced by payments received from European Union (EU) funds, which at the end of the year were comparatively lower than at the beginning. In 2013, a total of 1.051 billion euro was received from EU funds, which is slightly less than a year before. Significant inflows of EU funds came from agriculture funds (331.8 mil. euro), the European Regional Development Fund (327.2 mil. euro), and Cohesion Fund (228.7 mil. euro).

In the financial account, a negative balance of 76.9 mil. euro (1.2% of predicted GDP) formed in the fourth quarter. The fourth quarter was successful in attracting foreign direct investment (FDI): they grew by 223.1 mil. euro (3.5% of predicted GDP). In the year overall, FDI increased by 2.6% of predicted GDP. The largest part of investment in 2013 inflowed in financial and insurance operations (from Sweden and Russia), yet significant investment was also made in manufacturing (from Luxembourg, Cyprus, and Denmark) and trade (from Estonia and Lithuania). The stability of Latvian economic growth is evidenced by the fact that at the end of 2013 and beginning of 2014 several international credit rating agencies confirmed Latvia's rating at the current level, and Standard&Poor's raised Latvian credit rating's forecast from stable to positive, which could promote investment activity in the future.

The balance of payments financial flows in the public sector will be impacted at the beginning of 2014 by the fact that in January Latvia emitted securities in international markets in the amount of one billion euro (previous such emission took place in December 2012). In 2014, however, Latvia must make payments on the loan received from the European Commission within the framework of international loan programme and previously emitted securities in the international markets.

With a view to the projected inflows of EU funds into the capital account and stable attraction of FDI, it can be expected that the small current account deficit (about 2% of GDP) predicted for 2014 will be fully covered by stable and investment oriented financing.

Textual error

«… …»