Why are lending rates in the Baltics higher than elsewhere in the euro area?

Although part of the population, following the painful experience gained during the financial crisis of 2008–2009, associates the word "loan" with something bad and hard to bear, loans represent a critical component of a healthy economy. It is unlikely for the Latvian economy to reach the best standards of Western Europe in the absence of new business ideas, innovation and investment. Unfortunately, own resources are not always sufficient for this purpose, which requires active lending to businesses. However, lending activity has been very sluggish in Latvia over the past decade, falling far behind almost all other euro area countries. As recently as in 2010, the total loans to non-financial corporations exceeded the euro area average, but currently Latvia ranks third from the bottom.

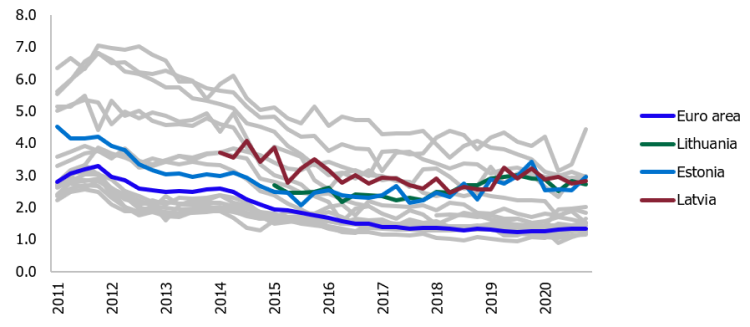

On the one hand, caution of companies themselves plays a certain role in this bad ranking, since experiences of the crises make one follow the saying "look twice before you leap". On the other hand, there are signs which suggest that there are also problems concerning the access to loans. One of such signs is relatively high interest rates on loans in Latvia which are among the highest in the euro area. For example, interest rates on new loans to non-financial corporations in Latvia at the end of 2020 were more than twice as high as the euro area average rate. The level of interest rates is similarly high in both neighbouring countries, Lithuania and Estonia.

Chart 1. Interest rate on new loans to non-financial corporations in euro area countries; %

Moreover, the Baltic countries are also among the very few euro area countries where the past five years have not seen these interest rates decline significantly. Despite the efforts of euro area central banks to improve access to loans and make them cheaper, in Latvia interest rates on new loans last year were almost the same as in 2015, and those in Lithuania and Estonia – even higher. By contrast, interest rates in other euro area countries almost halved over the period considered.

What distinguishes the Baltic countries from the rest of the euro area: why are corporate lending rates so high?

To answer this question, we conducted a study, using information on 269 euro area commercial banks over the period 2014–2020, which led to the following conclusions.

First, loans in the Baltic countries are generally riskier than in the euro area on average but not to an extent that would explain differences in interest rates. The share of non-performing loans in the Baltics, particularly in Latvia, is higher than in the euro area on average. However, it is significantly smaller than in a number of southern European countries where interest rates on loans are on average lower. Furthermore, one should note that the share of small (less than one million euro) and thereby riskier loans is rather low in the total loan portfolio in Latvia. It is the relatively small recovery rate from resolving insolvency that makes loans to businesses issued in the Baltic countries riskier than in most other euro area countries. As a result, the losses given default increase and banks apply higher interest rates. However, it is worth noting that this indicator is not so dramatic in Latvia to use only this aspect for justification of the high interest rates, let alone for their rise in the last few years. Moreover, the cautious lending policy observed over the past few years suggests that the risk profile of the new customers is lower than the historical average; therefore, interest rates should also follow a downward path.

Second, costs of funds for Baltic banks do not significantly deviate from the rest of the euro area. Deposit rates are close to zero in almost every euro area bank. Moreover, euro area banks, including the ones in the Baltics, can borrow funds even at negative interest rates in the framework of the Eurosystem's central bank programmes. Meanwhile, Baltic banks very rarely resort to relatively more expensive types of financing, e.g. bond issues.

Thus, we arrive at the third and the most important conclusion: the relatively high interest rates on loans to non-financial corporations in the Baltics can hardly be explained by lower quality of the loan portfolio (higher risk), higher costs of funds for banks and other conventional factors that are assumed to affect lending rates.

The results of the study suggest that interest rates on loans to Baltic non-financial corporations are among the highest in the euro area even once the above explained factors are excluded. In 2020, the unexplained difference between the interest rates on new loans in the Baltics and Germany was approximately 1.5–2.0 percentage points. Moreover, this was not driven by few outliers, since relatively high interest rates were charged by almost every commercial bank in the Baltics. In 2020, the majority of Baltic commercial banks ranked among the 10% of banks with the highest interest rates in the euro area.

Chart 2. Distribution of the unexplained part of interest rates on new loans to non-financial corporations in euro area commercial banks

Notes: 0 stands for the average unexplained part in Germany. Interpretation of the chart: if a dot is located close to value 1 on the x-axis, the interest rate on loans to non-financial corporations (adjusted for the risk and other factors) in the respective bank is by 1 percentage point higher than in Germany's on average.

Over time, the gap between the Baltics and the rest of the euro area has even widened, raising concerns about the heterogeneity of the monetary policy transmission in the euro area. Relatively high interest rates reduce competitiveness of the Baltic economies, i.e. such interest rates not only restrict business activity but also hamper the implementation of investment projects and weaken the potential of the post-crisis economic recovery.

To reduce these barriers and enhance sound lending development in the Baltic countries over the coming years, a discussion on the reasons behind the high interest rates and instruments to cut them should be launched between the financial sector and policy makers. This could become a major challenge for economic policy makers in the next few years.

Textual error

«… …»