Impact of Russia's invasion of Ukraine on energy prices. What are the potential inflation scenarios?

Russia's invasion of Ukraine, which started at the end of February, contributed to huge hikes of oil and natural gas prices at global level already in the first weeks following the invasion; moreover, there are risks that prices can climb further. Assumptions about energy prices have a major effect on inflation projections. This article presents possible inflation scenarios in the event that energy prices continue to rise.

The inflation projections have been revised upwards substantially this spring

The world has changed dramatically since the publication of the previous projections in December 2021, making us change the way we look at economic developments. The inflation outlook has been increased substantially in the latest Latvijas Banka's projections published in March 2022.

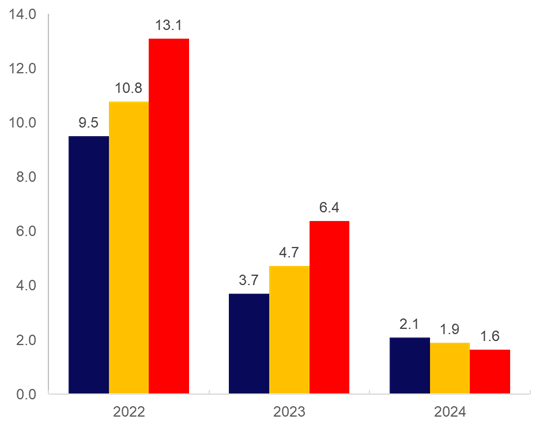

Russia's warfare in Ukraine has contributed to the soaring global energy and food prices. The uptrend in prices has been driven by several factors, including the economic sanctions, disruptions in global supply chains, concerns with respect to whether Ukraine, which is an important supplier of grain and other agricultural products, will be able to sow and plant. In view of the above, inflation projections for 2022 and 2023 have been revised upwards to 9.5% and 3.7% respectively. According to the inflation baseline scenario, trade with Russia and Belarus ceases on account of the sanctions and low business confidence, as well as food and energy prices follow an upward path [1].

Inevitably, the assumptions about the expected development of energy prices have significant effects on inflation projections. Higher oil prices support fuel price rises, which in turn push up transportation costs of both raw materials and finished products, and also affect increases in prices of other goods in the medium term [2]. The rise in natural gas prices means that it is not only the households having gas stoves or gas-fired central heating boilers that pay higher bills. Natural gas is also used for generation of both heat and electricity. Accordingly, it can be expected that heat tariffs and electricity prices will mount.

Inflation in the event of adverse and severe scenarios

There is a risk that prices can rise even more rapidly if economic conditions become far more unfavourable. Based on the risk scenarios prepared by the European Central Bank (ECB) , we have developed two inflation outlook risk scenarios in addition to the baseline scenario, i.e. the adverse and severe scenarios analysing the impact of a faster upswing in energy prices on inflation in Latvia:

- the adverse scenario envisages possible disruptions in energy supply from Russia to euro area countries. These disruptions would contribute to faster rises in the prices of both energy products and goods whose production can be affected by energy prices and its availability;

- the severe scenario, in addition to the previous conditions, foresees a more rapid response of global oil and gas prices to energy supply disruptions and difficulties the global markets face over the projection horizon in relation to energy replacement.

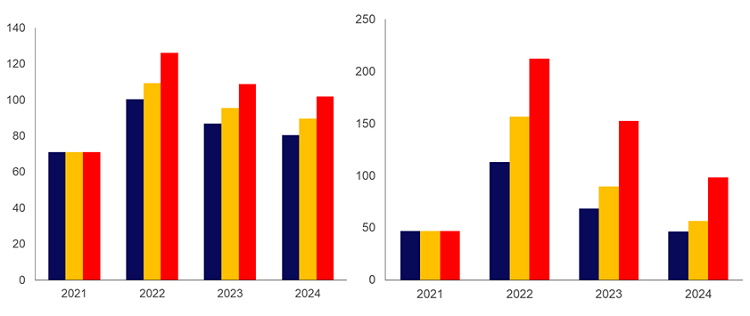

Chart 1. Oil and natural gas price scenarios

To the left: Oil price scenarios (on average per year; USD/bbl). To the right: Natural gas price scenarios (on average per year; EUR/MWh)

What is the expected inflation rate in the event that the adverse or severe scenario materialises?

If the adverse scenario materialised, inflation in 2022 would average 10.8%, but in 2024 it would be 4.7%. Meanwhile, according to the severe scenario inflation in 2022 would average 13.1%, while in 2023 it would be 6.4%.

Chart 2. Inflation in the event of different scenarios (annual growth; %)

There is a need to strengthen energy independence and help the vulnerable population groups

Currently, while an active warfare is ongoing on Ukrainian soil, the projections are associated with a high degree of uncertainty, and the adverse inflation outlook scenarios may materialise. However, regardless of the scenarios that might materialise, it is crystal clear that Latvia has to strengthen its energy independence and facilitate energy efficiency. This is a costly and time-consuming process, but at the same time a necessary one to stabilise energy prices and to cushion the impact of strong price fluctuations on inflation in the future. The soaring energy prices are directly passed through to fuel and natural gas prices, but indirectly to heating, electricity and food prices. Therefore, people on lower incomes will be most affected by these steep cost increases, since the above goods and services represent a substantial share of their consumption basket. Thus, against the backdrop of rising inflation, a targeted support has to be provided to the vulnerable population groups.

[1] The Macroeconomic Developments Report of Latvijas Banka describes the assumptions and results taken into account in the inflation baseline scenario by component.

[2] For more details concerning the model used in the projections and the global energy impact channels, see: Bessonovs A., Krasnopjorovs O. Short-Term Inflation Projections Model and Its Assessment in Latvia. Available at: https://datnes.latvijasbanka.lv/papers/wp_1_2020_en.pdf

Textual error

«… …»