Will limited budget resources impede government plans?

Despite deterioration in the economic situation elsewhere in the world, Latvia's economic growth has been relatively fast reaching almost 5% in 2018, according to Latvijas Banka's estimates. The solid economic performance has also contributed to the government budget: higher level of employment and the average wage growth has brought additional budget revenue from taxes on labour, while an increase in consumer spending has boosted the VAT and excise tax revenue. As a result, despite the losses created by the tax reform, tax revenue increased by approximately 8% in 2018.

However, the current growth rates should not be considered the long-term norm. Weaker euro area growth, deteriorating economic situation in China and other global developments will, sooner or later, also affect Latvia. Like other small economies, Latvia relies heavily on external demand for goods and services produced by its businesses. Therefore, Latvia's growth rates are expected to become slightly lower in the years to come[1].

With the economic growth decelerating, the increase in tax revenue will also slow down, thereby constraining the new government's ability to achieve its objectives. Namely, in the context of weaker economic growth, the total cost of the measures included in the government's declaration will most likely exceed the available budgetary resources. Therefore, to follow through on its promises, the government will need to look for ways to generate additional revenue or find resources in other expenditure items.

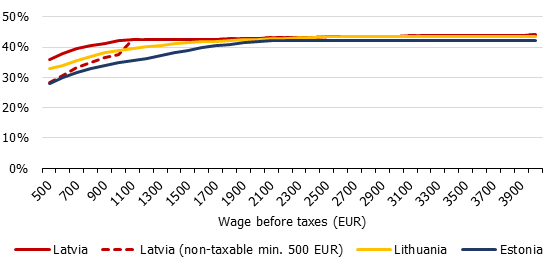

The commitment to make Latvia's labour tax the most competitive in the Baltic States may be especially costly. At this stage, the tax burden on labour in Latvia is somewhat higher than in Lithuania and Estonia, for low wage earners in particular (see Chart 1). The difference could be reduced by raising the non-taxable minimum to 500 euro, a proposal relatively often heard in the run-up to the elections. According to our estimates, however, this would lead to budget losses of approximately 100 million euro (the amount is equivalent to half of the budget expenditure for higher education) and increase the budget deficit by 0.3% of GDP.

Chart 1. Labour tax burden per individual without dependants in the Baltic States in 2019 (labour tax as a percentage of labour costs)

Reduction of the tax burden on labour combined with a commitment to improve the social benefit system is a good recipe for boosting the business competitiveness. Moreover, it can help reduce income inequality. Unfortunately, it is also a recipe for a higher budget deficit.

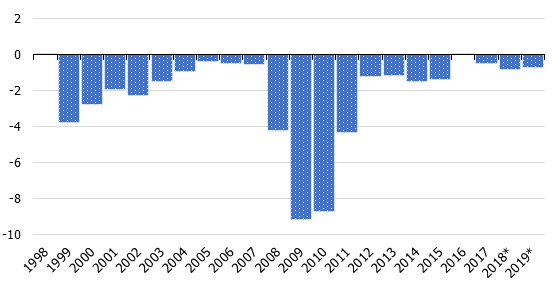

Even leaving aside the vision of the new government, it is unlikely that, in the near future, Latvia will give up its habit to live beyond its means. Despite the buoyant economic growth, the estimates of the Ministry of Finance suggest that the budget deficit will have reached 0.8% of GDP in 2018. Meanwhile, the 2019 draft budgetary plan approved by the outgoing government states a similar budget deficit in the amount of 0.7% of GDP. It is worth noting that the government budget expenditure has not exceeded its revenue only on two occasions[2] over the past 20 years (see Chart 2). If the new government implements its plans without finding additional funds, this practice will most likely continue after 2019 as well.

Chart 2. General government budget balance in Latvia from 1998 to 2019 (% of GDP)

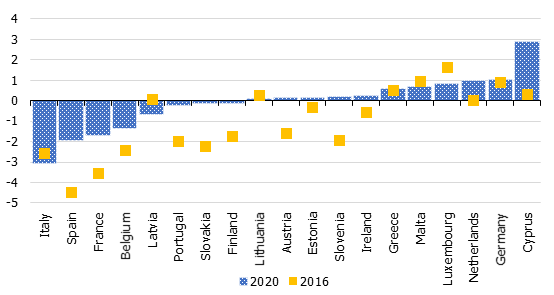

A similar development is projected by the European Commission which includes Latvia among the few euro area countries having a negative budget balance (i.e. budget deficit) also in 2020 (see Chart 3). Moreover, apart from the troubled Italian economy, Latvia is the only country expecting a deficit increase. To a large extent, this reflects the losses created by the last-year's tax reform and the commitment to grant additional funds to the health-care sector.

Chart 3. Euro area general government budget balance in 2016 and its forecast for 2020 (% of GDP)

The above considerations lead to the conclusion that the new government will be constrained in its ability to achieve its objectives not only on account of a slowdown in the economic growth but also due to the previous government's legacy. Thus, it can be expected that the real challenge of the new government will be finding balance between the needs listed in its declaration and the available resources in compliance to the limits set by the legislation of the Republic of Latvia and the European Union. Under these circumstances, the coalition's commitment to keep the 2019 government budget unchanged and the agreement on the implementation of responsible budgetary policy is highly welcome: this will serve as a reminder that the fulfilment of promises requires finding additional sources of financing.

[2] The budget was balanced in 1998 and 2016.

Textual error

«… …»