This Time Inflation is Different

Inflation in Latvia has reached the highest level in the last 25 years, exceeding the level which was experienced before the financial crisis. In August, the inflation rate showed a whopping 21.4% increase, compared to the peak of 17.7% before the financial crisis.

In short

-

The current level of inflation is similar to that experienced before the financial crisis, but the reasons are different.

-

Currently, Latvia's economy is much healthier than before the financial crisis, and domestic misalignments are not the reason for a significant rise in inflation.

-

We can expect a peak of inflation in the coming months.

-

How quickly will inflation decrease depends on: (i) stabilization of energy prices, (ii) the degree of pass-through of production costs to inflation, and (iii) whether inflation will become entrenched.

What are the differences between inflation then and now?

Although the inflation rate has been high both then and now, the reasons for the rapid increase in prices significantly differ (see Figure 1).

Before the financial crisis

Before the financial crisis in 2008, excessive lending and capital inflows contributed to internal imbalances. Private consumption and investments grew rapidly; as a result, the average wage increase reached a dizzying 33% in 2007Q3. Overheated domestic demand strongly contributed to the rise in inflation. At that time, half of the inflation – about 8 percentage points – was explained by the rapid increase in wages. In addition, strong global growth boosted demand for resources leading to higher global commodity prices, including energy and food prices. Prices in Latvia reacted accordingly. At that time, the contribution of energy and food prices to inflation in Latvia reached approximately 6 percentage points.

Hence, the high inflation in Latvia before the financial crisis was characterized by (i) internal imbalances and (ii) strong global demand for global commodities.

After the pandemic

Since the global financial crisis, the average wage growth in Latvia has been much more moderate – below 10% – and a far less important factor in the current surge of inflation, explaining about 3 percentage points of headline inflation. However, the increase in global energy and food prices plays a much prominent role – it contributes almost 13 percentage points to the headline inflation.

After the pandemic, mobility and business restrictions were lifted, households were on a rush to spend their savings accumulated during the pandemic. However, the capacity of businesses to meet the soaring demand was severely limited after the pandemic. As a result, inflation quickly gained momentum. Unfortunately, the post-pandemic recovery coincided with Russia's invasion of Ukraine. The war in Ukraine further aggravated the shortage of energy resources in Europe, but the associated risks of food supply have driven the prices of global food commodities to unprecedented high levels.

Therefore, in the post-pandemic period, the dynamics of inflation in Latvia is characterized by two important factors – (i) the steep recovery of demand after the pandemic, which was not matched by the supply, and (ii) the very limited supply of energy resources in Europe.

Figure 1. Inflation decomposition by factors (annual rates, % and pp.)

Source: Central Statistical Bureau of Latvia, Reuters, ECB data warehouse, author’s calculations.

Notes: inflation decomposition by factors is obtained using Latvijas Banka STIP model. Impact of oil prices comprises the impact on car fuel prices and indirect effects on other SPCI components. See details in Latvijas Banka Working Paper No 1/2020.

Energy prices have a strong impact on inflation

The current inflationary storm in Europe is mainly determined by the shortage of global commodities, especially energy commodities. Russia's invasion of Ukraine contributed to the shortage of supply of energy and fueled anxiety about the energy security in European countries. Precautionary oil demand likely contributed to the rise in oil prices. Although oil prices currently are slightly below the level of February 24, an expected embargo of Russian oil is likely to keep global oil prices at levels that a balanced global economic growth cannot afford. Moreover, the obvious Russian blackmail concerning the natural gas supply to Europe caused an unprecedented increase in natural gas prices.

The rise in natural gas prices has caused a wave of energy price increases, the impact of which on Latvia's inflation is a way higher than was experienced before the financial crisis. Considering the important role of natural gas in energy production in Latvia, the prices of electricity, heat energy and solid fuel have also increased (see Figure 2). Currently, half of the annual inflation (10 percentage points) is directly affected by energy prices.

Figure 2. Contributions of energy components to headline inflation (% and pp.)

Source: Central Statistical Bureau of Latvia, Reuters, ECB data warehouse, author’s calculations.

How quickly will inflation decline?

First:

In the first place, the reduction of inflation depends on the stabilization of prices in global energy commodity markets. Targeted renouncement of Russian oil and natural gas and limited global natural gas supply keep energy prices at unsustainably high levels.

This year, global growth is expected to slow down, and global demand will decrease, which could stabilize global oil prices. However, it is difficult to expect the same from natural gas prices. A complex supply structure, natural gas producers' preference for long-term contracts and European green policies are likely to keep European natural gas prices at elevated levels. If natural gas prices in Europe remain at a high level for a longer time than expected, there is a risk that natural gas prices will significantly affect energy prices in 2023 as well.

Second:

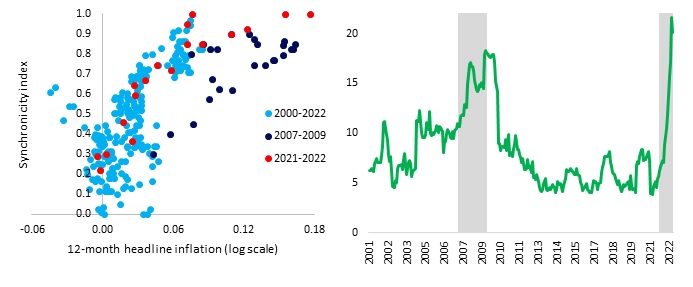

The pass-through of production costs to prices plays an important role in reducing inflation. In high inflation environment, firms can raise prices with less concern about losing their market share because competitors also raise prices to meet higher costs (Taylor 2000). Likewise, in high inflation environment, price dispersion is higher, which restricts consumers from finding the best deals for their purchases (Head et al. 2010). Consequently, entrepreneurs become more able to pass production costs and set higher prices. This means that there is an increasing risk that inflation could stay high longer than expected. Two indicators that implicitly display that these conditions may currently be in place are price synchronicity (Figure 3) and price dispersion (Figure 4). Currently, we observe that the synchronicity of price changes of individual goods and services in Latvia is at a historically high level and the dispersion of individual prices exceeds what was achieved before the financial crisis.

Third:

As prices rise, workers' real incomes fall, and they may require compensating for the lost purchasing power. The phenomenon, when workers compensate for high inflation with higher wages, is called second-round effects. In these circumstances high inflation could be self-sustaining and may become entrenched, causing a decline in public welfare. To prevent the second-round effects of inflation and reduce inflation more quickly, it is important that central banks currently raise interest rates. It gives a signal to economic agents that central banks will do everything to reduce inflation in the future and thereby to avoid inflationary pressures from becoming entrenched.

Figure 3. Synchronicity of price changes and Figure 4. Price dispersion (annual rates, %)

Source: Central Statistical Bureau of Latvia, author’s calculations. Last observation is August 2022.

Notes: Price synchronicity index is based on Mink et al. (2007) and implemented as in BIS annual report 2022. The index shows the degree of price change synchronicity. A higher number indicates greater synchronicity of price changes. Price dispersion is obtained using the annual rates of 95 individual HICP price indices.

Conclusions

Without any further surprises in the energy market, inflation could reach its peak in the coming months. The latest projections published by Latvijas Banka predict that inflation will gradually decrease in the first half of 2023 and will fall below 10% in 2023. However, the question is open – how quickly will inflation decrease?! There is currently very high uncertainty as to whether we are already at the end of an energy shock and to what extent production costs will be passed to consumer prices.

References:

Head, A., Kumar, A., and Lapham, B. (2010). Market Power, Price Adjustment, And Inflation.

International Economic Review, 51(1):73-98.

Mink, Mark; Jacobs, Jan P.A.M.; de Haan, Jakob (2007). Measuring synchronicity and co-movement of business cycles with an application to the euro area, Working Paper No. 2112, Center for Economic Studies and ifo Institute (CESifo), Munich.

Taylor, J. (2000). Low Inflation, Pass-Through and the Pricing Power of Firms. European

Economic Review, 44:1389-1408.

BIS Annual economic report (2022).

Textual error

«… …»