Residential lending in Latvia: nothing over the top so far, but have to watch out

The year 2021 was quite remarkable for lending to households: there was a significant rise in activity, and new loans for house purchase reached the highest level since the crisis of 2008.

In short

-

The pandemic has had no lasting effect on lending for house purchase, and 2021 saw the highest increase since the previous crisis of 2008;

-

At the same time, the rate of growth should be viewed as moderate, and Latvia remains outperformed by its Baltic neighbours;

-

The state support programme provides a considerable boost to lending for house purchase;

-

Despite no obvious signs of overheating on the housing market yet, there are several factors at play which warrant caution and call for a discussion on how to improve the state support programme.

The recovery of lending for house purchase from the initial short-term shock caused by the pandemic is in line with a more vigorous real estate (RE) market development. A rising demand for housing on account of households wishing to improve their living conditions or use the option of working remotely more extensively as well as better-off individuals looking for investment opportunities is a contributing factor. Higher demand is underpinned by both an improvement in the financial position of households and larger savings [1] as well as the state support programme for families with children. The increase is mostly attributable to large loans for house purchase over 100 000 thousand euro, which could be explained by higher activity in the private house segment, including construction thereof.

This impressive rise, however, started from a low base, as the lending dynamics was fairly weak over the decade following the previous crisis (2009–2018).

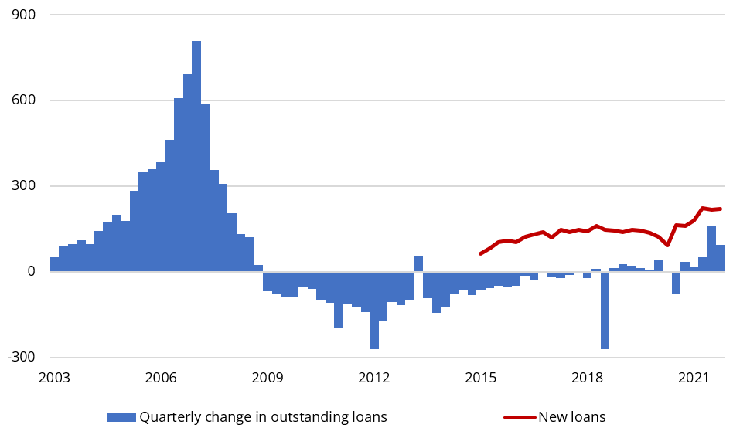

New loans are still considerably below the pre-2008 levels: in the second half of 2008, the total amount of new housing loans was 221 million euro, whereas, from the second half of 2006 to the first half of 2007, the average quarterly amount was over 675 million euro (see Chart 1) [2].

Chart 1. Quarterly absolute change in outstanding loans for house purchase and new housing loans (millions of euro)

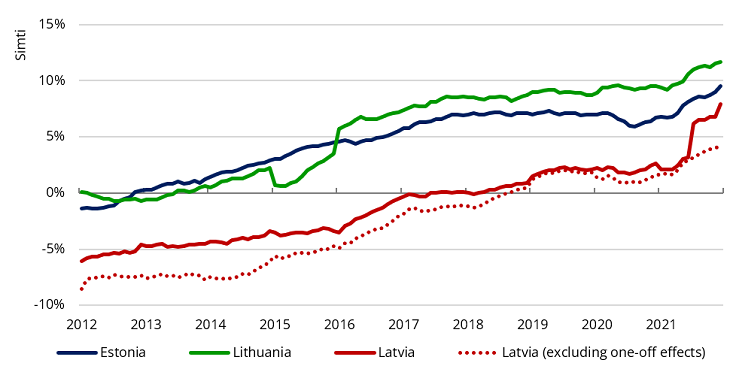

In Latvia, the growth of lending for house purchase has so far been moderate. Other Baltic countries are quite different in this respect, as Lithuania and Estonia have been recording solid growth already since 2014 and it has been rather significant since 2016. The RE markets in Lithuania and Estonia have also been much livelier than in Latvia over the most recent years. In order to address the housing market risks, Lietuvos Banka tightened the macroprudential measures concerning lending for house purchase by setting the loan-to-value (LTV) ratio requirement for second-time and subsequent borrowers purchasing housing property at 70% [3] as well as introduced a 2% sectoral systemic risk buffer for housing loans. Eesti Pank has also decided to introduce a 1% countercyclical capital buffer.

In Latvia, any noteworthy expansion in housing loans started only in 2021, with the growth rate in December reaching 4.1% (excluding the one-off effects related to structural changes in the banking sector; see Chart 2). Lending growth is dampened by significant repayments on loans granted before the crisis of 2008 which still constitute roughly 1/3 of all outstanding housing loans and are dominated by annuity mortgages, i.e. loans with gradually increasing principal repayments.

Chart 2. Annual rate of change in loans for house purchase[4]

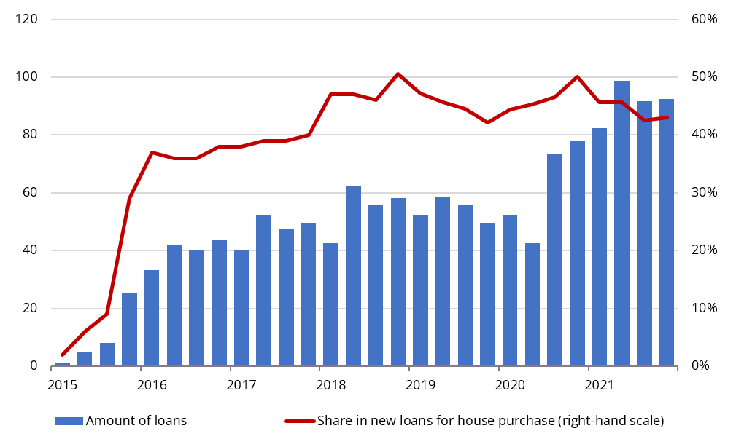

State support programme for house purchase continues to provide a significant boost to lending for house purchase (see Chart 3): in 2021, 44% of new loans for house purchase were granted within the framework of this programme, representing already 27% of all outstanding loans for house purchase at the end of December. Although the currently active RE market has not yet reached the boiling point, the state support programme has lowered the effectiveness of the macroprudential policy. In 2021, about 27% of all mortgage loans for house purchase were granted with LTV above 90%, and the volume of such riskier loans in absolute terms continues to rise.

Chart 3. State-guaranteed loans for house purchase (millions of euro)

Although no signs of overheating are apparent on the housing market yet, the mismatch between the rising demand and the overall stagnating supply contributes to acceleration of housing prices. The state guarantee programme in its current form is an additional contributor. The programme was introduced at a point when the RE market was depressive and the mortgage lending growth was deeply negative. It had a significant growth-promoting role under those circumstances, but, at the current juncture, its side-effects (not just the rising RE prices, but also lower effectiveness of macroprudential measures and potential effect on contingent government liabilities associated with the provided guarantees) are becoming increasingly more prominent.

The above considerations call for a discussion whether the state support programme should be refined to provide more targeted assistance in order to address any potential imbalances in the housing market.

[1] Household deposits reached a historical high in 2021 both in absolute terms as well as relative to gross domestic product (GDP).

[2] Statistics on new loans was introduced in 2015. Before 2015, the quarterly growth rate of outstanding loans has been used as the best proxy for data on new loans, but it has to be noted that new loans exceed the increase in outstanding loans.

[3] This requirement does not apply if the first housing loan has already been largely amortised (LTV<50%).

[4] Excluding the effects of loan write-offs, exchange rate movements, reclassification and other on-off effects; Latvijas Banka's approach to exclusion of one-off effects when using more granular data available on developments in Latvia's commercial banks is to exclude additional reclassification and other one-off effects and not to exclude the effects of loan write-offs.

Textual error

«… …»