Mid-2009 as a watershed: consolidation begins, growth resumes

The strategy aimed to resolve the debt crisis by gradually decreasing budget deficits and debts is implemented against a background of hot debates ("economic and political suicide" or "the only solution without a real alternative"), which find a variety of echoes in Latvia as well. Lately, a discussion on the impact of fiscal consolidation on economic growth has been reinforced?. Some analysts claim that there is an inherent positive relationship between budget expenditure and economic growth: with budget expenditure growing or the tax burden diminishing, the rate of economic growth picks up and vice versa. The experience with fiscal consolidation in Latvia, however, indicates that this relationship does not always apply and in certain circumstances, cutting the expenditure can promote economic recovery in a relatively short time.

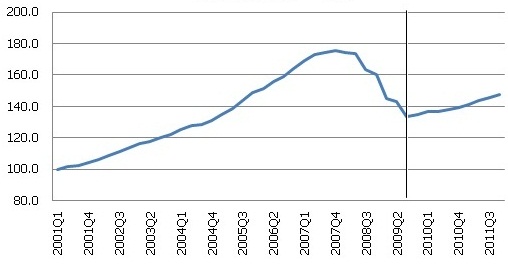

Looking at GDP dynamics, it can be seen clearly that the most rapid drop in economic activity, as a result of the world financial and economic crisis, took place in the second half of 2008 and beginning of 2009, when any real consolidation measures had yet to be taken and that growth resumed as early as after the very first substantial budget consolidation (marked by the vertical line in Figure 1), i.e. in the third quarter of 2009.

Figure 1. Gross domestic product, 1st quarter of 2001 = 100

Source: CSB

It is worth remembering that cutting budget expenditure dictated by the need to resolve the crisis, really began in Latvia only in mid-2009 when it had become clear that the GDP drop will be much steeper and the budget deficit in 2009 could reach 20% (!) of GDP. The budget consolidation carried out at the beginning of 2009 amounted just to an adjustment of the overly optimistic expectations, leaving the actual budget expenditure for 2009 at the level of the previous year (as the economy was dropping rapidly and budget expenditure was going down, the budget deficit continued to rise at the beginning of 2009).

How do economists assess the impact of fiscal consolidation on the economic activity?

Standard macroeconomic theory, which nowadays is at the foundation of the majority of macroeconomic models and serves as a guideline for politicians and economists, asserts that at least in the short term, the impact of fiscal consolidation on the economy is negative and may be compensated in the long term by the positive effect from tax cuts expected in the future (when the budget situation has improved).

Yet there exists an alternative view that gained popularity in the 1990s and which we have discussed before [1]. That is the so-called non-Keynesian effect which can materialize?? through two channels: that of demand and that of supply. Let us look at each of them separately.

The demand channel has been discussed by McDermott and Westcott, 1996[2]. As the government debt increases, investors have higher expectations of the default risk and thus demand higher interest rates. If fiscal consolidation strategy is persistent and credible, the risk is reduced and the risk premium added on to interest rates also drops. Lower interest rates, in turn, stimulate investment and that part of private consumption that is sensitive to interest rate changes. The supply channel is reasonably well presented by Alesina and Perotti, 1995[3]. The authors claim that any average salary cuts in the public sector brings down salaries in the private sector as well as the unit labour costs. That creates a positive supply shock resulting in expanded production. Cutting the costs of labour resulting from the constraining budget policies raise an enterprise's competitiveness and increases exports.

To determine which of the non-Keynesian effect channels (the demand or supply one) could have been at play in Latvia, it is necessary to look at the main components of GDP and their dynamics during a crisis.

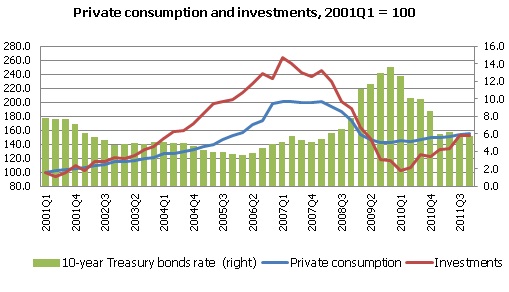

As we look at the effect of the supply channel – the dynamics of private consumption and investment in Latvia – it becomes obvious that these indicators also began to recover after a substantial consolidation was launched in the second half of 2009, whereas the greatest drop in the economy took place when the government expenditure still remained at the high level of the previous year. Private consumption began to recover in the fourth quarter of 2009, which also corresponds to an improvement in consumer confidence (evaluation of the future) while investments growth resumed in the second quarter of 2010. An improvement in investments was also promoted by the drop in interest rates after a rapid rise, which had been?? caused by the financial crisis and distrust of government policies before consolidation. The dynamics of both consumer confidence level and interest rates was impacted positively by fiscal adjustments implemented by the Latvian government indicated that both consumers and investors were regaining confidence in government policies and the economy at large and they were ready to resume economic activity soon after consolidation, without waiting for a launch of government stimulus.

Figure 2. Private consumption and investments

Source: CSB, State Treasury

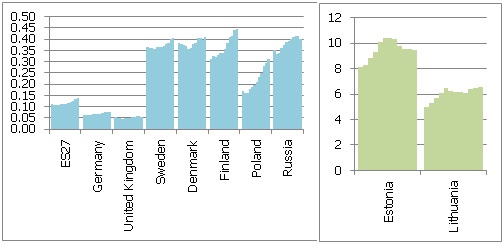

As regards the supply channel export recovery began almost immediately after fiscal consolidation measures were taken. That is hardly a coincidence. The most important austerity measure was a reduction in compensation of public sector employees which had grown disproportionally over the boom years. That took place parallel to salary cuts in the private sector, which, by balancing the remuneration and productivity levels led to reduced production costs and prices and thus to lower costs of Latvian produced goods. Of course, it is important to remember that external demand also began to improve around this time: as the economic situation abroad improved, demand for Latvian export goods grew. The effect of improved competitiveness, however, was also important: in addition to the increase in external demand, it allowed Latvia to substantially increase its export shares in the markets of its partner countries by outdoing the producers of other countries.

Figure 3. Latvian exports vis-à-vis the imports of main trading partners

(slid. avg. %, 4Q 2008– 4Q 2011)

Source: CSB

Thus the scenario of Latvian economic development in 2009-2010 could become a historic precedent where non-Keynesian effects were at play both through the demand and supply channels. That contradicts the stereotypical view that cutting budget expenditure leads to the shrinking of the economy always and everywhere. The Latvian developments indicate that the economy shrunk at the time when no actual budget consolidation was taking place. Growth, on the other hand, resumed almost simultaneously with the launch of budget consolidation measures.

Below, I will try to provide a historical overview of the consolidation to highlight the crucial significance of mid- 2009 in the crisis resolution in Latvia.

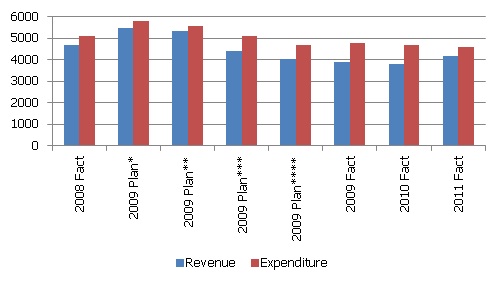

When did the budget consolidation really begin?

Let us go back to 2008, when Latvia, on the brink of insolvency, agreed with the international lenders on implementing the programme of economic stabilization and growth revival. The programme envisaged a budget deficit of 5% of GDP in 2009, which meant changes in the Law "On State Budget for 2009" already adopted and amended between its two readings. At that moment it seemed that an important step had been taken in the direction of cutting the budget deficit. However, if we take a closer look at the amendments adopted at that time, we have to conclude that budget expenditure was cut against the 2009 budget already approved, which, in keeping with the traditions established in the previous years, still provided for a rather steep rise in expenditure (See Fig. 4). Relative to the actual expenditure of 2008, the expenditure planned for 2009 was not cut. The budget consolidation planned at the end of 2008 and implemented at the beginning of 2009, amounted simply to an adjustment made to the previous overly optimistic expectations, leaving the budget expenditure at the previous year's level. That meant that at the beginning of 2009, as the economy plummeted rapidly and drop in budget revenue continued, the budget deficit continued to grow, threatening to reach unsustainable levels. At the beginning of that year it became clear that the GDP drop will be much more rapid than expected and that the budget deficit in 2009 could reach 20% of GDP. It was then, and not at the end of 2008, that the actual budget consolidation began and the first result was the adoption of supplementary budget for 2009 in June. Thus it was only in mid-2009 that cutting the budget expenditure began.

Figure 4. Planned and actual state budget revenue and expenditure, mil. lats

The figure represents the actual annual data with the exception of cases marked with an asterisk.

What consolidation measures were implemented?

Over four years, six budget consolidation packages were adopted: two for the 2009 budget, one for 2010, two for 2011 and one for 2012, with the budget consolidation measures amounting to about 17% of GDP. Note, however, that in many categories expenditure was increased, e.g., for co-financing of EU funded projects. The net impact of fiscal consolidation is thus lesser for this reason.

On the revenue side, the most important measures were the raising of the VAT standard rate from 18% in 2008 to 21% in 2009 and 22% in 2011. The VAT reduced rate was likewise raised and the range of goods and services subject to this rate was narrowed. The excise tax rates were reviewed several times, the minimum income not subject to personal income tax (PIT) was reduced, the social security contributions (SSC) rate was raised by 2 percentage points and the SSC and PIT base was expanded (including capital income in the latter). A decision was made to impose the real estate tax on dwellings, applying a differentiated rate depending on the cadastral value. Finally, the share of the profits gained by state enterprises and the Bank of Latvia to be paid into the budget was raised.

On the expenditure side, substantial consolidation was undertaken, allowing to keep the proportion of expenditure against GDP under 50% in 2009 and promote its gradual reduction in the coming years. Many European countries meanwhile increased the amount of 2007 expenditure, exceeding 50% of GDP. At least the short-term economic development data currently indicate that Latvia is more successful in maintaining growth at a time when many European countries have to review their economic predictions and adjust them downward.

The cuts were greatest in the salaries of employees, which dropped by 5% of GDP. Such a reduction would not have been possible without structural reforms in the state administration, where the average salary was cut and a unified system of compensation was introduced along with eliminating or combining several institutions etc. as well as in healthcare system and secondary education. The second largest reduction was in goods and services (about 2.4% of GDP), also promoted by structural reform in the public sector. As the central government budget earmarked transfers to local governments have dropped, so have local government investments. The expenditure of the central government for investment was also cut. The total cuts in investment expenditure are estimated at about 2.5% of GDP. Here it must be added, however, that the agreement with the international lenders provided for speeding up the implementation of projects co-financed by EU funding, which helped to compensate the reduction in local financing of investment and to continue investing in infrastructure and promotion of entrepreneurship thus improving the long-term potential of Latvia. The cuts in social expenditure were small, introducing a ceiling for social insurance benefits. Moreover, in cooperation with experts from the World Bank, the Latvian government developed a social security network programme that provided for financial support for the poorest among the population and that allowed many to cope with the financial consequences of the crisis.

Table 1. Budget revenue and expenditure measures in 2009-2012

| Measures | 2009 | 2010 | 2011 | 2012 |

| Review of VAT rates | 0.9 | 0.6 | ||

| Review of excise tax rates | 0.2 | 0.1 | 0.1 | 0.2 |

| PIT measures | 0.3 | 1.2 | ||

| SSC measures | 0.3 | 0.5 | ||

| Real estate tax measures | 0.2 | 0.1 | ||

| Review of dividend rate | 0.6 | 0.1 | 0.1 | |

| Other revenus measures | 0.1 | 0.3 | 0.2 | |

| Compensation of employees | 2.8 | 2.2 | ||

| Intermediate consumption | 2.1 | 0.1 | 0.2 | |

| Subsidies | 0.3 | 0.4 | 0.1 | |

| Social expenditure | 0.4 | |||

| Investments | 1.7 | 0.7 | 0.2 | |

| Other expenditure measures | 0.3 |

Source: BoL estimate

[1] http://www.makroekonomika.lv/vai-mazak-ir-vairak-par-budzetu-un-deficitu

[2] McDermott, J, Wescott, R. “An Empirical Analysis of Fiscal Adjustments”. IMF Staff Papers, Vol. 43, No. 4, pp. 1-26, 1996

Textual error

«… …»