Latvian manufacturing output in 2014 on par with 2013

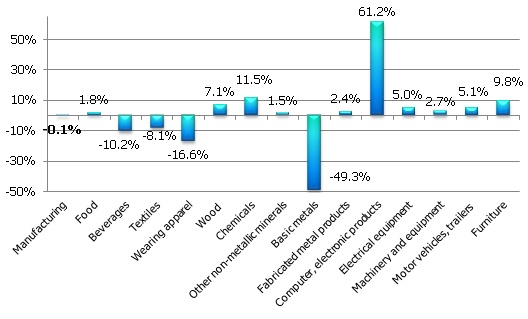

The latest data indicate that despite problems in the external markets, the manufacturing output last year remained at its 2013 level. In 2014, wood industry as well as the production of computers, electronic and optical equipment had a positive impact on manufacturing. Several other industries, for example, the production of wearing apparel and textiles as well as the production of pharmaceuticals suffered due to the weak foreign demand.

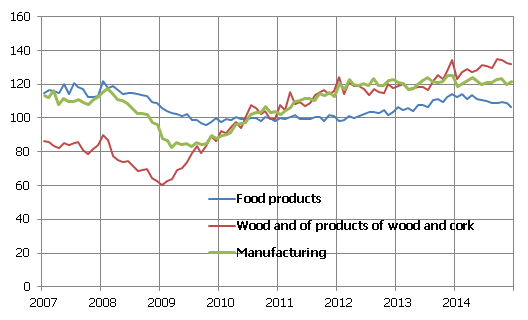

According to the data of the Central Statistical Bureau, manufacturing output in December 2014 grew 1.4% month-on-month (seasonally adjusted data). Year-on-year, there was a drop of 2.8% (working day adjusted data). Overall the amount of manufacturing output remained almost unchanged in 2014 (-0.1%) compared to 2013.

Month-on-month, the greatest increase was observed in the volatile production of beverages (+61.7% !!), and this small sub-branch was also the greatest contributor to the December increase of manufacturing output. The drop in the output of food industry (-1.7%) had the greatest negative impact on manufacturing in December. The falling production output in wearing apparel manufacturing (-14.9%) and metal processing (-3.6%) were also a substantial drag on manufacturing results.

Despite the challenging situation in the external markets, manufacturing output in 2014 was very close to its 2013 level. The production of wood and the production of computers, electronic and optical equipment grew – a historical maximum output level was reached in September in both sub-branches. The turnover data in both sectors were also strong. The producer price trends last year differed between the two sub-branches: while the prices of computers and electronic equipment have experienced a rather steep drop, the prices of wood products rose. Wood producer associations had already announced in the media the good news regarding increased turnover in the businesses of the sector. The successful year in wood processing is related to the growth of the construction sector in the principal markets. For instance, the construction PMI (Purchasing Managers' Index) in the United Kingdom was at a very high level in 2014, in fact, UK construction firms recorded the strongest calendar year since the PMI survey was introduced in 1997.

In 2014, an output maximum was reached also in the production of automobiles and trailers and in the production of electrical equipment (respectively in July and October), but the end of the year for both sub-branches was less successful. Over the year, dropping producer prices were observed in the production of electric equipment. That partially explains the weak turnover data in the industry: in the first 11 months of the year, turnover dropped rapidly both in the domestic (-30.5%) and in the export (-19.1%) market. The falling turnover data are partly due to problems in the businesses dependent on the Russian market, and if the situation in the neighbouring country does not improve the problems may continue in 2015 as well. Falling output last year was posted by metal producers as well as beverage producers. The drop in the production output of textile products and wearing apparel in 2014 can be related to the impact of the Russian crisis and to problems in some enterprises.

The food industry in 2014 overall managed to post a year-on-year rise; furthermore, in February a post-crisis output maximum was observed. Yet the output index of the industry was on a downward trend over the year. The drop in producer prices, particularly pronounced at the end of the year, was related both to the falling prices of raw materials and to the greater competition in the sector. The turnover of foodstuffs over the year dropped faster for the exported production. Currently the food manufacturers that are facing difficulties because of the situation in the Russian market are actively looking for new trade partners. Food production has been singled out as the Latvian industry that has some of the best prospects in the Chinese market. One of the ways of finding new markets is by participating in international trade fairs (the state support for the participation in trade fairs has been increased as a response to the crisis in Russia). Yet finding new markets is a long-term process. The success stories that we currently hear in the media refer by and large to those businesses that take part in international trade fairs regularly, whereas those who have just begun to look for alternatives to the Russian market are facing greater difficulty.

In 2015, the geopolitical instability and the weak recovery of the euro area will continue to impede manufacturing growth. On the other hand, the cheaper oil pushes the prices of energy resources down both in Latvia and the euro area, which is expected to have a positive effect both on the purchasing power of consumers and the production costs of manufacturers. This year, "KVV Liepājas metalurgs" is expecting to resume production, which would have a positive impact on manufacturing. News on investments of mechanical engineering and metal processing enterprises in increasing their production capacity gives rise to hopes that these sub-branches will increase their output in the coming years. Overall, however, 2015 in manufacturing will be complicated, particularly for the enterprises that are closely linked to the Russian market.

Fig. 1. Output in manufacturing and its two largest sub-branches, 2010 = 100

Fig. 2. Changes in output in manufacturing and its sub-branches in 2014, %

Textual error

«… …»