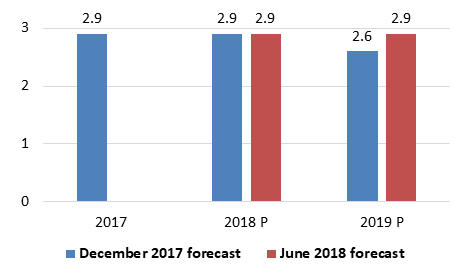

Latvian inflation: 2.9% = 2.9% = 2.9%

For Latvijas Banka Monthly Newsletter, In Focus, June, 2018

Latvian consumer prices posted a 2.9% increase in 2017, in line with our expectations (see June 2017 Monthly Newsletter). It seems now that inflation in Latvia is likely to stick at 2.9% for three consecutive years. In June, Latvijas Banka's Council kept the inflation forecast for 2018 unchanged at 2.9%, while raising it by 0.3 percentage points to 2.9% for 2019. What lies behind this decision? Overall, the inflation forecast was revised upwards due to climbing oil prices. In 2018, however, this effect has been compensated by lower-than-expected food prices at the beginning of the year.

In the first five months of 2018, headline inflation was somewhat lower than expected. This was partly on account of the lowering of the VAT rate on vegetables and fruit typical of Latvia from 21% to 5% as of January 2018, the impact of which exceeded expectations. Therefore, Latvijas Banka's inflation forecast for this year has remained unchanged despite the rise in oil prices.

In May 2018, Brent oil prices climbed beyond 75 dollars per barrel reaching a level not seen since 2014. This was driven by several events, e.g. strong compliance with the agreed oil supply cuts by OPEC as well as its ongoing cooperation with Russia, military and political tensions in the Middle East, declining oil extraction in Venezuela and the US cancelling the Iran nuclear deal. Nevertheless, as a result of the rising oil prices, the US oil output reached new historical highs. With slight exaggeration, it could be said that, in the medium term, the US could offset any oil supply cuts by OPEC, leaving the global oil supply broadly unchanged. Therefore, as the oil price for a moment approached 80 US dollars per barrel, OPEC and Russia finally considered a possible increase in their oil output, and this announcement alone was enough to end the oil price rally or at least to put it on hold.

The recent oil price hike has already been transmitted to retail fuel prices. For instance, the price of 95 petrol rose to 1.30 euro, 16 cents higher than a year ago (about a quarter of this increase was driven by a rise in excise tax as of January 2018). Moreover, the impact on heating and gas prices is yet to be seen, even if the oil price is going to decrease moderately over the next few months as suggested by its future contracts. Another administrative price rise will come from the new water and sewerage tariffs in Riga in effect as of June 2018 (their impact on the overall price level is 0.1%).

After dropping at the turn of the year, global food prices resumed moderate growth in the spring. However, the global rise in dairy product prices mainly reflects tight supplies in New Zealand, with a limited impact on the European region. The global prices of cereals are climbing because the harvest estimations were revised downwards for this year and fell below both the growing demand and the previous year's record-high harvest.

Our estimate of the impact of domestic demand on inflation remains almost unchanged. While it is true that wage growth accelerated to 8.6% in the first quarter of 2018, this was mainly driven by a more significant minimum wage rise this year. Core inflation (excluding taxes, food, energy and administrative prices) is lagging by a few quarters relatively to the slightly positive output gap. As a result, the core inflation is expected to nearly double this year to 2.4% and retain its level in 2019.

Consumer price inflation (HICP; %)

Textual error

«… …»