Four years in the euro area - have the promises come true?

For Latvijas Banka Monthly Newsletter, In Focus, January, 2018

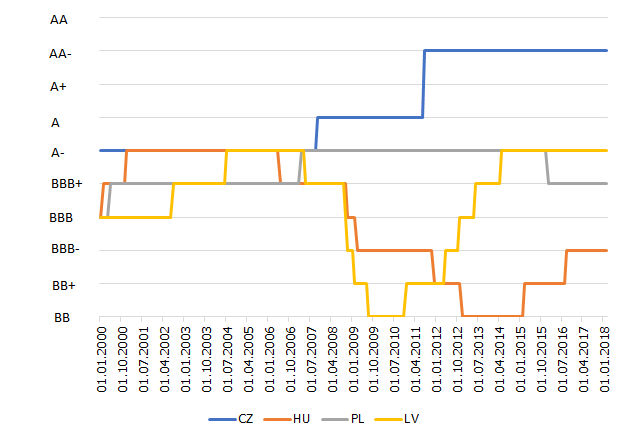

According to Latvijas Banka's estimates before joining the euro area, this step would improve Latvia's credit rating by 1-2 notches. Since the announcement that Latvia (LV) had joined the euro area, Latvia's credit rating was revised upwards by two notches, i.e. from BBB to A- in a short period (2013–2014). If we look at the Czech Republic, Hungary and Poland (CZ, HU, PL), their credit ratings remained unchanged in the same period.

Before Latvia's joining the euro area Latvijas Banka emphasized that improvement of Latvia's credit rating by 1-2 notches would reduce Latvia's 10 year government bond rates by 150 basis points (bp). Since the announcement that Latvia had joined the euro area, Latvia's 10 year government bond rates have dropped markedly from 3.25% in the middle of 2013 to 0.71% in October 2017. Moreover, Latvia's 10 year government bond rates in the national currency have decreased by approximately 160 bp compared to those of CZ, HU and PL. This has resulted in savings of around 0.6% of GDP or 150 million euro in the government budget over the reference period of five years.

Lower interest rates ensure more favourable conditions for private sector borrowers, thus affecting investment and consumption decisions. Latvia's joining the euro area and the improvement of its credit rating has also had an impact on the interest rates on loans; they were lower than those of CZ, HU and PL in October 2017.

Latvia's interest rates on loans to enterprises and households decreased by approximately 90 bp compared to those of CZ, HU and PL. Meanwhile, the money market interest rates in Latvia could be 160 bp higher than they are now if Latvia had remained outside the euro area.

Before joining the euro area Latvijas Banka had estimated that savings in the economy resulting from reduced currency conversion volumes of households and businesses would amount to 70 million euro per year. These estimates were based on real foreign exchange transactions conducted, taking into account the actual margins between the purchasing and selling rates of currencies. Statistics showed a steep year-on-year decline in currency exchange transactions in 2014 confirming the accuracy of Latvijas Banka's estimates. With the euro changeover, the risks and costs of businesses related to exchange rate fluctuations have decreased considerably having a positive effect on foreign trade related business.

What would happen if Latvia had remained outside the euro area? The assumption used in economic modelling is that Latvia's interest rates would exceed approximately 160 bp based on the above comparisons with countries outside the euro area, financing conditions would worsen whereas investment and profit would decrease. Within the reference period of five years, investment would decline by 5%, the number of unemployed would exceed the current level by 5000 persons, while Latvia's GDP per capita would decrease by 164 euro against a rising interest rate environment.

Overall, it may be concluded that Latvijas Banka's estimates before joining the euro area have proven to be accurate and the positive outcomes have materialised, namely, Latvian people and businesses have benefited from the euro.

Chart 1. Dynamics of S&P credit ratings

Textual error

«… …»