Foreign direct investment globally and in Latvia

For Latvijas Banka Monthly Newsletter, In Focus, March, 2017

Competing for global foreign direct investment (FDI), Latvia has been among the Central and East European countries with the largest FDI inflows recorded in the post-crisis period. The activity of FDI flows is affected by global factors and the growth potential of the countries as well as the structural aspects. Thus, the political will and the efforts of institutions to create a more attractive investment climate in Latvia are more than welcome. In this regard, the government plans to present a new simple and competitive tax policy strategy in April 2017.

The global FDI activity remains volatile. 2016 saw a decline following a significant upswing in the year before; nevertheless, flows remained slightly above the average levels experienced in the post-crisis period. In the circumstances of heightened protectionism and weak global trade, it is even more important to establish a presence in the potential export markets. In 2016, the US, the UK and China were among the top three FDI host economies in the world. Along with an increase in global economic growth also high-level representatives of companies in different countries, surveyed by A.T. Kearney (global consulting company) point to further persistence of FDI global flows. 70% of them admit that they intend to make FDI in the three coming years.

Research suggests that FDI facilitates productivity spillovers through knowledge and technology transfers, and thus enables local companies' access to new markets. Integration in global the market, as measured by the stock of FDI, is vital for productivity and income growth.

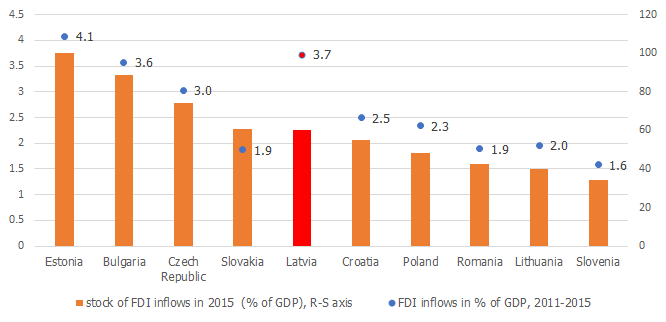

In the post-crisis period, FDI inflows in Latvia recording an average of 3.7% per year have been among the largest compared with other countries of the region.

Inward FDI (in % of GDP)

From an analytical point of view, FDI inflows in 2016 continued to be similar to the average levels registered in previous years, at 3% of GDP. Statistical data record inflows at only 0.5% of GDP. Yet, this difference is related to a one-off transaction, namely, a commercial bank group's optimisation of the capital structure, that masks the activity of other foreign direct investment. However, Latvia still has the potential to increase integration into the global market. The stock of FDI accounted for 54% of GDP at the end of 2016 that is a lower level than the one recorded by several other countries of the region. The financial and real estate sectors, as well as trade and manufacturing sectors are the major holders of the stock of FDI, while the trade, transport, construction, IT and communication sectors recorded the largest FDI inflows in the previous year.

FDI is an important source of investment in Latvia, and, according to UNCTAD data, accounts for close to 15% of total investment. This is a higher ratio than the global and the EU average. Taking account of the fact that access to EU structural funds is likely to be lower in the next programming period, it is even more urgent to support FDI. FDI flows are influenced by global factors such as the persistently weak growth, high political uncertainty and heightened protectionism, affecting all countries of the region. The growth potential of the countries and other economic aspects are not the only preconditions for FDI attraction. Moreover, a significant role is played by structural factors determining the investment absorption capacity and the attractiveness of business environment such as, for instance, effective governance, tax policy, infrastructure development, human capital potential and the like. Currently, the development of a simple and competitive tax policy and discussions with social partners are underway in Latvia. This new initiative strives for easing the tax burden on labour and introducing zero corporate income tax on retained earnings. A more attractive environment for companies and investors will strengthen the capacity for economic development in Latvia.

Textual error

«… …»