Exports are weathering the storm well

In the first quarter of 2021, countries in the European Union and other parts of the world were still introducing strict restrictions to contain the pandemic. However, with people and businesses adapting to the new situation, the impact of the restrictions on the economy was less pronounced. Economic sentiment in Latvia's trade partners had also improved since the beginning of the year, standing well above its long-term average as well as its pre-pandemic level already in May. At the same time, with restrictions being gradually lifted, epidemiological tensions in Latvia's trade partners eased.

In the first quarter of 2021, countries in the European Union and other parts of the world were still introducing strict restrictions to contain the pandemic. However, with people and businesses adapting to the new situation, the impact of the restrictions on the economy was less pronounced. Economic sentiment in Latvia's trade partners had also improved since the beginning of the year, standing well above its long-term average as well as its pre-pandemic level already in May. At the same time, with restrictions being gradually lifted, epidemiological tensions in Latvia's trade partners eased.

The demand for goods produced in Latvia and, thus, exports continued to increase rapidly in the first quarter, mostly on account of the industries that bore the brunt of the last year's crisis. The services export sectors whose activities were less dependent on restrictions on movement and gathering also developed successfully.

In the first quarter of 2021, the value of exports of goods increased by 8.2%, with the biggest contribution coming from the "hot" exports of products of wood, driven by high demand in the construction sector and the related increase in prices. The export value of electronic products and electrical equipment continued to increase steadily even after the double-digit surge recorded in 2020. The export growth of the chemical industry products accelerated, with exports of pharmaceutical products being the largest contributor. Exports of agricultural products also continued to contribute significantly, although the sector's active season was already over.

In the first quarter, exports of goods eased concerns about supply disruptions, weaker demand or lower prices as well as concerns about an excessively high rate of capacity utilisation, with several sectors exceeding the record-high levels reached in 2020.

However, these risks remain relevant, and at least some of them will, sooner or later, materialise.

In the first quarter, the services export growth was still hindered by the stagnation in the travel and transport services sectors, while other sectors continued to develop successfully. In the first quarter, various business services which were little affected by the crisis grew by more than 16% quarter-on-quarter. The value of telecommunication and computer services also continued to grow.

Recovery of exports in the travel and air transport services sectors remains impossible as their activity can only resume when the restrictions are eased.

The fall in the value of the services provided by other types of transport, additionally affected by the longer-term unfavourable trends associated with the decline in Russia's transit flows, moderated somewhat, and this might suggest that the adverse effects of the pandemic are receding.

In the first quarter, the value of imports of goods continued to increase, albeit at a much slower rate, on account of disruptions to imports from the UK caused by the introduction of the post-Brexit customs procedures as well as the persistently low import volume of vehicles. At the same time, the stagnation in the travel and air transport services sectors weighed on the imports of services, as was the case with exports of services.

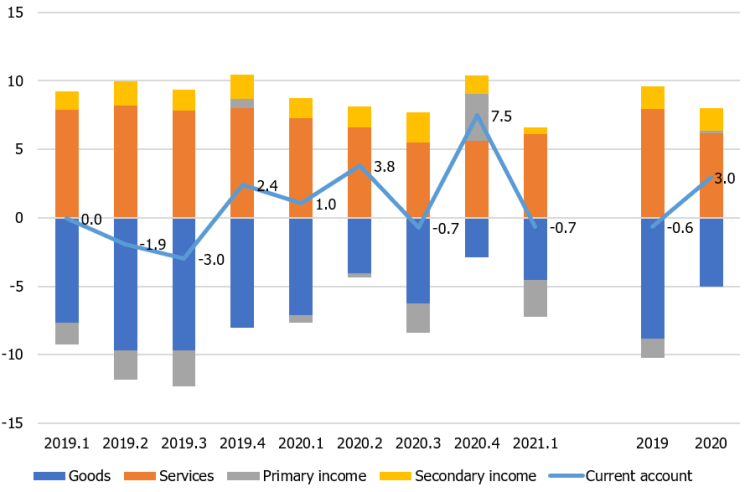

As a result of stronger exports of goods, in the first quarter the surplus of the goods and services trade balance was significantly higher as compared to the corresponding period of the previous year (1.5% of GDP). At the same time, along with the income account deficit of 2.2% of GDP, the current account posted a deficit of 0.7% of GDP in the first quarter of 2021. The rise in the income account deficit was primarily driven by an increase in foreign investors' profit compared to the level seen in the first quarter of 2020 when it was not yet affected by the crisis. This profit was mainly re-invested in investor companies in Latvia.

Chart. Main components of the current account (% of GDP)

In the first quarter, the largest flows in the financial account were related to Latvijas Banka's participation in Eurosystem monetary policy operations and reductions in debt liabilities of financial corporations (excluding monetary financial institutions). Moreover, in the first quarter the amount of foreign direct investment increased rapidly and reached 5.4% of GDP, approximately twice the average amount observed over the recent years. Most of the growth was recorded in investment in trade and manufacturing.

Textual error

«… …»