Monetary aggregates back to moderate growth

In the absence of the effects caused by the one-off factors observed in September, monetary aggregates returned to their traditional development trends in October. A rise was observed for both corporate and household deposits with banks and well as corporate loans and consumer credit, resulting also in an improvement of the respective annual rates of change.

The domestic loan portfolio expanded by 1.4% in October. Non-bank financial institutions were accountable for a lion's share of this increase in lending, yet the loan portfolio of non-financial corporations and consumer credit to households also expanded (both by 0.4%).

Domestic deposits with banks grew by 2.0% in October. This included a 5.7% and a 0.8% rise in deposits by non-financial corporations and those by households, with the annual growth reaching 4.4% and 8.5% respectively.

Larger deposits also translated into a 2.5% increase in Latvia's contribution (annual growth of 2.8%) to changes in the total M3 for the euro area. Overnight deposits of euro area residents with Latvian credit institutions increased by 3.3%, deposits redeemable at notice grew by 0.4%, while deposits with an agreed maturity of up to 2 years shrank by 3.8%.

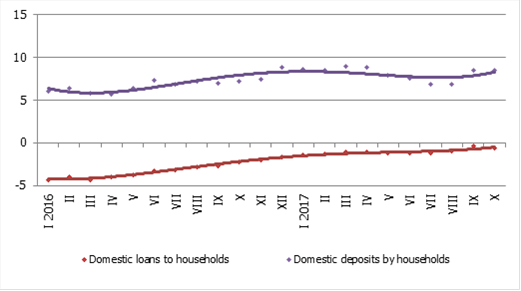

Annual changes in household deposits and loans (%)

<

The growing household deposits continue a long-observed tendency: the annual growth remains stable and the outstanding amount of deposits is increasing virtually month by month. Therefore, considering the economic developments in general and those of the labour market in particular, such pattern can be expected to persist also in the last months of this year and in 2018.

With the household loan portfolio remaining broadly unchanged and even increasing in some months, the annual rate of change is still only approaching zero. It can be expected that the annual growth of lending to households will return to a positive territory as early as in the coming months. This will be supported by the amendments to the Law on Assistance in Solving Apartment Matters passed by the Parliament in November. Persons up to the age of 35 years who have graduated from a secondary vocational education or higher education institution will now also be eligible for support within the framework of the housing support programme.

The recovery in corporate lending, however, is slower than expected, yet it is also likely to gather strength next year on account of an increased availability of the EU structural funds, higher investment required to boost the production capacity and the government support to lending to small businesses. As concerns corporate deposits, their growth will continue to be uneven, although positive in annual terms.

Textual error

«… …»