Structural changes in the banking sector shuffle the data, but leave the trends unaltered

One of the commercial banks transferred part of its corporate loan portfolio to its foreign parent bank. Hence total loans contracted and their annual growth rate also returned to a negative territory.

Nevertheless, the above developments had no effect on the Latvian economy, as companies continued to use the received loans, thus supporting further economic growth. Moreover, in the absence of those structural changes, loans would have continued growth in annual terms. Deposits with banks shrank in September, with companies decreasing their savings on the bank accounts and households doing exactly the opposite.

Although total loans and loans to non-financial corporations contracted, household loans increased by 0.5% in September, including a 0.6% rise in the case of consumer credit (annual rates of change were –0.4% and 4.9% respectively).

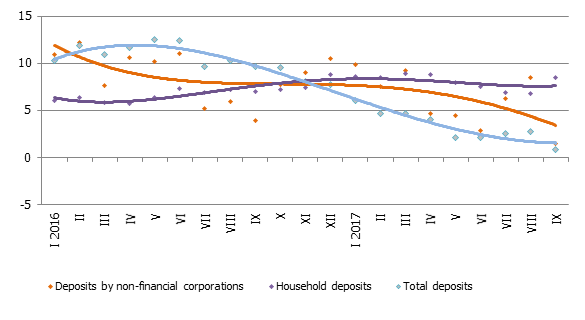

Domestic deposits with banks decreased by 1.8% in September, with deposits of non-financial corporations shrinking by 6.0% and household deposits growing by 1.5% and their annual growth rates standing at 1.5% and 8.5% respectively.

As a result of the shrinking deposits, Latvia's contribution to changes in the monetary aggregate M3 of the euro area also decreased by 2.0%, with the annual growth rate standing at 0.6%. Overnight deposits of euro area residents with Latvian credit institutions contracted by 2.7%, whereas deposits with an agreed maturity of up to 2 years and those redeemable at notice increased by 3.8% and 0.3% respectively.

Annual changes in domestic deposits (%)

Deposits can be expected to preserve their current trends in the last quarter of this year and also in 2018: moderate overall growth will be achieved on account of a stable increase in household savings supported by the growing wages and the shrinking unemployment. Corporate deposits, however, will show higher volatility.

Lending to households is likely to return to growth.

This will be supported by both an improvement in consumer confidence and overall favourable economic conditions as well as higher activity on the real estate market.

A positive contribution can be also expected from ALTUM housing support programme, supplemented by support to young professionals up to the age of 35 by the Cabinet of Ministers in October. Corporate lending portfolio is also likely to grow slightly: investments required for boosting the production capacity and the government support to lending to small businesses could cause higher activity also in this segment of lending.

Textual error

«… …»