Latvia's Balance of Payments in the Third Quarter of 2010

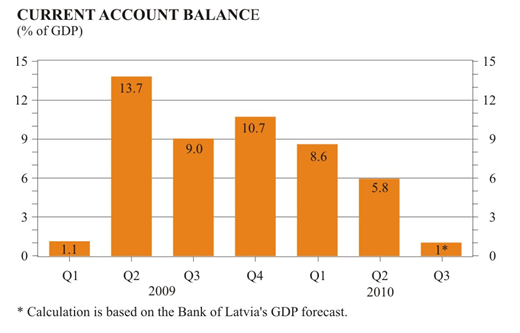

In the third quarter of 2010, the current account of Latvia's balance of payments remained in surplus (37 million lats or approximately 1% of the projected GDP).

With the economic activity in Latvia expanding - production and exports growing - the need for imports of intermediate goods and capital goods, particularly so of metals, mineral products and transport vehicles, also increased. Hence the trade balance no longer improved. Services trade balance remained broadly unchanged quarter-on-quarter, whereas its year-on-year surplus was higher (over the year, the major increase was observed in the value of exports of transportation services and financial services). The value of imports of transportation services and other services also recorded a rise. With the performance of foreign direct investment companies improving, their total losses decreased and the income account balance grew negative for the first time since the third quarter of 2008.

Current transfers contributed to the current account to a lesser extent than in the previous quarters; nevertheless, inflows of the European Union funding expanded both over the year and the quarter. They posted almost the same amounts in the current transfers account and the capital account. In the current transfers account, these inflows mostly reflected the funding received from the European Social Fund (in the first three quarters of 2010, the inflow of the above funds grew almost twofold year-on-year); in the capital account, the funding received from the Cohesion Fund for the implementation of environmental projects recorded the highest increase.

In the financial account, government borrowings contributed to quite substantial inflows also in the third quarter, at the same time expanding the reserve assets managed by the Bank of Latvia. A positive sign is a pickup in foreign direct investment in comparison with the first half of 2010, including higher investment in manufacturing.

In the third quarter, Latvia's net foreign debt continued on a downward trend (approximately to 56% of the projected GDP). Although Latvia continued to receive funds from both the International Monetary Fund and European Commission under the international bailout programme, Latvia's total external debt (both gross and net) gradually decreased due to contracting private debt. The latter shrank on account of banks repaying their long-term liabilities while a slight increase was recorded in the liabilities of the enterprises sector, mostly as a result of expanding trade credit.

A positive development is the fact that an increase in productivity in manufacturing keeps the current account close to balance at this stage, ensuring improved competitiveness and expanding exports. Unlike the reasons underlying the current account improvement in the previous periods (losses of foreign direct investment companies or declining imports caused by a fall in consumption), it is a sustainability-promoting factor. In the future, investment in production is required in order to maintain the external balance. Transparent, predictable and sustainable tax policy, a state budget approved on a timely basis, and hence a higher credit rating assigned to Latvia by international rating agencies will help ensure the required stable investment environment, attractive to both domestic and foreign investors.

Textual error

«… …»