Latvia's Balance of Payments in the Second Quarter of 2011

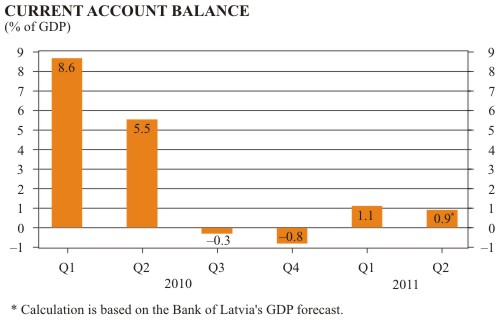

In the second quarter of 2011, the current account of Latvia's balance of payments recorded a surplus of 31.8 million lats or stood at 0.9% of GDP forecasts, i.e. close to the level in the previous quarter[1].

The foreign trade deficit for goods increased as imports grew faster than exports (in absolute terms). The predominance of goods imports over goods exports became more pronounced in June when some enterprises engaged in purchasing capital goods. Exports of transportations services reached an all-time high, with trade surplus for services reaching 235.7 million lats. They were significantly spurred by higher value of transport services to non-residents, with exports of travel (due to seasonal factors), financial and other business services expanding as well.

The deficit in the income account amounted to 85.9 million lats primarily on account of dividends often paid out by companies in the second quarter of each year following the submission of annual reports.

In the current transfers account, the surplus reached 140.4 million lats. With subsidies and other financing from the EU funds remaining broadly unchanged, the improvement of the current transfers account balance was the result of an increase in other private transfers.

In the financial account, the deficit contracted notably (to 7.7 million lats) in the second quarter. As international rating agencies upgraded Latvia's credit rating, the government has been able to borrow, for the first time since the first quarter of 2008, from the international financial market by issuing debt securities worth 500 million US dollars. The growth of the overall external debt, on the other hand, was slowed down by certain reduction in short-term and long-term liabilities of credit institutions.

In the second quarter, the net inflow of foreign direct investment grew by 186.1 million lats, i.e. on a par with the previous period. Quarter-on-quarter, the structure of net foreign direct investment inflows has changed: the FDI share inflowing into equity increased. Largest second quarter net foreign direct investment inflows were recorded for financial intermediation (mainly reinvested earnings), real estate activities, trade (mainly other capital as liabilities to direct investor), and manufacturing (mainly investment in equity).

Risks to the external economic outlook have amplified and testify to a potential deterioration in foreign demand in the upcoming quarters, most likely to adversely affect exports. Meanwhile, the information available on large infrastructure projects (often related to the drawdown of financing from the Cohesion Fund for the period up to 2015) suggests that imports of construction materials and transport vehicles are to be expected at a robust level over medium term. It cannot be asserted, however, that the anticipated deterioration in foreign trade fundamentals would substantially alter the current account balance dynamics, as global developments are expected to impact it in the opposite direction as well. Slower economic growth globally can reduce the pace of consumption domestically, thus restricting both imports of consumer goods and profits of foreign investor companies in Latvia. As a result, the deficit in the income account is unlikely to increase.

Textual error

«… …»