Latvia's Balance of Payments in the Fourth Quarter of 2010 and Year 2010

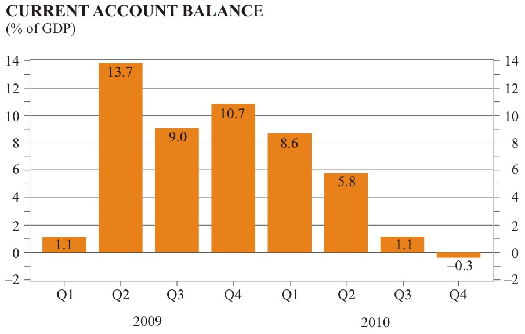

The surplus in the current account of the balance of payments amounted to 3.6% of the forecast GDP in 2010. As a result of the recovery of industrial output which supported the growth in consumption of imported intermediate goods, as well as a more successful performance of the companies owned by foreign investors and purchases of investment goods, the current account surplus contracted gradually in the course of the year. Consequently, a small current account deficit was observed in the fourth quarter of 2010 (11.3 million lats or 0.3% of the forecast GDP) for the first time since the fourth quarter of 2008.

In 2010 overall, the activity of foreign trade in goods increased significantly, with exports of goods rising by 28.6% and imports increasing by 20.4%. The rebound of the services trade began much later in comparison with that of the goods trade, and the annual growth of services exports amounted to merely 1.4%, as its developments were considerably dampened by the sluggish demand for transportation and travel services, particularly by the negative performance of transportation services by sea. In the fourth quarter, the overall goods and services trade balance remained broadly unchanged quarter-on-quarter, and the deficit amounted to 29.5 million lats or 0.9% of the forecast GDP, with the quarter-on-quarter growth in the exports of goods slightly exceeding that of their imports. The positive contribution of the services trade balance marginally declined in the fourth quarter, with the export value of passenger transportation by air and travel services decreasing (the reduction in the imports of these services was smaller). Thus the services trade balance did not offset the deficit of the goods trade.

The changes in the income account were the main contributor (over 3% of GDP) to the developments of the current account balance in 2010, as the significant banking sector losses which reversed the position of the current account in 2009 and still determined its surplus in the first half of 2010 were gradually replaced by the profits earned by foreign direct investment companies in various sectors. The deficit of the income account grew to 3.7% of GDP in the fourth quarter as a result of both higher reinvested earnings of foreign direct investors and dividend payments.

In 2010, the current transfers surplus increased to 3.6% of GDP mainly due to the inflows of EU funding, particularly larger amounts received from the European Social Fund. The quarter-on-quarter improvement in the balance of current transfers in the fourth quarter was also caused by the received EU funding, yet the funding flows increased mainly on account of agricultural subsidies.

In the financial account, single substantial inflows were formed by the international loan instalments received by the government in 2010, at the same time expanding the reserve assets of the Bank of Latvia. The confidence of non-resident depositors and investors returned gradually in the course of the year, positively contributing to the received deposits and foreign direct investment. Although it would be premature to attribute the fourth-quarter growth of foreign direct investment in the equity of various sector companies in Latvia to the upgrade of ratings by international credit rating agencies in September and December, the rating improvement will be important in promoting investment flows already in the near future. In 2010, financial account outflows mainly consisted of long-term liability repayments by the banking sector. The international loan instalment received by the government from the European Commission in the amount of 200 million euro continued to contribute to the financial account developments in the fourth quarter.

Overall, a small surplus of the current account could be retained in 2011 mainly as a result of current transfers. Meanwhile, the goods and services will be close to balance due to moderate changes in foreign demand, whereas the deficit of the income account will widen. Such developments characterise economic growth periods in Latvia when both private consumption and overall domestic demand improve and foreign investor companies earn good profits in Latvia. In 2011, changes in the financial account could be more related to private capital injections, as the current plan is to significantly reduce the government borrowing from international institutions as compared to 2010, while new various-scale investment projects to expand the existing production facilities or launch new business, including in manufacturing.

Textual error

«… …»