Latvia's Balance of Payments in the First Quarter of 2010

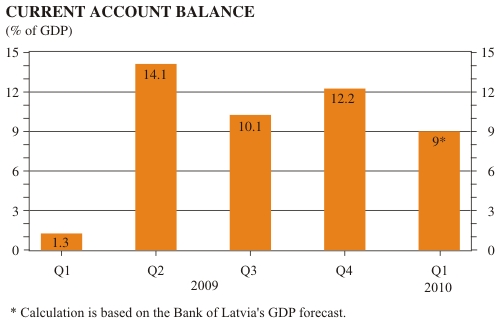

The surplus in the current account of Latvia's balance of payments amounted to 263.3 million lats or about 9% of GDP in the first quarter of 2010*. With exports growing and annual decrease of imports moderating, the aggregated trade gap in goods and services nearly closed.

In the first quarter, a stronger foreign demand and improving competitiveness boosted the share of exports in GDP up to 50%. More export orders and the projections as to the number of employees suggest that this year the role of export-oriented production in economy will increase further, and that more new jobs will be created. However, one should keep in mind that the economic problems arising from the financial situation in Greece potentially might have an adverse effect on external demand, thereby also slowing down Latvia's economic recovery. Yet, the growing export market share, already now supported by the improving competitive ability of Latvian producers, is expected to compensate for this at least partly.

A growth in intermediate goods imports and trade credit signals that the problems which intensified early in the crisis, namely, constraints on working capital, are easing now. The increase in industrial credit outstanding during the recent months also points to the fact that capital is more readily available, and so do the European Commission survey data, disclosing that in the second quarter net percentage of businesses reporting the availability of funding as a constraint to production has declined in comparison with the beginning of 2008. In the months to come, imports are likely to grow somewhat faster, nevertheless leaving the dynamics of the current account of the balance of payments broadly unchanged.

Losses incurred by direct investment companies accounted for about half of the current account surplus; accordingly, foreign direct investment in Latvia contracted. Same as in the previous quarters, the EU funds continued to be a major source of financing (7% of GDP). Of this, a half added to the surplus of the current account, while the other half is for capital investment and contributed to a surplus in the capital account.

With banks' long-term liabilities decreasing and, simultaneously, short-term deposits growing at a lesser extent, Latvia's net foreign debt stood at 7.1 billion lats (56% of GDP), down from 7.5 billion lats in the fourth quarter of 2009. For the first time since the second quarter of 2008, the net amount of granted trade credits went up, implying that, step by step, Latvian businesses are winning back trust. The government placed its borrowings with the Bank of Latvia, thus boosting the reserve assets, therefore, for the time being, the public sector has not had any serious impact on changes in net foreign debt. However, upward pressures on debt will intensify progressively while the government is going to finance the budget deficit with the funds borrowed from international lenders.

Textual error

«… …»