As Latvia moves towards euro area, demand for cash currency drops

For the first time since last August, the total domestic credit institution loan portfolio grew slightly in May – it happened with the short-term lending to businesses growing relatively fast. At the same time, there was a moderate drop in deposits attracted by credit institutions, the demand for cash currency continued to shrink and, as a result, total money supply also dropped.

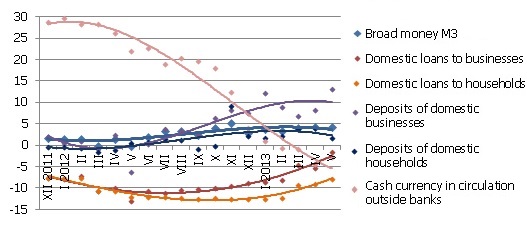

The money indicator M3, which characterizes the amount of cash and noncash currency in the economy dropped by 0.3% in May, whereas its annual growth rate remained unchanged, at 4.2%. Similar to April, the domestic overnight deposits rose as did deposits redeemable at notice, but deposits with the set maturity of up to 2 years dropped. In May, as the course toward the euro became more determined, businesses and the population continued to reduce their lats cash currency accruals: cash currency in circulation dropped by 1.3% and, at the end of May, lagged behind the level of the corresponding period last year by 2.8%.

Chart. Annual change of some monetary aggregates (%)

Chart.  (%)

(%)

Source: Bank of Latvia

The domestic household deposits in May rose by 1.6 million lats, whereas the deposits of non-financial enterprises dropped by 7.3 million lats. The rise in the balances of current accounts continued both in the business and household sectors, resulting from the drop of cash currency in circulation and the rising level of revenues. The drop in term deposits, on the other hand, could be related to spending the accruals of previous periods for purchases of durable goods as well as payments for import transactions.

In May, the balance of loans granted to businesses rose by 0.7%, whereas the household loan portfolio continued to shrink slowly. Year-on-year, the business loan portfolio lagged behind only by 1.5% in May and the annual drop rate for loans granted to households improved to 7.8%.

The drop in money supply in May might already point to a possible impact of the dynamic of external demand, which could increase in the future. The demand for cash currency will probably drop further by the conclusion by the European Commission (EC) regarding Latvia’s readiness to join the euro area, confirming that time has come to transform the lats cash currency accruals as conveniently as possible. The domestic demand stimulated by growing revenues, however, could compensate the impact of external demand, with the overall money supply remaining close to the existing level in the coming months. A positive piece of news for economic development is the halted drop in lending in the business sector, therefore we can expect a more substantial growth in lending to businesses in the foreseeable future. Such macroeconomic stability underscoring factors as the positive assessment by the EC regarding Latvia’s readiness to introduce the euro, the received invitation to begin negotiations for joining the OECD, as well as the upgraded credit rating of Latvia by Standard & Poor's could gradually make loans more accessible for a wider circle of businesses and later also households.

Textual error

«… …»