Growth trends in lending stabilize

The rise in domestic loan portfolio observed in May reinforced the changes of the previous month – the rate of the 12-month growth stabilized in the positive sector. In May the loans granted to both nonfinancial corporations and households increased, as did those granted to nonbank financial institutions. At the same time, the balance of deposits attracted by banks grew.

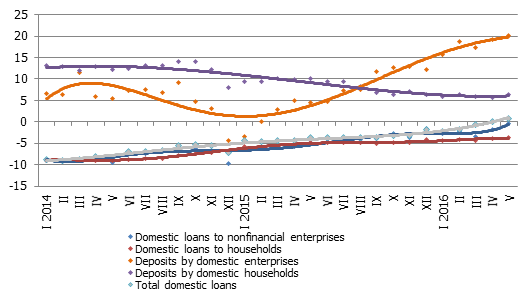

The balance of domestic loans of banks in May increased by 1.2%, with loans granted to nonfinancial enterprises increasing by 2.1% and loans to financial institutions by 1.7% and consumer loans to households growing by 1.9%. The annual rate of change of total domestic loans improved by 0.8 percentage points, reaching +0.9%, however for loans to nonfinancial corporations and households it remained negative, approaching, however, zero level (respectively -0.5% and -3.7%).

The domestic deposits attracted by banks in May increased by 0.3% and their year-on-year rate of increase reached 12.5%. Deposits of enterprises increased by 0.2% month-on-month (the year-on-year increase was 20.2%) and household deposits by 0.4% (year-on-year increase 6.4%).

Even though the domestic deposits increased slightly, the decrease in the demand for cash currency caused a small decrease in the Latvian contribution to the euro area broad monetary aggregate M3. The overnight deposits of euro area residents with Latvian credit institutions in May increase by 0.5% and deposits redeemable at notice by 0.2%, whereas deposits with the set maturity of up to two years shrank by 5.7%. Overall, the Latvian contribution to the euro area M3 in May dropped by 0.2%, again exceeding the corresponding level of the previous year by 10.5%

Y-y changes in some monetary indicators (%)

Source: Latvijas Banka

The Eurosystem is continuing to actively stimulate the growth of the economy, and a positive impact on continuing recovery of lending is expected also in Latvia. Furthermore, the participation of three Latvian commercial banks in the new longer-term refinancing operation (TLTRO II) auction in June, borrowing funds that could foster the granting of new loans. The growth of the loan portfolio will be supported also by the overall tendencies among banks and businesses, which is getting more favourable for lending both on the side of supply and demand. The impact of these positive trends, however, could be counteracted by the results of the referendum on the exit of the United Kingdom from the European Union, increasing uncertainty, which could once again impede the adoption of investment decisions.

Textual error

«… …»