Corporate and household deposits up

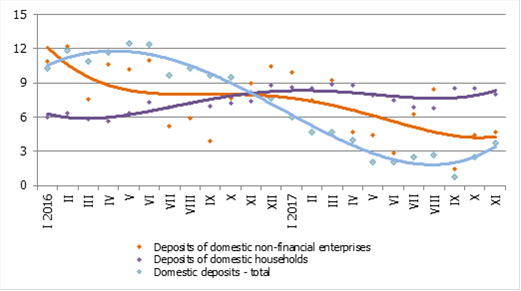

Domestic deposits with banks expanded by 1.8% in November, including increases of 1.7% and 1.0% in corporate and household deposits respectively, with their annual growth rates being 4.7% and 8.0%.

Deposit growth also accounted for a 1.7% increase (and annual growth of 2.8%) in Latvia's contribution to changes in the monetary aggregate M3 of the euro area. Deposit dynamics by maturity remained unchanged: overnight deposits of euro area residents with Latvian credit institutions expanded by 2.2%, deposits redeemable at notice grew by 0.7%, while deposits with an agreed maturity of up to 2 years shrank by 2.4%.

The domestic loan portfolio expanded by 0.3% in November, with the loan portfolio of non-financial corporations increasing by 0.8% and loans to households for house purchase edging up by 0.1%. Although in November new loans to both non-financial corporations and households were larger year-on-year, they fell behind the levels recorded in October 2017.

Annual changes in domestic deposits (%)

The fact that strengthening of the economy supports and is likely to stimulate accumulation of savings also next year is a positive factor both supporting financial sector stability and developing economic growth potential. Despite favourable financing conditions provided by the central bank, lending growth is rather weak. Next year lending will continue to develop on a very moderate path and will not be among the main drivers of economic growth; nevertheless, some growth is expected both in corporate lending (in the real estate and construction sectors in particular) and loans to households for house purchase and consumer credit.

Textual error

«… …»