Commentary on Latvia's balance of payments and international investment position for Quarter 1 of 2011

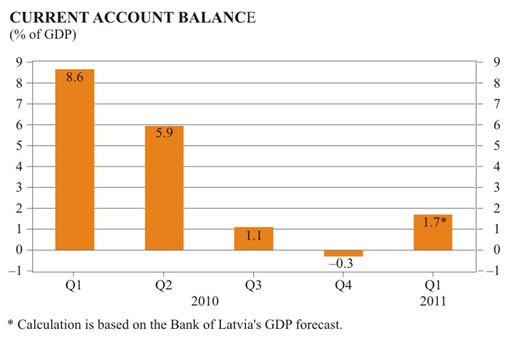

In the first quarter of 2011, the current account surplus of Latvia's balance of payments reached 52.7 million lats or 1.7% of the forecast GDP. Both goods and services trade balance and income balance improved quarter-on-quarter.

The goods and services trade deficit contracted quarter-on-quarter since the decline in exports was slightly smaller than that in imports due to seasonal factors. Exports and imports of goods and services posted similar annual growth rates (slightly above 30%). Positive changes were observed in exports of services: the export value of transportation services increased, particularly that of freight transportation by rail.

Income account balance remained in a negative territory also in the first quarter of 2011 (0.5% of the forecast GDP) as a result of profits earned by foreign investor companies and interest on loans paid by various sectors of the economy; however, the deficit was considerably smaller than in the previous quarter when it had grown on account of dividend payments.

The surplus of the current transfers account shrank, slightly exceeding 3% of the forecast GDP, as Latvia's contributions to the EU budget increased and transfers received by private persons fell. However, subsidies received from the European Agricultural Guidance and Guaranty Fund posted a substantial rise.

In the first quarter, the capital and financial account recorded a net outflow of 50.0 million lats or 1.6% of the forecast GDP. The funding received from the Cohesion Fund in the first quarter in Latvia was minor in comparison with the substantial inflows observed in 2010; however, funding claims might still be submitted during the year. Net inflows of foreign direct investment increased by 184.3 million lats. With foreign investors still showing notable interest in the financial sector and real estate activities, net inflows of foreign direct investment also expanded in several other sectors, inter alia electricity, gas and water supply, manufacturing, and trade. With the government refraining from assuming further external liabilities and credit institutions reducing both long-term and short-term liabilities, Latvia's gross external debt contracted in comparison with the fourth quarter of 2010.

The current economic problems encountered by several Latvia's trade partners (e.g. a GDP fall in Denmark for two consecutive quarters and the uncertainty related to the future economic policy in Belarus) could have a negative effect on Latvia's exports of goods and services. Nevertheless, the robust economic growth in Latvia's major trade partners (e.g. Estonia, Lithuania and Sweden) and partly also the favourable export price changes in major commodity groups are expected to maintain Latvia's trade balance in goods and services close to balance in 2011. Overall, the annual decrease in the current account surplus will mostly depend on changes in the income account. Although the topical political issues in Latvia might possibly encumber timely adoption of the budget for the next year and temporarily prevent investors from making their investment decisions, the improvement in the ratings by some international credit rating agencies and the persistently favourable price level will promote foreign investors' interest in investment opportunities in Latvia.

Textual error

«… …»