Devaluation: Loans and Deposits

Devaluation would be equally harmful for borrowers and depositors as well as the lending and depositing process.

Devaluation would undermine population's well-being, steeply push up the number of insolvent companies, and indefinitely postpone the economic recovery. At this junction, devaluation will reduce to rubble the dreams about availability of financing for the development of enterprises, export-oriented including. This article will deal with the situation of borrowers and depositors if devaluation were implemented.

With regard to devaluation and its effects on the economy, the currency in which individual and corporate loans are extended is a key aspect in Latvia. The statement in this regard is clear and unambiguous:

for the overwhelming majority of borrowers the immediate consequence of devaluation would be destructive, with the prospects for the population, corporations and economy as a whole deteriorating at the same time.

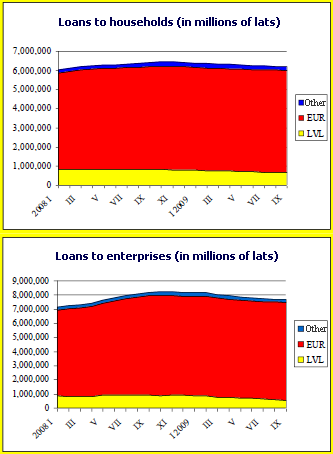

Due to persistently low interest rates on euro loans, 91% of corporate loans are denominated in the euro (current end-of-October data). This implies that for a company with income in lats but credit liabilities in euros, interest rate payments would automatically increase consistently with the extent of devaluation. Thus, devaluation would have a substantial impact on corporate solvency for companies with massive credit liabilities in foreign currencies and income predominantly in lats. The number of initiated insolvency cases in the ten current months has already increased by almost 70% year-on-year, and devaluation would have amplified the process even more. It leads to no less than four inferences: 1) companies would be closed and unemployment would soar, 2) state budget revenue would contract, 3) companies would be unable to make settlements for goods and services delivered, thus adversely affecting other companies as well, and 4) banks would not recover loan resources thus jeopardising further lending.

Even though only one fifth of Latvian households or families are among borrowers (loans predominantly for house purchase), the scope of household and corporate borrowing is almost identical, at close to 50% of GDP. 86% of loans to the population are in the euro.

As the majority of population earn their income in lats, in the event of devaluing the monthly payments would rise by devaluation percent; it is estimated that monthly payments on loans for house purchase of medium-seized households average 210 lats, which may seem quite moderate compared with, e.g. Germany; yet the income level is considerably lower in Latvia while the ratio of credit liabilities to income notably higher. There are countries with an overall similar or even higher population's debt to income ratio than in Latvia; however, the debt burden in Latvia is shared by a smaller proportion of people, i.e. the burden of existing borrowers is "heavier". Thus, for instance, in France and Finland where the ratio of population's debt liabilities to GDP stands at about 50%, the respective amount is shared by almost twice as numerous households than in Latvia.

It has often been argued that the current policy of state budget, wage and employment cuts exerts a similar-to-devaluation pressure on inhabitants' ability to settle their payments. In addition, however, devaluation is accompanied by other negative effects: the first is soaring inflation that would "eat up" income gains; by contrast, currently observed deflation or dropping prices partly alleviates the pressure. Likewise, due to eventual company bankruptcies, the unemployment rate would rise markedly. Finally for many, the negative factors would aggregate: people would lose jobs, prices would be high, and interest payments would hike.

For exporting companies with income in euros, the direct effect on credit liabilities in euro from devaluation would not be painful, yet it would only be the visible tip of the iceberg. Undoubtedly, imported materials and equipment would become more costly. Meanwhile, very essential but little acknowledged is the interconnection between devaluation and credit availability. Vilis Vītols, a former entrepreneur from Venezuela, a country to devalue its currency many times and thus to destroy its own economy, characterises it saying that his and his father's construction business could not exist any longer due to high interest rates imposed on individuals and businesses alike, and also due to long-term crediting ceasing to exist.

Why so? The banking system is often called the blood stream of the economy. Notwithstanding the fact that bank financing has become scarcer than during the euphoria of "fat years", lending has not stopped. Due to devaluing, the bank loan quality would deteriorate and financial problems amplify dramatically; moreover, investors' confidence would weaken, reducing bank opportunities to obtain resources either for lending or refinancing the existing contracts.

Devaluation of the lats would destroy any hopes pinned on the improving bank financing in the near future, which currently are reasonably supported by the progressive upturn in the global financial system and first activities toward a recovery of the Latvian economy. Likewise, Latvia's exchange rate policy would have lost its credibility. It would be a precedent demonstrating that devaluation as an instrument is kept ready, hence giving rise to even deeper concerns about the future exchange rate stability. The bank concerns would rise with respect to all corporations and households who earn their income in lats. Higher risk assessment would result in elevated interest rates not only on loans in the national currency but also on euro and other currency loans, a luxury even for exporting companies.

"People do not keep their savings in such [which devalues - S. Bērziņa] a country; they flee from it as they cannot be confident what would happen to their money. The money that could have worked for the country flowed away to the US banks and, according to preliminary data, the Venezuelan deposits with the US banks exceed the amount of Venezuela's foreign debt," says Vilis Vītols.

Consequently, individuals and corporations would prefer their free cash in foreign currencies and kept safe at home tucked in a sock or with a foreign bank. This was clearly demonstrated by concerns rising within the community about the stability of the lats in the first half of 2009 and affecting the behaviour of the population: overall bank deposits in lats decreased by almost one tenth. When in autumn these concerns abated, this trend discontinued as well. Those people and companies that did not lose their confidence in the stability of the national currency would have been betrayed, for in the event of devaluation their deposits in lats would have lost the value due to inflation at home and to the extent of devaluation also when spent abroad. Corporate deposits in lats to finance day-to-day operations currently amount to around 770 million lats. Should devaluation materialise, they would also lose their value, rendering companies unable to pay for resources and semi-fabricated goods (predominantly imported) needed in production. Credibility in the currency exchange policy, once lost, is difficult to regain.

Textual error

«… …»