Covid-19 and the credit institutions' profitability

The Covid-19 pandemic has affected the profitability of credit institutions. Owing to the government support measures, the swift response of supervisory authorities and the cautious behaviour of credit institutions themselves, the negative effect from the pandemic has so far been moderate, and credit institutions have remained solvent and have been able to continue lending to the economy. Yet, the profitability risk remains high, since the uncertainty associated with the medium-term impact of the pandemic on the borrowers' solvency is still elevated.

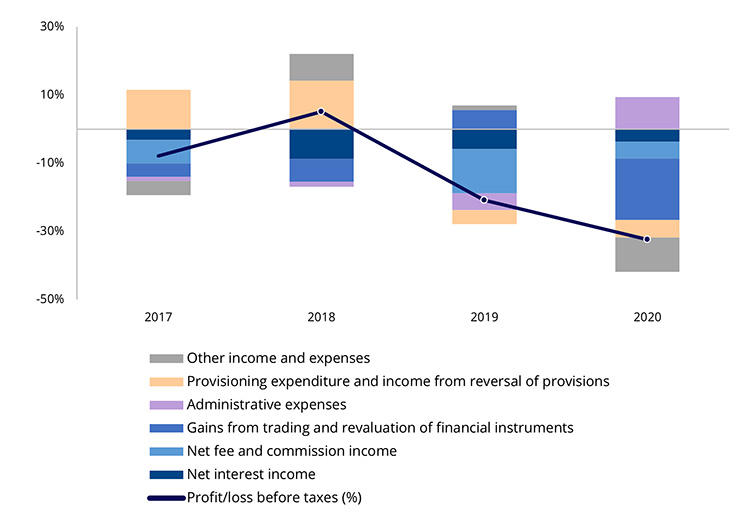

The Covid-19 pandemic caused a decline in the profitability of credit institutions. Nonetheless, most credit institutions concluded the year 2020 with a profit. In 2020, the overall pre-tax profit of credit institutions decreased by 32.0% on a consolidated basis [1] (see Chart 1). This decline was mostly due to lower gains from trading in financial instruments associated, to a large extent, with the one-off losses incurred by one bank due to its tail risk management strategy [2].

Chart 1. Annual growth rate of credit institution profit before taxes on a consolidated basis and contribution of its components to growth (% and percentage points)

The previous paragraph refers to a declining profit of credit institutions. The credit institution data published by the Financial and Capital Market Commission [3], however, reveal that the credit institutions' profit after taxes has grown by 83% in 2020 as compared to 2019. Why this controversy? The explanation lies in a different number of credit institutions. In 2019, AS PNB BANKA was recognised as a failing or likely to fail financial institution, and insolvency proceedings were opened against it. As a result, the bank booked significant provisions and consequently posted a loss above 179 million euro at the end of 2019 [4]. The magnitude of those losses had a significant effect on the aggregate profit of the credit institutions reported in statistics. In 2020, AS PNB BANKA was no longer covered by the statistical data, as its banking licence was cancelled at the beginning of 2020.

As the main focus when analysing the credit institutions' profitability is on the operational results of currently active credit institutions, the effect of AS PNB BANKA performance should also be excluded from 2019 data. Hence, the above-mentioned decline in profit. It is also confirmed in the FCMC data by individual credit institutions as well as the public annual reports of the credit institutions themselves.

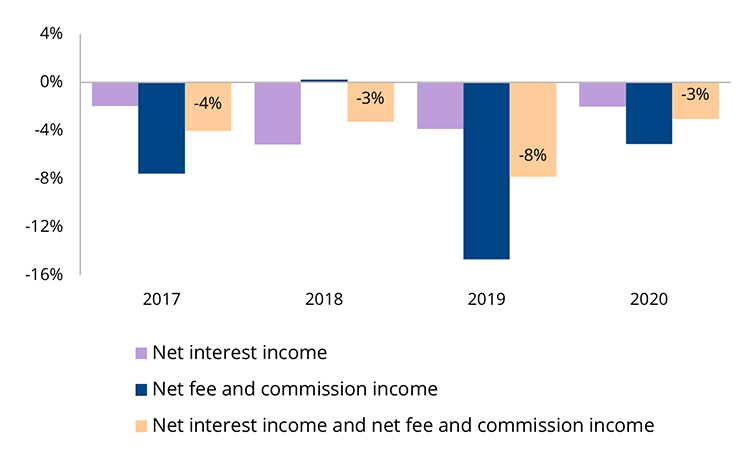

The net interest income of credit institutions shrank moderately, albeit no more than in the previous years (see Chart 2), since the possibility to apply moratoria on loan repayments and government support measures implemented in the hardest-hit sectors enabled most borrowers to continue servicing at least the interest payments on their loans. The decline in the net interest income was mostly related to a decrease in loans to non-financial corporations.

Chart 2. Annual rate of change in net interest income and net fee and commission income (%)

At the same time, the pandemic had just a minor upward effect on the net provisioning expenditure of credit institutions. Building much larger provisions for non-performing loans was unnecessary for the time being because of the implemented loan repayment moratoria and government support measures. Moreover, the net provisioning expenditure was overall increased already in 2019 owing to a deterioration in some large borrowers' credit risk assessment. A decline in administrative expenses is mostly related to a reclassification effect [5], as the costs related to wages and salaries of credit institution employees remained broadly unchanged.

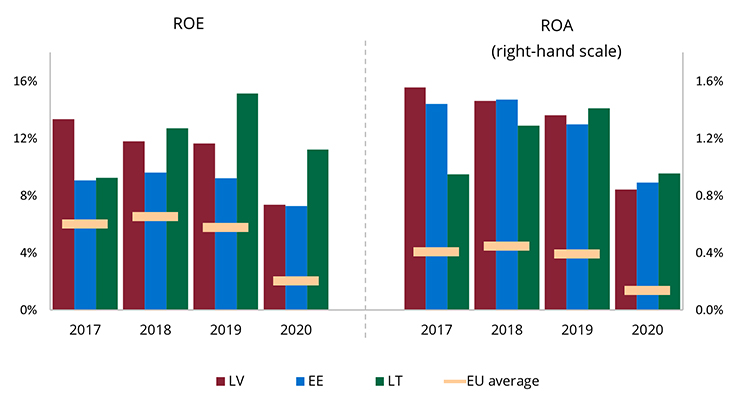

The decline in profit weighed on the credit institutions' return ratios. In 2020, their return on equity (ROE) and return on assets (ROA) decreased to 5.4% and 0.67% respectively, down from 9.6% and 1.05% in the previous year. Although the profitability of Latvia's largest credit institutions still remained above the respective EU averages, in 2020, it was below the averages of the largest credit institutions in the neighbouring countries (see Chart 3) [6]. The credit institutions' total cost-expenditure ratio also deteriorated to 64.5% in 2020 as compared to 62.5% in 2019.

Chart 3. Average ROE and ROA of the largest credit institutions in the Baltics and the EU (%)

According to the preliminary data provided by the credit institutions [7], the net interest income and net fee and commission income, which are the main profit sources of credit institutions, have even slightly grown over the first six months of 2021 compared to the respective period of the previous year. Interest income remained rather stable, whereas interest expense on time deposits contracted. As a result, the net interest income grew by 2.2%. At the same time, income from fees and commissions increased by 9.8%, primarily on account of larger income from payment card service fees in some credit institutions. Meanwhile, the largest contributors to the overall changes in profit were the absence of further losses from trading in financial instruments in 2021 (see above), higher income from dividends received from affiliated companies and lower expenditure on provisions as compared to the previous year (the build-up of precautionary provisions began already at the onset of the pandemic in March 2020).

While the above results of credit institution performance may be interpreted as a sign of stabilisation, this impression can be misleading. The economic crisis caused by the pandemic far from over, and some customers of credit institutions are most likely facing solvency issues owing to the prolonged operational constraints. Along with successful combating of the Covid-19 pandemic, economic restrictions will be eased, and economic growth will resume. However, these developments may be insufficiently rapid to prevent deterioration of the borrowers' solvency and an unfavourable impact on the credit institutions' profitability. New rounds of imposed restrictions are also still possible, should the numbers of new infections go up again. Nevertheless, the profitability of the largest credit institutions remains relatively solid, and they would be able to withstand profitability shocks without jeopardising their solvency and continue lending to the economy. Moreover, the largest credit institutions have indicated that, they will continue to offer individual solutions to the customers facing solvency issues even after the expiry of the non-legislative industry-wide moratorium. This will ease the adverse impact on the credit institutions' profitability also in the future.

References

[1] In this section, the one-off effects have been excluded from all the data reflecting profitability: In 2018, the banking licence of ABLV Bank, AS was cancelled, whereas in 2019, AS PNB BANKA was recognised as a failing or likely to fail financial institution, and insolvency proceedings were opened against it. As a result, the credit institution recognised considerable provisions. The effect of the sale of VISA Europe Limited shares has also been excluded from 2016 data, and the effects of the establishment of Luminor Bank AS group and the deferred tax asset write-offs of AS Citadele banka and Signet Bank AS due to the amendments to the Law on Corporate Income Tax have been excluded from 2017 data.

[5] Given that a separate reporting item was introduced for contributions to the Single Resolution Fund and the Deposit Guarantee Fund, these expenses were reclassified from administrative to other expenses.

[6] Note that Chart 3 is based on the sample data of the largest Latvian credit institutions compiled by the European Banking Authority (EBA), which differ from the previously shown data on all Latvian credit institutions. According to the EBA sample data for Latvian credit institutions, in 2020 the average ROA and ROE was 7.4% and 0.8% respectively.

[7] Individual-level data of the Monthly Financial Position Reports of MFIs compiled by Latvijas Banka.

Textual error

«… …»