Circulation of money during crisis: can "money printing" solve economic problems?

Economic agents are likely to describe an economic crisis and the subsequent period of slow growth briefly: lack of money. This sensation, personally experienced by many, may seem like a paradox, since the recent year's dynamics of monetary aggregates testify to buoyant growth. What has happened to money and where has it gone? How are public perceptions about shrinking volumes of money formed? The answer lies within a term of relatively seldom use in macroeconomic analysis, and it is "circulation of money". Even though broad money or disposable stock of money (cash and cashless) of households and businesses has been swiftly expanding since the end of 2009, the velocity of money, i.e. the number of transactions with one unit of money, has decelerated substantially. This article is an attempt to look at the process of economic recovery from the positions of money circulation by both outlining the path of money theoretically and describing its impasses realistically.

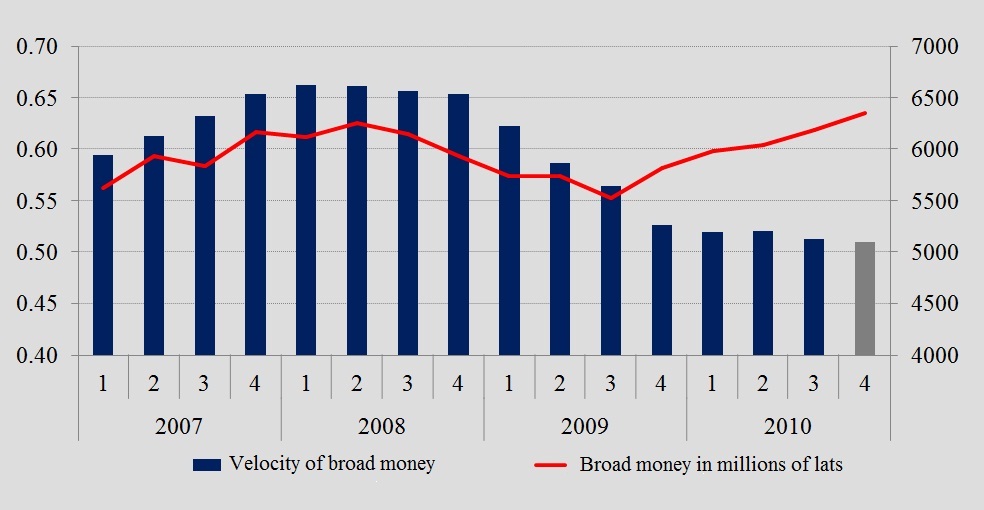

Stock of broad money and velocity of circulation

In general, money and its circulation describe the same phenomenon as nominal gross product does, i.e. the economic activity; the analysis of circulation of money and the related problems provides a different angle for looking at economic growth. Bank accounts capture the economic activity in terms of money circulation. In the process of economic agents settling domestic payments for goods and received services or companies paying out wages and salaries, the stock of money remains unchanged, with money simply changing bank accounts.

Money, however, is not only an instrument for settling payment obligations; it also serves as a means of accumulation and saving; hence only a part of money stock is in active circulation. Money savings are necessary to increase household solvency in cases of sharply and unexpectedly contracting income. In particular, the role of precautionary savings is increasing in the periods of crises. However, unbalanced concentration of substantial funds in deposits, without investing that money in company capital or other domestic assets and thus without channelling it into boosting entrepreneurship, reduces the amount of financial resources available to the economy.

In a situation of widespread access to bank loans, ineffective circulation of money in the economy is thus offset. Financing channelled into promising business projects gives rise to steady stimulus for money circulation, since the funds granted as credit to such businesses actively circulate in the economy and via business activities continue to generate new money flows. Moreover, money having been used for new investments boosts the production capacity and contains the risks of higher inflation or depreciating monetary value. Hence, with bank lending losing momentum all of a sudden, the velocity of money also slows down, and the economy incurs certain problems, which would aggravate, if the economy is short of business financing other than bank loans and the situation evolves in the environment of intensive precautionary saving.

Why does bank financing for economy drain away during crisis?

The value of bank and corporate assets is calculated using market prices, which during crisis may fall notably below economically justified levels and push the process into reverse bubble. Be it so, both banks and companies incur losses that worsen their balance sheets and prevent them from undertaking new obligations, i.e. borrowing money from banks or issuing loans. Even if bank balance sheets are repaired, the resumption of lending is hampered by corporate balance sheet imbalances. In the event of companies incurring losses, capital contracting and the value of potential collateral depreciating, perspective project financing cannot take place due to capital inadequacy and low capacity of commercial collateral.

To follow up with the above stated, it should be noted that the over-used phrase structural reforms or changes as eventual exit from the crisis does not refer to public administration alone. In Latvia, structural reforms are needed also in the domain of business financing, i.e. using other-than-bank-lending models of capital attraction more actively. Implied here are issuances of shares to increase bank capital, of debt securities to finance projects, etc. They would reduce the demand for bank loans and enhance the return in circulation of inactive money. At this junction, low deposit interest rates might entice large investors into undertaking the risk of financing a business via capital market. It is true however, that such capital and financial market processes may be hampered by individualistic attitudes of community members and overruling distrustful sentiments in Latvia, since extending the scope of counterparties involved in capital formation suggests sharing spheres of influence and business information. Potential investors without control in the company, on the other hand, may be held back by worries about effective utilisation of their invested funds. This phenomenon is known as moral hazard. Thus at present, the use of these instruments is encumbered by the problem of moral hazard, yet the outlook for future is moderately optimistic. With the global economy progressively returning to sustainable growth path and external demand in markets strengthening, moral hazards are likely to abate in the Latvian economy, as earning profit in productive entrepreneurship would gradually become more remunerative than fraudulent manipulation with investors' capital.

Can money circulation be enhanced by expansionary monetary policy, sometimes simply referred to as "printing money"?

In order to provide an answer, one should know how money emerges in an economy. Central banks lend directly to the banking sector duly considering price stability and, during a crisis, also financial stability conditions. Nevertheless, money supply to the private sector and government is mediated via commercial banks and the financial market. As companies and private persons can open accounts only with commercial banks, currency issued by central banks mostly remains on the commercial bank accounts, entering into circulation as cash only. At the same time, most of the money stock is cashless money generated by lending to the economy.

Consequently, "money printing" only creates preconditions for better access to bank loans due to lower interest rates, while circulation of money as a result of lending strongly depends on the decisions of households, businesses and commercial banks. In the absence of demand for loans and simultaneous unwillingness of banks to lend, the currency issued by central banks indeed exerts downward pressure on interbank market interest rates but does not increase the money stock, a phenomenon well-observed in large economies in the current crisis situation as well. Therefore, "money printing" by central banks reaches only the banking system, supports the recovery of bank balance sheets, and helps stabilise the financial system but does not ensure the revival of business financing, unless low interest rates decelerate the growth of money savings and cause an opposite process, i.e. rising consumption and renewed circulation of money.

Exit from crisis and foreign exchange policy

The strategy of pegged exchange rate employed by the central banks of small and open economies restricts the ways of creating money supply by "printing" money without foreign currency backing; hence sometimes claims to abandon the fixed exchange rate regime are voiced. However, these claims for devaluation of the lats completely ignore eventually resulting rises in inflation, an increase in private and public debt, and the related ineffectiveness of the very decision due to enormous import volumes required by manufacturing. Disregarded also is the monetary policy which is effective only in the presence of demand for national currency, i.e. when economic agents use the national currency not only in settlements and tax payments but also as a medium for saving. The unpredictability of shifting away from the current peg regime propagated by some economists lies in an uncontrolled drop in the demand for national currency as a follow-up to lost credibility of policy.

An attempt to carry out "controlled" devaluation of currency would lead to an unpredictable and hardly confinable process of currency replacement. "Currency" in fact is something that economic agents use as money, and the lats is only one of the currencies used in the economy. The currency structure is determined by demand; a shift away from a fixed exchange rate initially would always undermine confidence in the central bank's policy. As the Latvian legislation does not prohibit currencies of other countries in counterparties' mutually agreed settlements, a massive transition to foreign currencies also for payments, to a great extent spurred by internet banking, can be expected. As a result, a shift in foreign exchange regime would counteract the objective to increase the nominal stock of money: the stock of money would decrease on account of conversion costs, while the amount of national currency could not be increased due to the weak demand. Instead of expanding, the amount of the lats would contract; in order to realise it, one should recall the bustle at the currency exchange offices during the periods of surging rumours of currency devaluation. It should be also noted that the expansion of money stock per se (as referred to above) does not warrant the economic recovery.

In order to avoid a currency switch, the opportunities to use and accumulate foreign currencies should be substantially reduced; in the case of a small and extremely-open-to-foreign-trade economy this, however, would lead to notable losses. Likewise, in order to avoid a currency switch and stabilise the banking system effectively, companies and households should be forbidden to possess foreign currency accounts with banks, and the use of cash foreign currency should also be confined. Unfortunately, if these and similar solutions materialised, the Latvian exporting companies, the drivers of economic growth, would bear the brunt of costs on account of imports used in their production cycles; hence the policy of shifting the exchange rate regime is unacceptable on the grounds of both financial system's stability and Latvia's external economic competitiveness considerations.

Summary

- Despite the increase in the amount of money in the Latvian economy, money circulation is weak. Money on settlement and deposit accounts per se neither generates any value added, nor ensures investments in production, nor earns any income.

- Monetary and fiscal policies are effective in stabilising the economy, yet low interest rates and government spending for financing the delivery of public services do not boost the production potential.

- The budget deficit is still high. In the environment of drying lending, it is a source of money supply in Latvia, yet due to the growing public debt it is merely a short-term instrument for stabilising the banking system and maintaining the domestic demand.

- Currently Latvia's problem is not the total amount of resources but rather their placement; hence the solution should consist in the development of a more versatile system of attracting financing to business projects and corporate capital, with a lesser reliance on bank loans as the primary source of financing.

The article was published by Delfi on 18 January 2011.

Textual error

«… …»