Challenges of Latvia's exports in the shade of Russia's sanctions

For Latvijas Banka Monthly Newsletter, In Focus, August

Over the last year, the external economic environment was particularly difficult. One of the main challenges was the intensification of risks surrounding exports to the Russian market. Russia's decisions on sanctions along with its economic problems and declining demand highlighted the need to diversify Latvia's export markets.

The unfavourable external environment notwithstanding, overall exports performed fairly well. Income from exports of goods grew by 3% in the first half of 2015 in comparison with the corresponding period of the previous year. Nevertheless, exports to Russia dropped substantially (by 20%) and in many commodity groups. This was partially due to Russia's embargo, which caused stronger competition in the region's food industry leading to a fall in prices. However, the sanctions are not the only factor hampering exports since they apply only to a part of food products. Other factors include the unfavourable economic situation in Russia, declining global dairy product prices reinforced by the lifting of the EU milk quotas as well as weakening demand in several trade partners.

Over the past 20 years, Russia's role in Latvian exports of goods has changed significantly with exports to Russia following both downward and upward trends (see Figure 1) depending on developments in this large and hardly predictable market. Over the past 3 years, exports of food products [1] to Russia accounted for less than 10% and thus did not dominate the export market. One way of securing exports against any country's trade-restrictive decisions is diversifying risks by expanding the geographical region of markets. In this respect, diversification of Latvia's export markets by country, as measured by the widely applied Herfindahl-Hirschman Index, is relatively high and similar to that of Estonia and Lithuania (see Figure 2). In 2015, Russia's role in Latvian exports continued to lose its significance not only due to Russia's restrictions but also as a result of the companies' own initiatives to redirect their exports to more predictable markets.

Figure 1. Share of exports to Russia in Latvia's total exports of goods and in Latvia's total exports of food products (% of the total exports)

* Food products excluding beverages: data for comparable calculations available as from 2004.Source: Central Statistical Bureau.

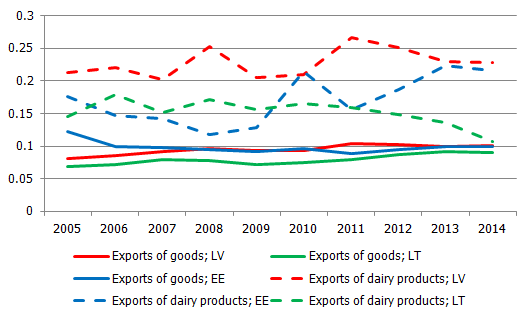

Figure 2. Herfindahl-Hirschman Indices for total exports and exports of dairy products in the Baltic States in 2005–2014*

* A lower index reveals a higher degree of diversification by country and vice versa).Source: Eurostat; author's estimates.

Sanctions affected part of exports of food products. Although several Latvian food industry companies relied extensively on Russia's market, only 14% [2] of all products subject to the sanctions were exported to Russia. Thus, the direct impact of the sanctions on the overall exports is insignificant. On average, losses amounted to slightly more than 6 million euro per month2 accounting for 0.7% of the total exports of goods.

In the first half of 2015, however, income from total exports of food products excluding beverages decreased by 97 million euro year-on-year, with the sanctions representing only one of the causes of the decline. The conditions are particularly difficult for the producers of dairy products. Their exports have dropped not only to the Russian market but also to the Lithuanian and Estonian markets. Latvian exporters faced growing competition in these countries since Russia was an important dairy products market also for the neighbouring Baltic countries. The situation deteriorated further due to the fall in milk prices driven by the global price trends. Meanwhile, the good news is that the dairy product exporters have been able to open up new markets such as Malaysia, Morocco, Turkmenistan and Turkey, with some of the dairy products exported to China as well. Several Latvian companies received certificates allowing them to trade their dairy products in China's market and thus opening new doors and providing a fertile ground for developing exports of dairy products.

Although the "closed" Russian market is substituted with other markets in every group of food products, the lost income has not yet been recovered since the period was most likely too short to perform thorough studies and research for acquiring new markets. However, geographic expansion of Latvia's export markets and the forecast recovery of the demand in the euro area trade partners allow projecting increased exports in the future.

[1] Food products excluding beverages.

[2] This is the annual average amount before the introduction of the sanctions, i.e. from August 2013 July 2014.

Textual error

«… …»