Can Latvian businesses participate in global price competitiveness?

At present, when the economic growth is gradually reviving in Latvia, reduced deflation can also be observed; now and then, it gives impetus to reoccurring discussions about the lost and God-knows-if-regained competitiveness.

It should be first noted that price and cost indicators cannot be isolated when assessed; neither growth in inflation nor its decline gives a reliable signal about changes in the competitiveness position. Moreover, it should be taken into account that we deal with price and cost competitiveness, one of a number of country competitiveness components.

Thus, several aspects that underpin the ability of the economy to maintain the existing operational "framework" (production structure, internal and external market strategies, etc.) are important for the assessment of price and cost competitiveness. An individual business can quite soundly project a target price for its output in the external market and compare it with that of competitors; in the economy, however, such comparisons are more difficult to make. To put it simply, the economy is a very complex formation, and definite prices and costs to conduct cross-country correlation cannot be identified. Hence external competitiveness of countries is most often described using changes, their direction and intensity rather than an absolute term, analysing them in terms of average price level or a significant cost component, e.g. labour costs.

However in terms of competitiveness, the country assessment may also have certain similarities with an individual business. In order to estimate the country price competitiveness trends, not only internal price and cost changes but also those in external markets and rival countries should be assessed. Making comparisons of the domestic indicators with those of competitors is the only way to correctly assess the competitiveness dynamics.

Prior to the financial crisis, prices grew more buoyantly in Latvia than in most trade partners, which implies that, irrespective of how advantageous or disadvantageous its initial competitiveness position had been, it was gradually becoming less favourable. To paraphrase, protracted periods of domestic price rises due to economic overheating rendered the Latvian market increasingly favourable for producers of other countries, while the markets of other countries became more disadvantageous for Latvian manufacturers.

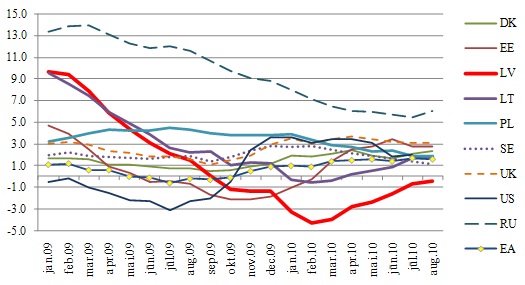

However in 2009, the situation rebounded strongly. The contracting income in both the private sector and the state budget due to the economic downturn imposed considerable limitations on formerly too excessive consumption reflected, first, by declining inflation and later by dropping prices or deflation. From an inflationary economy Latvia turned into a deflationary one in a couple of months, while Latvia's major trade partners experienced much more subdued price changes (see Chart 1).

Chart 1. Annual consumer price changes in Latvia and its major trade partners

Source: Eurostat.

Today many point to the end of the deflation period, stating at the same time that it would be impossible to regain competitiveness. Fortunately, this perception is erroneous, as Latvia's competitiveness is continuing to improve. As can be seen from Chart 1, the deflation period in Latvia is actually over, while price rises continue to rule the markets of Latvia's European and US trade partners and competitors, with prices there also on an upward trend. It suggests that notwithstanding Latvia's rebound to a moderate inflation level, the country's competitiveness has improved notably and this trend is likely to be sustained also in the near future.

What has determined Latvia's rebound to moderate inflationary levels? First, it needs to be noted that price changes, positive and negative, result from the impact of both internal and external factors. The abating of deflation at the moment is primarily determined by external and supply-side factors due to which food and energy prices go up. Apparently, the current price rises have been forced upon Latvia by the outside developments whose impact is recorded and felt also in other economies. In a longer perspective however, with the economy growing successfully, moderate price rises as a rule result from other than external or forced-upon developments and, over time, it will be experienced also in Latvia along with the economic recovery.

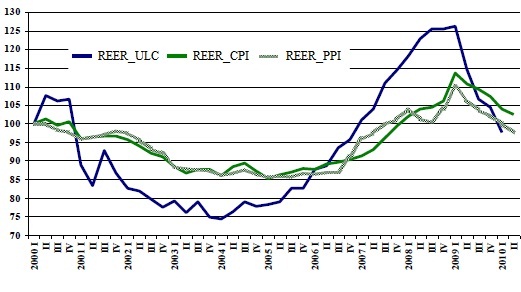

It is obvious already at this juncture that the Latvian economy is returning to the recovery path, i.e. the implemented austerity measures bear fruit. Manufacturing has been on the rise for several months now; exports are steadily expanding for quite a time; labour productivity is improving. According to survey data, producer and consumer confidence indicators have taken a turn for the better. In the breakdown by quarter, the dynamics of export market shares is favourable, and to maintain these shares the price and cost factor cannot be neglected. All above stated testifies to Latvia having regained much of its price and cost competitiveness it lost in the years of economic overheating which subsequently will enable its businesses to stand the price competition vis-á-vis other countries. The correlation of domestic price and cost dynamics against foreign counterparties is well described by the real effective exchange rate trend, which, as can be seen from Chart 2, has gone down to the pre-crisis level largely due to the shrinking labour costs.

Chart 2. Dynamics of the lats real effective exchange rate (REER) calculated using changes in consumer price index (CPI), producer price index (PPI) and unit labour costs (ULC). Quarter 1, 2000 = 100%.

Source: the Bank of Latvia.

Competitiveness of the economy is a complex notation capturing much more than simply the price and cost levels. Similar to commodities, the ability of a country to successfully compete with its counterparties is affected not only by prices and costs but also by other factors apart from prices. Speaking about goods, such affecting parameters would be the quality, functionality, ergonomics, appropriate design, etc. Competitiveness of a country, in the broadest sense, means the ability to ensure an ever higher level of prosperity for its people and is preconditioned by a number of significant factors, e.g. business and institutional environment, production structure, education system, scope of expertise, research capacity, innovations and many more factors. But this would be an off-topic discussion forum.

The article was published by Delfi on 5 October 2010.

Textual error

«… …»