Are trade relations with Russia really being severed? What do the latest trade data reveal?

The second quarter of 2022 was marked by price hikes and uncertain future on the demand side. The mounting prices have pushed up the value of both imports and exports. However, it is the rise in energy prices that has affected the value of imports most, since long-term alternatives to Russian gas have been sought and substantial purchases of natural gas have still been made in the short term. These developments have contributed to a rise in the import value of mineral products, reaching almost half of the overall growth in imports. Imports of transport (mostly aircraft) show a very significant increase. Likewise, imports of articles of wood have grown considerably in quarter-on-quarter terms (particularly in May) due to the high wood prices and the execution of the existing contracts before the sanctions imposed on Russia and Belarus took effect. With regard to the first quarter, almost all other groups of goods witnessed an increase in imports; however, the annual growth rates have somewhat decelerated.

The value of exports of goods has followed an upward path, albeit at a slower pace than that of imports. Due to the rising prices, exports of a number of major groups of goods and services have expanded, with articles of wood, machinery and electrical equipment recording the most significant increase. Meanwhile, the fall in the prices of agricultural products and wood suspended the rise in export prices in June. Thus, despite the overall improvement in the terms of trade in the quarter, it was already in June that they deteriorated.

It is surprising that exports to Russia have only slightly decreased and even taken an upward trend in the groups of goods such as machinery and electrical equipment, as well as products of the chemical industry. Meanwhile, imports from Russia have significantly drifted downwards, with the volumes of oil products and gas imported from Russia decreasing. Imports of other goods such as iron and steel have witnessed the sharpest fall, since the share of their imports from Russia has not been replaced successfully.

Imports of services have somewhat expanded in almost all groups, with travel increasing most notably, as people of Latvia have become more active travellers. Exports of services reveal a similar upward trend, currently already exceeding the pre-pandemic level in nominal terms.

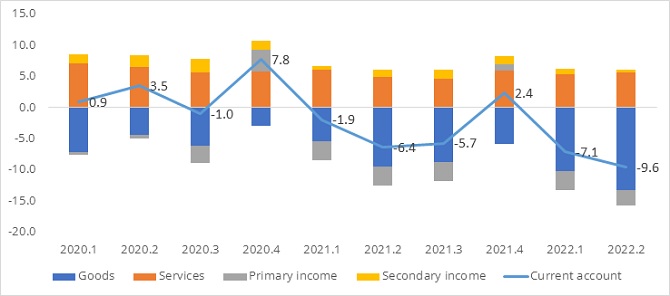

The above developments have substantially increased the current account deficit. With imports of goods growing faster than exports, the foreign trade deficit reached 13.3% of the gross domestic product (GDP). Overall, the current account deficit has grown to 9.6% of GDP, with other components of the current account remaining almost unchanged.

The current situation, when foreign demand is decelerating, does not show exports in a good light. Meanwhile, the high energy prices exert pressure on imports. Thus, although no one knows what the future holds in store, it is unlikely that the current account balance will return to balance.

Chart 1. Main components of the current account (% of GDP)

In the second quarter, inflows of foreign direct investment in Latvia stood at 3.3% of GDP, with inflows in manufacturing, financial and insurance activities, as well as professional, scientific and technical services rising most. In addition to direct investment, the most significant developments in the financial account are related to the central bank's monetary activities and transactions of monetary financial institutions.

Textual error

«… …»