2009 vs 2020: where's the difference

The coronavirus COVID-19 pandemic is still raging, yet it is already absolutely clear that its economic consequences are going to be severe.

Although the recently published Latvijas Banka's forecasts envisage a relatively smaller fall in Latvia's economic activity as compared to the deepest point of the previous crisis (–6.5% in 2020 as opposed to –14.3% in 2009), at the moment, no one can rule out materialisation of more adverse scenarios. The perception of a striking resemblance of the near-term outlook to the 2009 crisis in terms of magnitude and scale is growing also among several other European countries.

Given the current circumstances, the need for highly expansionary fiscal and monetary policies to support the economy is crystal clear. Some of the support comes automatically: with growth contracting, tax collections decrease, while disbursements of unemployment benefits increase. Therefore, a higher budget deficit is inevitable, regardless of what the government is doing. Nevertheless, the additional fiscal stimulus adopted by the government may still have a decisive role in strengthening the economy. In this regard, the government's response in 2020 is quite the opposite of that in 2009: government spending was deliberately cut back then, whereas now it is being increased. Where does the difference lie?

First of all, the biggest difference between 2020 and 2009 lies in the fact that Latvia has joined the euro area. In theory, the government would have done better in 2009, had it undertaken additional borrowing by issuing securities. Unfortunately, there was no way it could be done. Concerns over potential devaluation of the lats were causing a progressive increase in the borrowing rates. Moreover, there were hardly any institutions in the market ready to lend money to Latvia's government even at those rates. Euro area membership has finally enabled the government to implement exactly the kind of a countercyclical fiscal policy which is currently required. The Eurosystem's asset purchase programme is another safeguard against a situation where there is no demand for government securities in the market at all, like in 2009. Backed by the European Central Bank and euro area's national central banks, commercial banks feel much more comfortable purchasing government securities.

Secondly, the government's pre-crisis course of action is completely different. It seems that in 2009 market players did not truly believe in Latvia's government being fully aware of the consequences of its actions, as it is, indeed, quite unwise to build the budgeting policy based on an assumption of a perpetual two-digit economic growth. The latest conservative fiscal policy is currently viewed as reliable. Of course, from the point of view of the central bank, an additional safety cushion in the budget (had it been made) would have been quite handy at the moment. Nevertheless, Latvia's fiscal policy looks sufficiently sound against the general euro area background. Since 2010, Latvia's government debt has decreased by more than 10 percentage points of gross domestic product (GDP). This is the fourth best result out of all euro area countries. The market has shown its appreciation as the yields on Latvia's long-term government securities are among the euro area's lowest. In 2009, Latvia was considered one of the European periphery countries, whereas now it is among the euro area's core countries. Therefore, we can afford spending now.

At the moment, no one can tell how much government spending will be required to prevent this crisis from turning into a lasting economic recession. Yet it is clear that the amounts will be considerable, and the mention of 10% of GDP does not seem too much of an exaggeration any more. In Latvia's case, this would be roughly 3 billion euro. This spending will, no doubt, result in considerably higher levels of government debt over the coming years, and Latvia is no exception. Yet central banks support this course of action. Why? Is it not the responsibility of central banks to advocate a minimal level of government debt?

Central banks have surely always highlighted the importance of the government debt sustainability. Nothing has changed in this sense, including in Latvia.

A smaller gross general government debt in the long-term will enable Latvia, as a small and open economy, to weather various external turbulences easier and quicker. Normally debt sustainability is best ensured by cautious planning of budgetary spending: the smaller the government deficit, the safer the government debt. In a major economic downturn, however, other rules apply, and, although it may seem weird, a larger deficit in the short run may mean less government debt sustainability risks in the long run. In 2009, Latvia implemented expansionary fiscal consolidation, whereas now it is time for a consolidating fiscal expansion. How does it work?

The main answer lies in the future economic growth potential. Like any other borrower, the government is going to use its future revenue (i.e. future revenue from taxation) to repay its current debt with interest. This revenue is dependent on the expected future economic growth. If the future economic growth exceeds the interest payable on borrowing, the debt will contract over time. Conversely, should the future growth decelerate significantly and fall below the borrowing rates, the government debt will have serious sustainability problems, as the debt would spin out of control even in the absence of any additional borrowing. Consequently, any additional government spending should have a maximum focus on safeguarding the future economic growth potential.

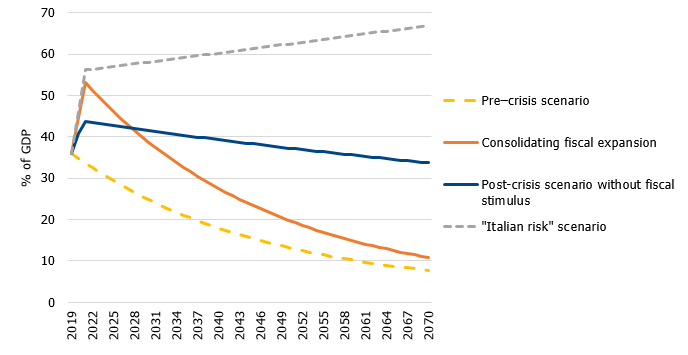

Development of government debt under various scenarios

The above chart illustrates potential development scenarios. Before the onset of the crisis, the sustainability of Latvia's government debt was close to perfect: a relatively low gross debt (about 35% of GDP), quite solid nominal growth (above 4% per year) and record-low yields on government securities (close to 0% and even negative at shorter maturities). Under such circumstances and given no additional borrowing, the level of debt would have continued to decrease over time (pre-crisis scenario). This scenario, however, is no longer feasible. If we have to choose between a scenario where this year and next year the government deficit is increasing only on account of an automatic drop in tax revenue and rising unemployment benefits (post-crisis scenario without fiscal stimulus) or a scenario involving additional measures to preserve the economic potential of the country (consolidating fiscal expansion), it is obvious that, even though there is a stronger initial increase in the level of debt under the second scenario, this is, indeed, the very scenario yielding a lower level of gross debt in the long-term.

So this is yet another confirmation that the "health" condition of the national economy is much more important in the context of the government debt sustainability than the size of the short-term budget deficit. Sadly, it is also confirmed by Italy's experience: its government debt is undoubtedly high (over 130% of GDP), yet not much higher than in several other European countries. Italy's chronically low growth rates (average growth around 0.1% over the most recent years), however, have turned this debt into a very serious problem. This is the key risk to be borne in mind also in Latvia's case: should the economic stimulus fail to improve the future economic capacity or, as a minimum, preserve the existing capacity, we may also find ourselves with a scenario where the level of debt starts growing instead of declining even in the absence of additional borrowing. The probability of such a scenario is, of course, considerably reduced by the public sector purchase programme implemented by the Eurosystem, keeping the yields on government securities exceptionally low. At the same time, the idea of using the crisis consequences as a pretext to increase government spending to satisfy all needs that were previously left uncovered because of the budget constraints, does not seem reasonable.

Consequently, it is crucial that any additional budgetary spending is also targeted on maximum preservation of the economic capacity until the moment when the crisis is over instead of merely focussing on surviving the crisis.

Latvia's future growth is closely linked to its export competitiveness. Therefore, the next priority after immediate measures to combat the virus should be a maximum broad support to the exporting sectors. Given the current uncertainties, clearly no one can foresee exactly how the situation will develop. Nevertheless, materialisation of the worst case scenarios can be avoided with timely action. Even that would be a major accomplishment in the existing circumstances.

Textual error

«… …»