Westerly winds in Latvian tourism

A year and a half ago I attempted to analyze – How important to Latvian economy is a foreign tourist? Since that time, important changes have taken place in the global economy and particularly in our neighbour, Russia. At the time, I concluded that Russian tourists keep increasing their contribution to the tourism sector, so there is no doubt that the drop in the purchasing power of these guests will also have an effect on the income of our entrepreneurs – hoteliers, caterers, carriers, merchants et al. Yet now it seems that we live under lucky stars, for just at the right moment, the economy is supported by other foreign guests who have come to Latvia to experience the cultural events in Riga as a Culture Capital of Europe or to take part in carrying out the tasks set by Latvia as the presiding country of the Council of the European Union (EU) etc. Below, I will consider these processes in greater detail.

Tourism balance continues to improve

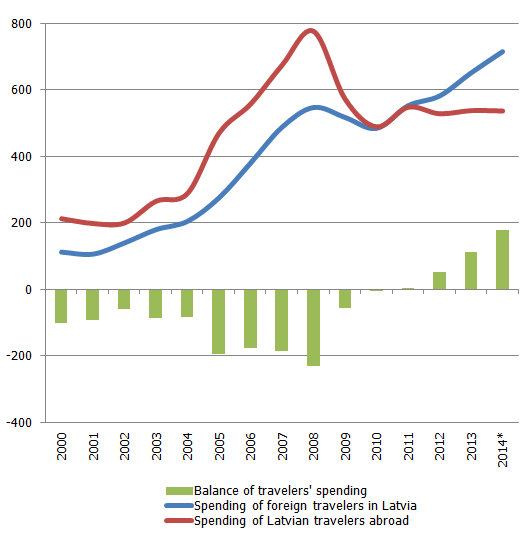

In 2011, the previously always negative tourist spending balance became positive, i.e. foreign guests in Latvia began to spend more than Latvians abroad. In subsequent years, this positive balance was reinforced and in 2014 a new record is likely to be achieved in the amount of close 200 million euro (See Fig. 1).

Figure 1. Spending of foreign tourists in Latvia. Spending of Latvian tourists abroad and tourism balance of payments (mil. euro)

Data source: Latvijas Banka – Balance of Payments data, business and personal travel, *author's projections (data available for Q 1-3)

The spending of Latvians abroad in recent years has remained almost unchanged; the positive balance forms and increases owing to the visits of foreign tourists. How do the increase in the number of foreign guests and their expenditure in 2014 form if we keep hearing about the decrease in the number of tourists from Russia?

Economy is cooling, but tourism is warmed by the West

In 2014, the Latvian economy began to cool gradually – the GDP growth rate slowed. One of the main reasons behind this slowdown was the drop in demand in an export market significant to Latvia, i.e. Russia. That was provoked by the conflict between Russia and Ukraine, the trade embargo and the drop in oil prices and the rouble exchange rate. Because of deteriorating purchasing power, the number of guests from Russia and nights spent in hotels dropped.

There were fewer guests also from Norway. The drop in oil prices notwithstanding, there is no reason to worry about Norwegian purchasing power, for Norwegian economic growth is stable. It seems that Norwegians have lost interest in Latvia and Estonia where the frequency of Norwegian visits has been decreasing for the past couple of years, whereas Lithuania remains of interest to them. In recent years, Norwegians have spent more time in Spain, Italy, France and the new EU country Croatia. These choices must have also been dictated by the availability of transportation, particularly, cheap flights.

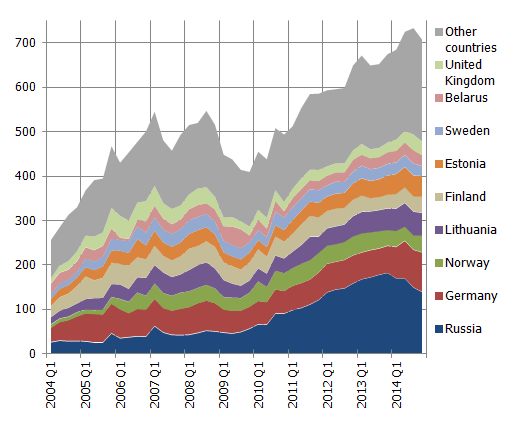

Figure 2. Nights spent in hotels by foreign guests (in th., seas. adj.)

Data source: CSB, author's projections

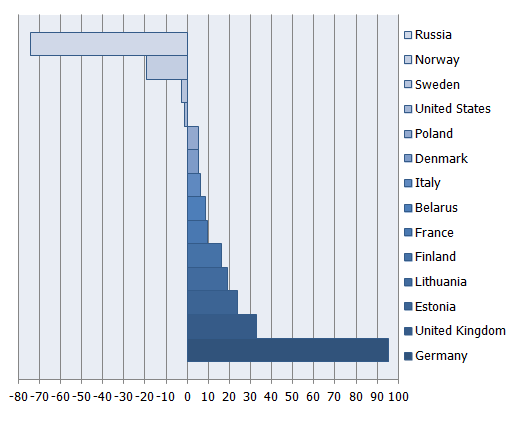

The drop in the number of guests from Russia and Norway was more than compensated for by guests from other countries (See Fig. 2). Guests from Germany were the ones to support the tourism sector in 2014 most significantly: they spent almost 100 thousand nights more in Latvia than in 2013. That compensated the "hole" created by the lower interest on the part of guests from Russia and Norway (See Fig. 3). The next highest rise in the number of nights spent in hotels was on the part of tourists from the United Kingdom, followed closely by Estonians, Lithuanians and Finns.

Figure 3. Changes in the number of nights spent by foreign guests in hotels in 2014/2013 (th. nights)

Data source: CSB, author's calculations

The changes in tourist interest are determined by many factors, including tourist purchasing power, the availability of cheap and convenient transportation, advertising abroad, attractiveness of prices etc. Yet 2014 was particularly interesting to tourists for two reasons: 1) a great number of various events ensured by Riga's status as a European Culture Capital; 2) Latvia joining the euro area, which ensured additional recognisability and may have encouraged the choice of Latvia as a destination for those tourists for whom it seems important to save on the charges on exchange operations.

"Déjà vu" from Estonia

Thinking about this, one is overcome by a feeling of déjà vu. 2011 was a year of record growth in Estonian tourism. It was remarkable compared to others for these same two reasons: Estonia introduced the euro and Tallinn became a culture capital of Europe. In 2011, the second largest increase in the number of tourists from Germany was observed (the fastest one was after Estonia joined the EU on 1 May 2004 and in 2005). The number of tourists from the United Kingdom doubled at the same time. The interest grew also among Latvians, Lithuanians, Italians, Spaniards and other Europeans. As opposed to the situation in Latvia in 2014, the number of tourists from Russia also grew in Estonia in 2011, for at that time, the purchasing power of Russians improved. As for the latest trends, in Estonia too there was a drop in the number of guests from Russia in 2014: the number of nights they spent in hotels dropped by 9.6% year-on-year, which is a slightly lesser drop than in Latvia (10.6%).

Returning to the developments in Latvian tourism sector and guests from Russia, I would like to remind the readers that their special role in tourism was related not only to longer stays on average but also because of the decrease of seasonality in tourism. Russians were among the most important guests not only in summer but also in winter, particularly at the end of the year for New Year celebrations and during the Russian Christmas holidays at the beginning of January. During the last holiday season, many hotel reservations were cancelled and in all likelihood they were not taken over by guests from Europe. December data for the occupancy of hotel rooms and beds do not point to a pronounced drop, however.

Merchants of luxury goods are among the greatest losers

The drop in demand was observed also in some segments of trade, i.e. Russian guests have a particular preference for luxury goods: brand name clothing, watches, jewellery, investment gold, electronics, on which in Russia there is surtax. It can be claimed with some certainty that for these merchants this season was not as lucrative.

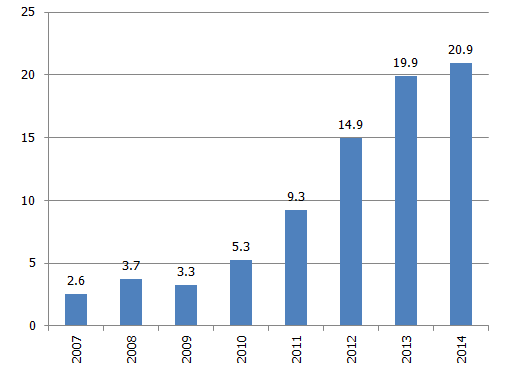

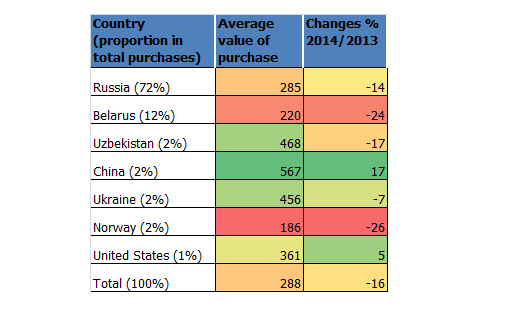

Even though it is impossible to identify tourist purchases among the total retail turnover data, some information can be gleaned from other data sources, for instance, data on purchases registered with the Tax Free Shopping system used by tourists from outside the EU for repayment of value added tax. Even though, for reasons of economy, the opportunity for reclaiming the tax amount was used even more often in 2014, the average values of purchases have dropped substantially. The number of purchases in the Tax Free Shopping system grew by 25% in 2014, but the purchase totals only by 5%, reaching 20.9 million euro; (See Fig. 4). The average value of purchase in 2014 was 288 euro, which is 16% less than in 2013. I must add, however, that the average values might have been affected by pricing, for merchants have reduced prices in view of dropping demand.

Figure 4. Tax Free Shopping purchase totals (mil.euro)

Data source: Global Blue Latvija unpublished data

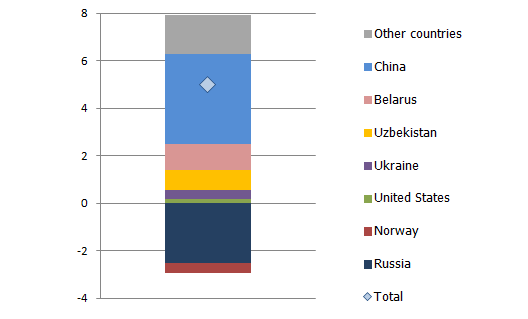

The number of purchases made by Russian customers through the Tax Free Shopping system increased by 17%, but total purchases dropped by 4%. The purchases of Russian guests in this system form the greatest percentage – 72% of the total of all purchases. As Vineta Kalmane, head of Global Blue Latvija points out, the Russian customers can no longer afford such expensive purchases – they pay more attention to their needs and more often use the opportunities to purchase goods on sale. The number of purchases keeps growing, however, because, for reasons of economy, customers use Tax Free Shopping even for small purchases.

Figure 5. Contributions to the changes in Tax Free Shopping total purchases 2014/2013 (%)

Data source: Global Blue Latvija unpublished data and author's calculations

Figure 6. Average value (euro) of Tax Free Shopping purchases and its changes 2014/2013 (%)

Data source: Global Blue Latvija unpublished data and author's calculations

Will the winds from the West be replaced by a storm from Asia?

It is interesting to note that the economy of the Russian guests was more than compensated for by the largest purchases by tourists from China: the average value of Chinese purchases is the highest among foreign guests and it has also grown the fastest (See Figs. 5 and 6). Even though the Chinese contribute only 2% to the total of purchases in Tax Free Shopping, the rapid, almost threefold growth has ensured a considerable contribution to the changes in total purchases. In 2013, the Shengen visas granted by Latvia to the Chinese came to only 0.6% or 1.2 thousand of the 203 thousand total. But every little bit counts apparently.

The "bit" attributable to China and other Asian countries probably marks future trends not only in the global but also Latvian tourism. And the future is likely to be full of challenges. In the first six months of 2015, the positive balance of tourism and business travel will be reinforced by the status of Latvia as the presiding country of the EU, but in the second six months, it will be more difficult to compensate for the drop in the number of guests from Russia. It is then that we will see whether the visits by Germans and Brits are a sustained phenomenon and whether the new hope of the tourism sector will be guests from Asia, the continent where manufacturers too are trying to make inroads, recognizing the potential for demand.

China has shown particular interest in Latvian design, food items and cosmetics. The exports of goods provide advertising opportunities for Latvia as a tourist destination. In a sense, we can also consider real estate an export item; in recent years, the Chinese have been attracted to it by the temporary residence permit programme. As of 2010, 1.3 thousand temporary residence permits have been granted to people from China. In this respect, however, future is unpredictable and it is not clear how the discussion about relaxing the Immigration Law will end.

Tourism services in Latvia account for less than 4% of gross domestic product. That is not much, moreover, some part of it involves Latvians travelling in Latvia, yet, as must have been obvious from this article, every little bit can indeed help..

Textual error

«… …»