Tax hike hinders retail

In January, retail turnover (in comparative prices, seasonal effects, including Christmas spending, excluded) dropped 1.7% compared to December, this time primarily because of a drop in car fuel sales volumes. In part because of snow-covered (i.e. "fuel guzzling") roads and mostly because of the expected price rises, the sales volumes of fuel had risen 6.2% over a month. The December rise was followed by a 12.5% drop in January. Again: these data reflect the real volumes, excluding the influence of prices.

For a good part of last year we discussed a slow and unsteady retail turnover growth, but since October of 2010, a continued slow recession has been the norm. If we evaluate the retail indicator together with automobile sales, the downslide began in December, therefore it is too early to consider it a trend. It must be taken into account, however, that a part of automobile purchases actually fall under the category of re-exports.

Already last year it was observed that the sales volumes of food and other goods of prime necessity remained almost unchanged while the sales volumes of durable goods rose substantially. If we just consider data, this is mostly explained by the inequality of income: a part of the population have found it relatively easy to deal with the crisis and are beginning to afford greater expenditures from previous savings, whereas a great number of people have seen their incomes and purchasing power shrink. The jump in automobile sales relative to the rest of trade, however, gives rise to the hypothetical question about the influence of the segmenting of the underground economy on statistics. To wit: automobile sales are rather strictly regulated by legislation regarding legal income: leasing documents can only be drawn up if a person's income can be substantiated while the merchants have to inform the controlling institutions about any costly purchases for which a customer uses his or her own funds. On the other hand, in the groups of less pricey goods, it is easier to make purchases using illegally derived funds or not paying taxes on the purchased item. During the crisis, growing agricultural products for own use gained in importance as did harvesting of forest products and purchasing of food products directly from farmers.

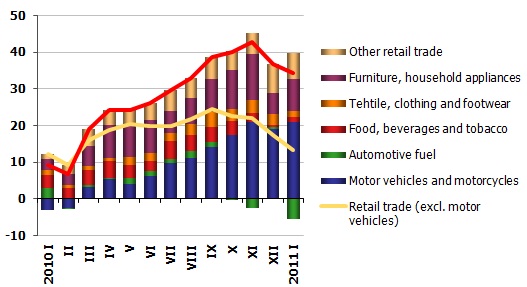

Retail goods groups compared to December 2010, changes in millions of lats, in comparative prices, seasonally adjusted data

Market signals indicate that the population uses more caution against the background of budget consolidation by raising taxes. Impulse buying is provoked only by expectations of a product's price rises, meaning that more sugar, more fuel or even a car is bought – depending of the respective purchasing power. While purchasing-power-dampening tax changes are on the agenda while the expenditure section of the government budget is not subject to substantial changes, no important positive developments are expected in the industry. Right now, consumers have adopted a wait-and-see attitude and are observing the developments surrounding the budget consolidation like a theatre audience without a playbill: no one knows how many acts the play has and when one is expected to applaud.

Textual error

«… …»