Savings in banks going up

Stable economic growth has enabled Latvia's businesses and households to save more on their bank accounts. In the circumstances of rapidly increasing compensation of employees, both consumption and deposits with banks are growing. Domestic deposits are on an upward trend for the fifth consecutive month already, with their annual growth rate in February reaching the highest peak since 2016 at 7.5%. At the same time, there were no significant changes with regard to lending.

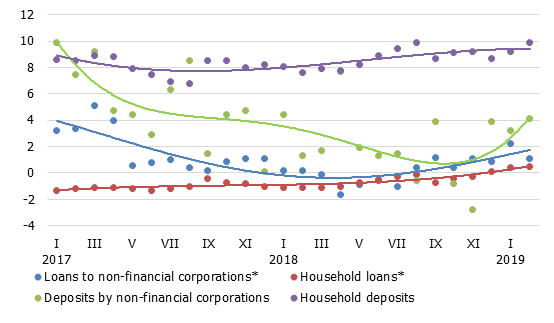

Looking at the domestic deposits with banks, in February the annual growth rates of household deposits and deposits by non-financial corporations stood at 9.9% and 4.1% respectively. Latvia's contribution to the monetary aggregate M3 of the euro area increased in February, with overnight deposits of euro area residents with Latvia's monetary financial institutions, deposits with an agreed maturity of up to two years and deposits redeemable at notice expanding and their annual growth rates being 11.9%, 17.9% and –0.1% respectively.

With the loan portfolio of non-financial corporations shrinking moderately and that of households remaining unchanged, domestic loans decreased by 0.4% overall in February, including 0.9% and 0.7% declines in the case of loans to non-financial corporations and consumer credit to households respectively. The only segment reporting a minor rise for the seventh consecutive month was loans for house purchase. The annual growth of domestic loans decelerated by 0.4 percentage point, to –4.1%. The respective rates for loans to non-financial corporations and household loans were –4.9% and –5.0%. At the same time, the effect from the banking sector restructuring excluded, the annual rate of change in all segments remained positive at 1.4%, 1.1% and 0.5% respectively.

Annual changes in domestic loans and deposits (%)

* For the sake of comparability, the one-off effects related to the restructuring of Latvia's banking sector have been excluded.

In the near term, deposits could be boosted by the government's intention to impose further restrictions on the use of cash, while external risks and the expected economic deceleration will continue to weigh down on loan growth.

Textual error

«… …»