The rise in money indicators abated in May

In the area of deposits, payments by state enterprises into the budget were notable, whereas the loan portfolio shrank as a result of some long-term loans granted to some nonfinancial companies. The amount of the household loan portfolio remained unchanged, with housing loans dropping slightly and consumer loans continuing to grow.

Domestic deposits attracted by banks dropped in May by 1.5%, yet their year-on year growth was at 2.1%. Meanwhile, deposits by state enterprises shrank by 19.2% and deposits by non-bank financial institutions by 8.9%. Deposits by households remained almost unchanged but deposits by private non-financial companies grew slightly.

Along with a drop in domestic deposits, the total deposits by euro area residents with Latvian credit institutions also dropped and Latvia's contribution to the euro area money supply indicator M3 contracted by 1.1% (year-on-year growth rate at 4.8%). The overnight deposits of euro area residents with Latvian credit institutions dropped by 1.6%, deposits redeemable at notice by 0.3% and deposits with a set maturity of up to two years increased by 2.7%.

The total balance of domestic loans in May decreased by 0.5%, including the ones granted to nonfinancial institutions by 1.3% and housing loans by 0.1%. The total household loan portfolio did not change because consumer loans increased by 1.6%. The loan year-on-year rate of change dropped in May to 0.7% (it was 0.6% for loans granted to nonfinancial institutions and –1.2% for loans granted to households). The amount of newly granted loans (not including reviewed loans) grew by 8.5% (incl. loans granted to households by 18.1%) month-on-month.

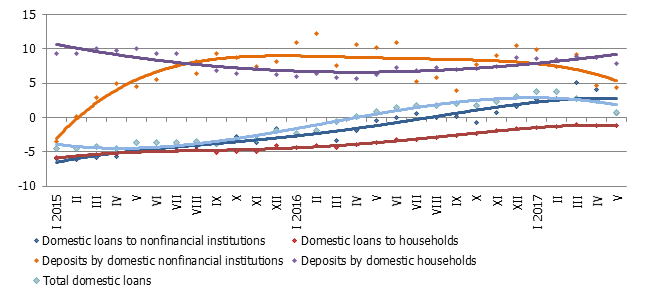

The y-y changes in some money indicators (%)

The economic growth trends suggest a moderate resumption of deposit growth in the coming months. Recovery in lending to households will also continue and a rise in consumer lending can be expected. The resumption of lending to enterprises has turned out to be less sustainable, yet considerable lending growth might resume along with a more energetic uptake of European Union funds.

Textual error

«… …»