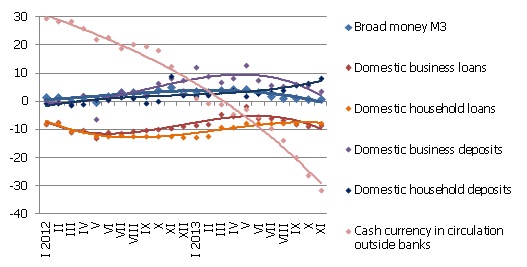

Rise in deposits more than compensates for the drop in demand for cash currency

In November, as Latvia moved ever closer to the expected euro changeover, the demand for cash lats continued to drop rapidly. The overall money supply, however, increased, not only because accruals of cash currency ended up in the bank accounts of businesses and households but also because deposits grew as a result of the successful growth of the economy. A positive contribution to the bank accounts was also made by the inflow of government finances, as government expenditure grew at the end of the year and the budget surplus shrank. Household deposits grew for a tenth consecutive month (the annual rate of growth reached 8.1% in November). For a second consecutive month, business deposits grew rapidly and overall, the balance of domestic deposits with banks reached a new record at the end of November: 5.9 billion lats. The total loan portfolio of banks grew for the first time in six months, with the rise resulting from a moderate increase in loans granted to non-financial institutions.

The M3 money supply indicator, which refers to the cash and non-cash amount in the economy, increased by 1.7% in November, with its annual rate of increase at 0.7%. The amount of cash lats in circulation dropped by 56.2 mil. lats in November, at the end of the month lagging behind the previous year's level of the corresponding period by 31.7%. Accruals mostly increased in the sectors of demand deposits and deposits redeemable at notice, with the balance of time deposits continuing to shrink.

Illustration. Year-on-year changes in some money supply indicators (%)

Source: Bank of Latvia

For the first time since May, the domestic loan portfolio of banks increased in November, with the increase determined by the rise of 0.7% in loans granted to non-financial institutions. The overall annual loan drop rate therefore improved to reach 7.7%.

The accruals of both businesses and households will rise in banks also in December and at the turn of the year the deposits will reach a record high under the impact of the cash currency factor and seasonal expenditure of the government. Even though in the beginning of 2014 deposits will undergo a short-lived seasonal drop, it can be expected that the Latvian tradition of conducting business in cash that has been in place for many years will moderate somewhat, as private individuals in particular learn about the advantages of using non-cash money. In the coming months, the positive economic growth prospects could also have an impact of increasing money supply.

The slight rise in lending in November is a positive development, yet it is not convincing enough to give rise to the belief that banks are likely to more actively engage in lending, using the large amounts of accrued finances at their disposal.

Textual error

«… …»