A rise in bank loan portfolio

In May, the lending growth dynamics showed positive signs: the domestic loan portfolio of banks increased month-on-month for the first time in the last eight months. At the same time, Latvia's contribution to the monetary aggregate M3 of the euro area did not change notably, as the contraction in time deposits was almost fully offset by a rise in overnight deposits. Nonetheless, total domestic deposits fell somewhat.

Total domestic deposits with banks shrank by 0.4% in May (7.2% annual growth). Household deposits dropped by 0.2% over the month, exceeding the figure of the respective month in 2014 by 10.0%. Meanwhile, deposits of non-financial corporations decreased by 1.1% in May (4.6% annual growth).

As to Latvia's contribution to the changes in monetary aggregate M3 of the euro area, overnight deposits of euro area residents with credit institutions in Latvia increased by 0.7% in May, while deposits with an agreed maturity of up to 2 years contracted by 4.8% and deposits redeemable at notice decreased by 1.2%. Despite a fall in May in the amount of currency in circulation, Latvia's overall impact on the euro area money supply did not change substantially, with Latvia's contribution to M3 increasing by 8.8% year-on-year.

The domestic loan portfolio of banks expanded by 0.5% in May, of which loans to non-financial corporations accounted for a 0.7% rise and loans to financial institutions grew by 4.7%. Although consumer credit to households posted a 0.9% increase, the total household loan portfolio shrank by 0.2% in May due to changes in lending to households for house purchase. The annual rate of decrease in domestic loans improved somewhat and stood at 3.7%, with loans to non-financial corporations decreasing by 4.8% and those to households by 4.9% over the year.

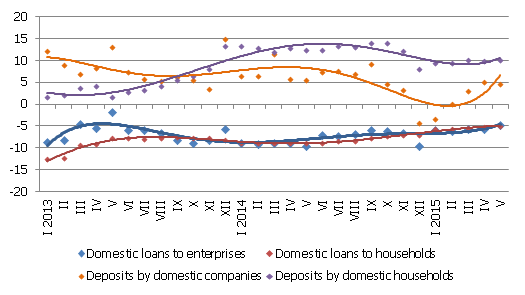

Annual changes in some monetary aggregates (%)

Source: Latvijas Banka

The slight decrease in domestic deposits in May can be explained by deceleration in the economic growth; however, in annual terms, the deposit growth continued to be strong, and no substantial shifts in deposit dynamics are to be expected in the future, when months of modest growth are likely to alternate with periods of moderate decrease.

Even though the customary month-on-month contraction in loan portfolio was not observed in May, eventual changes in the downward trend, if any, would be ascertained only in the future. Nevertheless, there are sufficient grounds for optimism, as in May lending to both non-financial corporations and financial institutions expanded, consumer loans to households increased, but contractions in loans to households for house purchase diminished. Better availability of resources and low interest rates, in part also due to the Eurosystem's monetary policy measures, as well as the borrowing potential of businesses (only 20% of market participants at present actively engaged according to the Association of Commercial Banks of Latvia) may act as drivers behind the strengthening of the demand for loans. Consequently, the year-on-year contraction in the total loan portfolio of Latvian credit institutions is likely to decelerate.

Textual error

«… …»