The return of cash currency to banks behind a record rise in deposits

December was the last month when the lats in Latvia was the only legal tender. As expected, when the moment of euro changeover was imminent, the amount of cash lats in circulation dropped rapidly, the accruals of both households and businesses returning to banks and an increasing amount of transactions taking place by way of noncash currency. The total money supply in December was raised by such factors as an increase in government expenditure in the last month of the year and the successful economic growth.

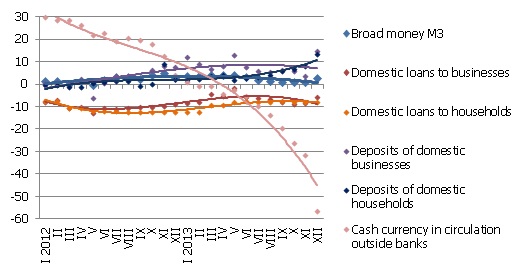

Money indicator M3, which reflects the amount of cash and noncash currency in the economy, rose in December by 2.7%, with the rate of its annual increase at 2.8%. The amount of cash lats in circulation dropped by 253.3 mil. lats (360.4 mil. euro) in December, by 56.6% behind the level at the end of 2012. That was one (but, as already mentioned, not the only one) of the factors that was behind the record month-on-month rise in business and household deposits – by 507.3 mil. lats (721.8 mil. euro). The rise in demand deposits was the most substantial, but term deposits and deposits redeemable at notice also grew in December.

Household deposits grew rapidly in December (by 6.3%; annual growth rate at 13.2%), but the rise in the deposits in non-financial enterprises was even faster (11.7% month-on-month, 14.8% year-on-year). Overall, the balance of domestic deposits with banks reached 6.4 billion lats (9.2 billion euro) at the end of the month.

Illustration. Year-on-year changes in some money indicators s (%)

Source: Bank of Latvia

Even though December for several years has been a month characterized by a substantial contraction of the loan portfolio both because of increased repayments of loans and writing off bad loans, only loans granted to households shrank in December 2013, and the total loan portfolio of banks diminished by a mere 0.6%. The loans granted to businesses increased for a second consecutive month and the rate of their annual drop improved to 4.9% and the rate of the overall annual drop in loans to 6.4%.

The December dynamic of monetary indicators points to a substantially faster than expected growth in deposit volume in banks, which was related to replacing lats cash currency with accruals of funds in bank accounts. This could be evidence not only of the effect of the positive growth of the economy but also of changes in habits stimulated by the euro changeover: an increasingly widespread decline of cash transactions. This is supported, for instance, by the data of the Association of Latvian Commercial Banks: in the first half of January, there was a 20-30% year-on-year increase in transactions using payment cards.

Textual error

«… …»