A Ray of Hope through the Mist of Lending

In January, the total balance of bank loan portfolio as well as lending to households did not actually change, while loans granted to non-financial corporations increased only somewhat. The outlook for lending, at the same time, has slightly improved due to the amendments the Saeima made to the Insolvency Law of Latvia and the Law on Consumer Rights Protection as well as in anticipation of the effects from the ECB's fairly extensive new monetary stimulus package.

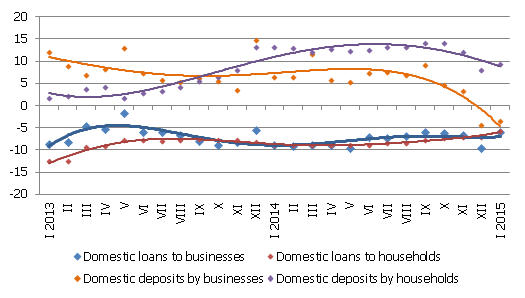

The aggregate domestic bank loan portfolio actually did not change in January, loans granted to households contracted by a mere 0.1%, while loans to non-financial corporations picked up 0.3%. Under the impact of the base effect (two credit institutions gave up their banking licences last January) the annual rate of decrease in total loans improved notably (by 2.7 percentage points) to -4.4% (including to -5.9% for loans to non-financial corporations and to -5.6% for loans to households for house purchase).

In January, the total balance of bank attracted domestic deposits posted a seasonal decline by 2.1%, which was below the low level recorded in December yet still by more than 150 million euro above the November indicator. As the deposits of non-financial corporations contracted substantially while those of households only somewhat, the total domestic deposits attracted by banks exceeded the level of January 2014 by 3.8% (including a 9.4% increase in household deposits and a 3.5% decrease in non-financial corporation deposits year-on-year).

Regarding the changes in Latvia's contribution to the euro area monetary aggregate M3, overnight deposits and deposits with agreed maturity of up to 2 years by the euro area residents with the Latvian credit institutions contracted by 0.7% and 7.2% respectively in January; meanwhile, deposits redeemable at notice increased by 1.4%. In the first month of the year, a seasonal decrease affected also currency in circulation, and, consequently, Latvia's overall impact on money supply in the euro area was on the downside.

Figure. Annual changes in individual monetary aggregates (%)

Source: Latvijas Banka

Even though the domestic economic slowdown and persisting geopolitical tensions adversely affecting the foreign market outlook, the two underlying factors behind the sluggish lending activity, have not lost their importance, some other developments are likely to have a positive impact on the lending activity. Among them, mention should be made of the amendments the Saeima made to the Insolvency Law of Latvia and the Law on Consumer Rights Protection, which once again have brought some hope for the revival of mortgage lending and for the involvement of several major banks in the state support programme for families for house purchasing. Furthermore, as the economies of Latvia's euro area partner countries are recovering, positive results are expected to emanate from the monetary stimulus measures already implemented and projected for the future by the Eurosystem. They will drive the demand for Latvian exports and increase the inflow of financing into export-oriented sectors.

Textual error

«… …»