Lending to businesses – the driver of economic growth regains momentum

For Latvijas Banka Monthly Newsletter, In Focus, November, 2016

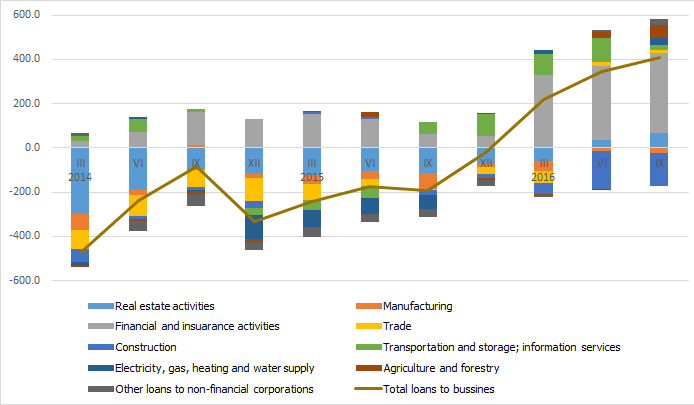

Due to the experienced economic crisis, the instability of the external demand, the poor state of legal environment and other factors, banks had significantly restricted granting of new loans for several years. Moreover, the borrowers' demand was also relatively low. If 2015 saw the first weak signs of recovery of corporate lending with a minor increase in the loan portfolio recorded in some months, 2016 shows very clear positive trends in lending to businesses. As of April, the portfolio of loans granted to non-financial corporations has shown monthly increases, while that of loans granted to businesses from the non-bank financial sector – already starting with February. Loans granted to businesses have increased by 443 million euro in the first nine months of this year (compared to a rise of only 50 million euro in the corresponding period of 2015), while the annual growth rate of loans reached 5.6% at the end of September. New loans have even recorded a more rapid increase, with new loans (excluding revised loans) to non-financial corporations totalling 1.2 billion euro in January–September 2016 and constituting a year-on-year rise of 36%. As can be seen in the chart below, the increase in the portfolio of loans granted to businesses across sectors has been largely spurred by credit inflows in the financial and insurance sectors. Bank loans have been mostly used by the financial services sector, including the financial leasing sector, as the growing leasing and factoring market requires financing. It should be noted that the amount of funds obtained by non-financial corporations via leasing and factoring exceeds 1 billion euro, equalling 17% of the portfolio of bank loans granted to non-financial corporations in June 2016. On the other hand, the financing of leasing companies to non-financial corporations almost equals bank loans to non-bank financial institutions in terms of volume. Namely, also loans granted to financial institutions via leasing companies largely flow into the real economy sector to support the financing of the purchases of equipment and transport vehicles.

By contrast to 2015, when a moderate growth in lending to financial sector businesses was only complemented by credit inflows in the transportation sector, 2016 can be characterised by positive lending growth in most economic sectors. At the same time, agriculture, particularly crop production and, to a small extent, also forestry, energy, and trade (wholesale) likewise recorded an increase in loans in the first nine months of this year. With the real estate market gradually recovering, real estate mirrored the same trend. Although loan investment in manufacturing has contracted even further, it has recorded increases in sub-sectors such as the manufacture of food products, textiles, wood, fabricated metal products, furniture and the pharmaceutical industry. Construction is the only sector where lending has declined considerably; however, it could expect significant loan investment inflows to ensure co-financing already in the near future, along with the more efficient absorption of European Union funds.

Under the current circumstances, further growth in lending to businesses is vital for long-term economic growth. Investment supporting competitiveness, exports and capitalisation, co-financing necessary for the absorption of European Union funds, loans for the construction of commercial objects, involvement in financing private and public partnership projects and the state-supported programme for heat insulation of multi-apartment houses are good goals to benefit from the Eurosystem's accommodative monetary policy and the low level of interest rates. A particularly rapid rise in loans cannot be expected since various contrary factors affecting lending will play a role simultaneously. Among the factors which support lending are, for instance, increased activity in the real estate market, construction of selected infrastructure objects, bank savings of businesses to ensure a higher level of self-financing and support provided by the European Investment Fund to grant loans to small enterprises, etc. Meanwhile, the factors restricting lending include, e.g. uncertainty that is more related to global, yet also domestic developments. However, lending growth will continue.

Structures of annual changes in the loan portfolio of the domestic enterprise (millions of euros)

Textual error

«… …»