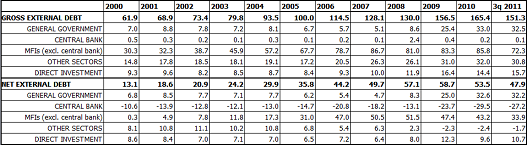

Explaining the difference between Latvia's gross and net external debt*

The gross external debt of an economy represents the outstanding amount of its actual (i.e. non-contingent) current liabilities that require payment of principal and/or interest to non-residents at some point in the future. These liabilities include debt securities, such as bonds, notes and money market instruments, as well as loans, deposits, currency, trade credits and advances due to non-residents. The debt may be issued with different maturity profiles by the general government, banks, and other sectors.

Gross external debt per se only captures one side of an economy’s external exposure to international debt markets. In effect, the net external debt position, obtained by subtracting the gross external debt assets from the liabilities, provides additional insights into the sustainability of external debt. The countries in which the financial sector plays an increased international role, relative to the size of the respective economy, tend to have high gross external debt, as it is in the case of Latvia. But this does not necessarily mean that the net debt position is also as high.

The sharp increase in external financing since 2000 has been accompanied by a marked shift in its composition. In 2000, when Latvia’s financing requirement (defined as the sum of the current and capital account deficits, errors and omissions, and changes in reserves) was 5¼ percent of GDP, FDI was the primary source of funding. Since 2004, however, external bank borrowing—largely from foreign parent banks—has become the dominant source of foreign financing. The counterpart to this increase in bank foreign borrowing has been the rapid expansion in bank lending to residents that is not covered by accumulation of residents’ deposits. With deposits increasing at a much slower pace than credits, rising net foreign liabilities of banks (including borrowing from parents) have made up the shortfall.

This, however, explains only the build-up of net external debt that, while having increased since early 2000s, remains at a rather comfortable level. Net external debt has peaked in 2009 at 58.7% of GDP and since then has been steadily declining to stand at the estimated 45.9% at the end of 2011. However, gross external debt is still considerably higher compared to net external debt. Having decreased significantly from its peak of 165.4% of GDP in 2010 to the estimated 147.5% of GDP at the end of 2011, gross external debt can still be considered rather high. While at the first glance this may appear as vulnerability for the Latvian economy, an in depth analysis reveals that risks associated with high gross external debt are rather contained.

Why high gross external debt does not represent a significant vulnerability to Latvia's economy?

Large part of MFI's gross external liabilities is counterbalanced by foreign assets; most of remaining banks' gross external debt represents intra group borrowing.

- It should be mentioned that the Latvian banking system has been represented by two groups of banks: those concentrating their activities on the domestic market and those focusing on non-residents business activities. The former group of institutions in terms of assets represents about two thirds of the total banking system; it is almost 100% foreign-owned with the Scandinavian capital dominating. The latter group, representing about one third of the total banking system, consists of domestically owned institutions. These banks attract non-resident deposits and invest the collected funds primarily in liquid assets abroad thus creating a sizable foreign asset side which explains large part of the significant difference between Latvia's gross and net external debt.

- The business model of the Latvian banks with the non-resident focus has been developing since early 1990s. Latvian financial institutions became stable much earlier than financial institutions in Russia and other CIS countries. As a result, individual private clients and businesses residing in Russia and CIS have started to use Latvian banking system for their cross border transactions.

- Latvian banks and financial stability authorities are aware of volatility of non-resident financial flows. Hence, the financial institutions that attract non-resident deposits have adequate safety buffers in a form of liquid foreign assets; liquidity ratio of such institutions (at 72.3% in December 2011) exceeds the Latvia's banking sector average (63.9% in December 2011). The supervisory authority of Latvia also requests higher capital buffers for the institutions following this business model. The existing business model proved to be sustainable during the most recent financial crisis, when banking system experienced strong fluctuations both in resident and in non-resident deposits. Notwithstanding outflows in late 2008 and 2009, non-resident deposits have recovered and even expanded by 13% in 2011.

As regards other sectors' external liabilities, substantial part of those is intercompany lending between foreign (mother) and domestic (daughter) companies.

The share of public debt has been increasing recently; however, it is still relatively limited and government has managed to stabilize its finances successfully graduating from the IMF/EC program. The country has re-established its name in international capital markets with a USD 500mn 10-year and a recent USD 1bn 5-year bond issues that will largely be used for the refinancing of the past loans provided by international institutions. Further on, a stabilisation of public debt to GDP ratio is expected as budget deficit has been contained and has been recently staying at low level.

Latvia's gross and net external debt (% of GDP)

Foreign financial assets and liabilities of Latvian banking sector

(Breakdown by balance sheet positions; Dec 2011, LVL million)

| Claims on MFI | Loans | Securities | Liabilities to MFI | Deposits | |

| Subsidiaries of bank groups of EU15 countries | 1,104.1 | 503.1 | 178.4 | 4,657.6 | 426.5 |

| Other banks | 2,039.5 | 904.3 | 894.0 | 115.4 | 4,687.9 |

| Total | 3,143.6 | 1,407.5 | 1,072.4 | 4,773.1 | 5,114.3 |

*Sources: Bank of Latvia, ECB, IMF

Textual error

«… …»