Positive trends emerge in lending

Ever more often the media report on lending to the development of various projects and in August these found a confirmation in numbers. The portfolio of loans granted to businesses has increased by 0.8% month-on-month, which is the most rapid monthly rise over the past two years. The total amount of domestic deposits attracted by banks has increased for the third consecutive month.

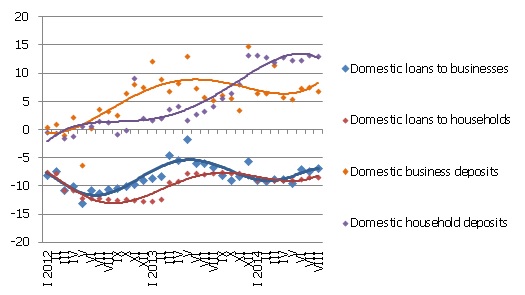

Business and household deposits in August grew by 0.9%, with the domestic deposit year-on-year growth rate at 10.4%. Both the household and business deposits grew moderately; the former by 0.5% (annual growth rate in August at 13.1%) and the latter by 1.4% (annual growth rate at 7.3%).

As to the changes in the Latvian contribution to the common euro area indicator M3, the overnight deposits by the euro area residents with Latvian credit institutions increased by 2.8% in August and deposits redeemable at notice by 0.3%, whereas deposits with a maturity of up to 2 years dropped by 3.7%. Thus, with the amount of cash currency in circulation practically unchanged, the overall Latvian impact on the euro area money supply was positive.

The total bank loan portfolio in August rose by 0.2%, with the annual drop rate improving to 6.6%. With both loans to non-financial enterprises and those to financial mediation enterprises (latter for a sixth consecutive month) growing and the household loan portfolio dropping only slightly, the total balance of loans grew in August for the first time since November of last year. As for lending to households, only the housing loan balance dropped whereas consumer lending grew for a second consecutive month. The annual drop rate in August was 5.0% for loans granted to businesses and 8.5%. for loans granted to households.

Fig. Year-on-year change for some money indicators (%)

Source: Latvijas Banka

Since risks in the external markets remain and a rapid growth of the Latvian economy is not expected in the near future, accruals of funds with banks could be increased by the wish to establish a security reserve, therefore the overall level of deposits with banks will continue to rise gradually. The positive lending indicators in August do not yet hold any promise of a substantial increase in lending, yet the annual drop rate for loans will continue to improve. As the participants in the "Expert Conversations" recently held at Latvijas Banka agreed, there are several factors that tend to impede the development of lending in Latvia. Recovery of lending at the level of the euro area will be promoted by the decisions made by the European Central Bank directed at the resumption of lending.

Textual error

«… …»