On macroeconomic forecasts by Latvijas Banka. September 2020

Conclusions and Forecasts

Owing to the gradual lifting of restrictions along with successful COVID-19 containment in Latvia and a somewhat more optimistic sentiment among consumers and businesses, in the second quarter the economic downturn was less pronounced than expected, and in the summer months several sectors already almost reached their previous business volumes. At the same time, the economic sentiment both in Latvia and its major trade partners was stabilised by the government support measures and the expected financing under the European economic recovery instrument "Next Generation EU". This contributed to a slight upward revision of the external demand assessment as well as the assessment of the domestic income and consumption levels which have been estimated to be more resilient. The latest global and regional pandemic developments call for more caution with respect to the fourth quarter outlook, a trend already suggested by the sentiment survey results.

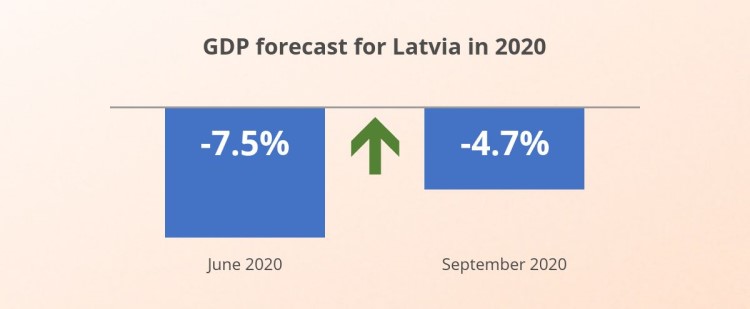

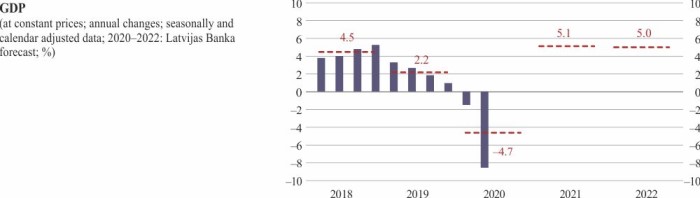

Taking into account the above data and the current developments, the GDP contraction forecast for 2020 has been revised upwards to –4.7% (–7.5% in June). Over the medium term, the GDP is expected to increase on account of higher external demand as well as the financing under the European economic recovery instrument which will facilitate new investment and exports. The 2020 performance was better than previously projected; the GDP growth forecast for 2021, however, was revised downwards to 5.1%, as opposed to 6.7% projected in June. The outlook for the sectoral growth drivers has remained unchanged in most sectors. Nevertheless, the actual situation in the first half of 2020 in many sectors turned out to be better than estimated in June, and the 2020 forecast was revised mainly on account of the latest data.

As before, the recovery is still projected to be the slowest in the hospitality sector as well as the recreational and cultural services sectors since several mass events can no longer take place or they have been postponed. Moreover, such events cannot be organised within a short time-frame after the easing of restrictions. As was already expected, the transport sector might not regain its previous role in the economy over the medium term. The sector's growth assessment for 2020 has not deteriorated; however, in addition to the impact of the fundamental factors observed so far, over the medium term the sector will also be affected by the European Commission Mobility Package adopted in July. With external demand recovering, manufacturing growth is expected to improve. The development of the construction sector will be supported by government investment over the medium term.

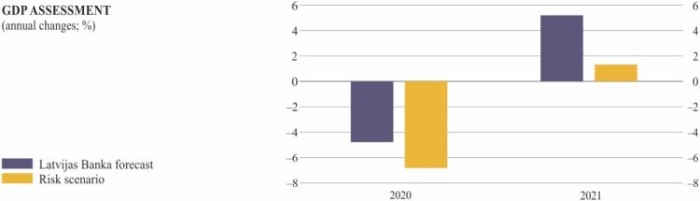

Mass restrictions implemented domestically and in Latvia's major trade partners in response to the second wave of the pandemic may cause yet another contraction in GDP in 2020 (for Latvijas Banka's assessment of the potential impact of a repeated COVID-19 outbreak on Latvia's GDP growth, see Box 2).

Potential impact of a repeated Covid-19 outbreak on Latvia's GDP growth

At the beginning of the summer, the number of infection cases decreased considerably in most EU Member States. In view of the favourable conditions, the governments of the above countries eased their restrictions[1], thus supporting the gradual recovery of economic activity. However, the number of cases in the EU started to increase rapidly towards the end of the summer. Moreover, in several countries, e.g. Croatia, Greece and Romania, the 14-day cumulative number of COVID-19 cases per 100 000 people is already higher than in the spring [2] . However, despite the rapidly growing infection indicators, the governments have not yet introduced restrictions similar to those implemented in the spring.

With the number of cases growing further, discussions on the tightening of restrictions may become increasingly important, inter alia, in Latvia. Although the current [3] number of cases in Latvia is lower than in most EU countries, a repeated rise in the number of cases and renewed tightening of restrictions in Latvia and other countries may pose a potential risk that would negatively affect Latvia's economic growth.

The impact of the materialisation of such a risk on Latvia's economic growth is illustrated with the help of the dynamic factor model [4] based on the following assumptions:

1) with the number of cases growing and the restrictions becoming tighter, in October the dynamics of the model's leading indicators follows that observed in April 2020 (with the respective level also remaining unchanged in November and December);

2) in the first quarter of 2021, the economic growth will accelerate rapidly according to the projections made in the third quarter of 2020;

3) during other periods, the GDP dynamics correspond to Latvijas Banka's forecasts (as published in the Macroeconomic Developments Report).

The obtained results (see Chart 32) suggest that in the event of such a scenario, the 2020 GDP fall would be much more significant than expected according to Latvijas Banka's forecasts. Moreover, the slowdown in economic activity would have a material negative impact on GDP changes in 2021.

However, the calculations do not take into account the fact that households and businesses may be better equipped to adapt to a repeated economic shock, should the number of cases increase and restrictions become tighter. Therefore, the obtained results most likely reflect a relatively pessimistic view on the potential impact on GDP changes.

It is also possible that the escalation of the political situation in Belarus and the potential imposition of economic sanctions could result in a decline in the demand for freight transportation. In should be noted, however, that GDP growth may be stronger in the projection period in the event that a medical solution for COVID-19 is developed rapidly and successfully and the use of funds available under the European economic recovery instrument "Next Generation EU" is purposeful and oriented towards innovation and productivity and their provision is not delayed significantly.

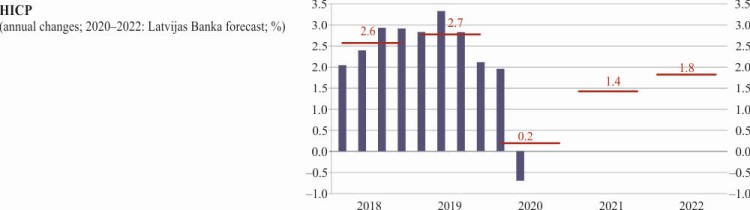

Given that the contraction in economic activity was less pronounced than expected and the labour market situation improved significantly, the inflation forecast was revised upwards. The inflation is expected to stand at 0.2% in 2020 (as compared to 0.0% in the June forecast) and reach 1.4% in 2021 (as compared to 0.2% in the June forecast). The projections were revised upwards mainly on account of a significantly better labour market situation and steeper wage growth than expected. Looking by component, the services sector was the biggest contributor to the upward revision of inflation. The current forecast has been produced based on the 2020 average oil price of 43 US dollars per barrel (the average oil price used in the June forecast was 36 US dollars per barrel).

Risks to the inflation forecasts are balanced. If the VAT on the local fruit and vegetables remains reduced for an extended period, inflation in 2021 might be 0.2 percentage point lower. While a significant impact of supply chain disruptions on inflation has not been observed so far, the next COVID-19 outbreak may result in tighter logistics restrictions and, thus, higher inflation.

[1] Oxford Covid-19 Government Response Tracker.

[2] European Centre for Disease Prevention and Control.

[3] In the first half of September 2020.

[4] For the purposes of forecasting the GDP quarterly growth rate, the model incorporates information on several leading indicators (retail trade turnover index (excluding the retail trade of automotive fuel), employment expectations index and industrial output index). The model specification is similar to that described by Boriss Siliverstovs in his research papers of 2012 and 2016 (Siliverstovs, Boriss. Are GDP Revisions Predictable? Evidence for Switzerland. Applied Economics Quarterly (formerly: Konjunkturpolitik), Duncker & Humblot, Berlin, vol. 58, issue 4, 2012, pp. 299–326. https://elibrary.duncker-humblot.com/journals/id/22/vol/58/iss/1630/art/6995/; Siliverstovs, Boriss. The Franc Shock and Swiss GDP: How Long Does It Take to Start Feeling the Pain? Applied Economics, Taylor & Francis Journals, vol. 48, issue 36, August 2016, pp. 3432–3441. https://www.tandfonline.com/doi/full/10.1080/00036846.2016.1139678).

Textual error

«… …»