No substantial change in deposit and loan level in March

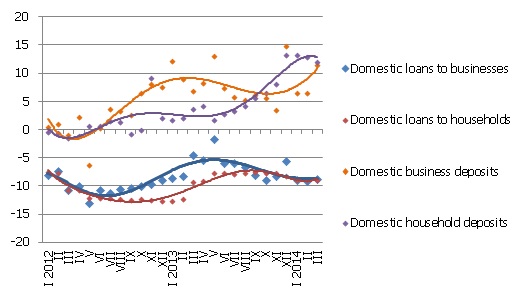

No substantial changes in money indicators were observed in March. A slight drop in household deposits was counterbalanced by a rise in the deposits of non-financial enterprises, whereas the total amount of domestic deposits was diminished by a drop in the accruals of financial intermediaries. The traditional shrinking trend remained in lending in March, with both the loans to non-financial companies and households dropping slightly.

Business and household deposits in March shrank by a total of 0.4%, with the deposits of non-financial companies rising by 0.6% and those of households and financial intermediaries dropping by 0.4% and 11.3% respectively. The rate of annual growth for household deposits remained higher (12.0%), yet it was approximated by the annual growth indicator of non-financial enterprises (11.5%).

As to the changes in Latvia's contribution to the total euro area money indicator M3, the overnight deposits of euro area residents with Latvian credit institutions increased by 0.6% in March, deposits with the set maturity of up to 2 years by 2.9% and deposits redeemable at notice by 0.6%. Even though the amount of cash currency in circulation dropped slightly, the overall impact of Latvia on the euro area money supply was positive.

In March, the banks' domestic loan portfolio shrank by 0.5%, with loans granted to businesses dropping by 0.5% and those granted to households dropping by 0.6%. At the same time, lending to financial intermediaries increased slightly and so did the consumer loan portfolio. The indicator of the annual rate of drop of loans also improved: in March, it was amounted to 8.7%, including loans to businesses undergoing an annual drop of 8.5% and those granted to households shrinking by 8.9%.

Illustration. Year-to-year changes in some money indicators (%)

Source: Latvijas Banka

With economic growth in the positive range, the level of deposits with banks will gradually rise over next year. It will be positively impacted by the residents' wish to develop a certain safety deposit reserve as their incomes grow. Yet deposit growth will not be rapid if the substantial external risks remain, which could act to diminish income from export and slow down a rise in business deposits. Because of these risks we can hardly expect any activation in the lending processes that would stimulate the economy. In the second half of the year, the situation could be impacted also by the newly adopted amendments to the Law on Consumer Rights Protection, which stipulate stricter requirements for lending to consumers.

Textual error

«… …»