Money supply on the rise: how to make money flow into the economy?

For quite a long time and good reason, money has been looked upon as the blood circulation system of the global economy; with respect to such interpretation, Latvia is not an exception. With money servicing a vast range of economic transactions, its volume indicators and the dynamics of changes and components describe the economic development processes in quite a detailed way both in the peaks and troughs of the economic cycle. What are the main monetary aggregates used in the macroeconomic analysis in Latvia and how have they been behaving in the last couple of years of the most complex situation ever since the days the country regained its independence?

Monetary aggregates are typically classified by the capital letter M (money) in combination with a numeral (M1, M2, and M3); a smaller numeral defines a narrower money aggregate. Narrower aggregates of money supply refer to most liquid assets that can be easily used and put into circulation in the form of cash or deposits. Meanwhile, broader aggregates including long-term deposits, etc. give the perspective of the longer-term trends, e.g. investment and lending growth opportunities. However, these aggregates per se only describe "the blood count": to have it changed and to have the money flow into the economy, decisive are the activities of the economic agents, i.e. banks and governments (to be dealt with hereinafter).

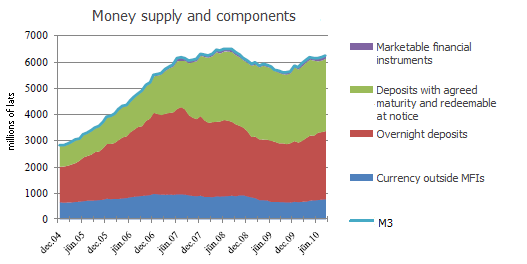

Broad money M3 is the broadest measure of money supply, currently in the amount of 6.3 billion lats. More than a half of the total money supply is made up of cash and demand deposits attracted by banks (3.4 billion lats), i.e. the funds on corporate and household settlement accounts. It is monetary aggregate M1 that captures the very nature of money as a payment instrument, for both cash in circulation and demand deposits via payment cards, bank transfers and internet banking can be used immediately at any moment. Meanwhile, other deposits, primarily functioning as saving means and marketable instruments that by nature are closer to investment, are included in the next levels of money supply.

Along with these indicators, monetary situation is also characterised by velocity of money (GDP ratio to broad money), showing the rate at which money circulates or turns over in an economy in a given period, e.g. a year, to service a number of transactions. Currently, the velocity of money in Latvia is slightly above 2, displaying a tendency to gradually decline on the backdrop of deepening financial system (at the end of the 1990s, the money stock turned over in the economy around 4 times on an annual basis).

Following a steep rise in the pre-crisis period when money supply was particularly fuelled by the lending boom, the development of monetary aggregates initially captured the sharp economic downturn at the end of 2008 and in 2009 due to abating of both the domestic and external demand, the enormous uncertainty, and the effects of the global financial crisis on Latvia's banking system and money market. Last autumn, however, with the economy and external demand stabilising, the increase in the money supply revived. During the period of downturn from July 2008 to October 2009, broad money M3 contracted by a total of 14%; by contrast, in the next 10 months up to August of 2010, M3 expanded by 12% thus coming quite close to a pre-crisis high. The domestic consumption, which remained rather low in the situation of fund availability improving, confidence in the financial sector strengthening, funding under international loan agreements expanding and exports continuing on an upward trend, spurred a pick-up in domestic deposits. Since the previous autumn, deposits have increased by 10% or 490 million lats. In the respective period, currency in circulation has likewise augmented by more than 100 million lats or 18%.

As the demand for cash accelerated, demand deposits account for almost 4/5 of the growth in overall deposits, and savings activities focused more on cash and settlement accounts in the past year, while time deposits grew at a slower rate. As to the latter, money gets "frozen" to a smaller or larger extent for quite a time, therefore this option was less popular during the economic downturn and in the first period of economic stabilisation. On account of the complex economic circumstances, uncertainty surrounding the drafting of the 2011 budget, and political activities of the pre-election period both businesses and households temporarily invested their free liquidity in easily marketable albeit less remunerated assets.

The decisive triggers for lending to dry up were bank precautionary stances towards lending in the circumstances of impaired loan quality and subdued willingness to borrow resulting from the weak domestic demand.

In this context the results of the recent Saeima (Parliament) election are of enormous importance. The anticipated continuity in the formation of the new government and effective adoption of the 2011 budget are most likely to direct depositors towards longer-term depositing and, via boosting investors' confidence, to re-establish and enhance the inflow of foreign investment as well as gradually increase quality demand for credit resources. This will reduce bank risk perceptions and enable banks to lift at least some of the obstacles so far confining their lending activities.

Some signs of improvement in lending have already surfaced: in some of the first eight months of 2010, the total bank credit portfolio remained almost unchanged (currently at 12.9 billion lats or 104% of gross domestic product), while loans to individual categories of borrowers, e.g. corporations, slightly expanded. The ability of banks to succeed in both discontinuing the downward trend in the credit portfolio and expanding the scope of lending is likely to gain in importance in the near future. Predictability of the political situation is apparently going to facilitate a better outlook of the population and businesses, thus also enhancing the demand for loans. Moreover, along with the expanding production volumes, capacity utilisation in manufacturing has been on the rise since the middle of 2009, with businesses' estimates regarding adequate capacity to accommodate new orders worsening. Consequently, the possibility to further boost production volumes will increasingly depend on new investments and the ability of businesses to finance them via borrowing.

Thus, the future activities of the government and banking sector will demonstrate whether banks are strongly enough motivated to channel available resources into the development of the economy and whether potential borrowers have trust in the stabilisation and outlook of the economic and political environment.

The article was published by Delfi on 12 October 2010.

Textual error

«… …»