Money indicator development trends remain favourable

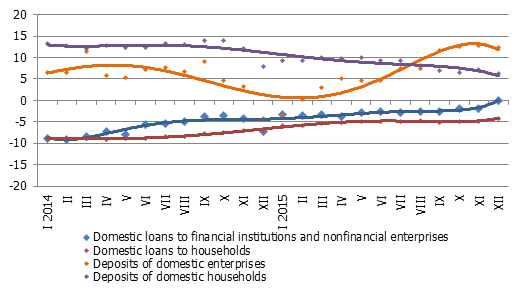

In December, the month-on-month growth of deposits attracted by banks was the seasonally fastest in 2015: +3.4%, yet it slightly lagged behind the rate of growth in the last month of 2014. The year-on-year growth indicator thus dropped slightly. The payback of short-term loans and writing off of bad loans characteristic of December moderately reduced the domestic loan portfolio. Yet the drop was less than half that of December 2014, which resulted in a radical improvement in the annual rate of decrease in loans (by 1.4 percentage points, to-1.8%).

The total balance of bank attracted domestic deposits increased by 343 mil. euro in December, with their annual rate of increase at 9.0% and the deposits of both enterprise and household deposits growing. The annual rate of growth of enterprise deposits reached 12.3%, but that of households 6.3%.

Latvia's contribution to the euro area's total money indicator M3 was positive. The overnight deposits with Latvian credit institutions by the euro area residents increased in December by 3.2% and deposits redeemable at notice by 4.1% and deposits with maturity set at up to two years dropped by 4.3%. Overall, the Latvian contribution to the euro area M3 increased by 2.5%, with the year-on-year growth of 9.2%.

In December, the domestic loan portfolio of banks decreased by 0.9%, including loans to nonfinancial enterprises by 1.0% and loans to households by 0.7%. The annual rate of drop of total domestic loans decreased substancitally while the annual rate of change for loans to domestic financial institutions and nonfinancial enterprises moved slightly into the positive sector (+0.02%) for the first time since 2009.

Chart 1. Y-y changes of some money indicators (%)

Source: Latvijas Banka

The positive direction of the Latvian economy continues to be borne out by the dynamic of monetary indicators. If month-on-month changes are not always so clear, then, looking at the dynamic of deposits and loans in a 12-month interval, positive changes are obvious. If in December 2014, the rate of rise of domestic deposits was only 3.4%, in December 2015, it was three times faster, whereas the rate of drop for loans has decreased from -7.1% to less than -2%. within 12 months. The dynamic of economic development and activities of the banking sector give reason to expect a similar dynamic of deposits and lending in 2016 as well.

Textual error

«… …»