Monetary aggregate dynamics reflects slower economic activity growth

In April deposits with credit institutions and aggregate money supply expanded slightly, while demand for cash fell and the total loan portfolio recorded a moderate decrease. Thus, with the major growth trends remaining unchanged, the dynamics of monetary aggregates generally reflected a fall in the economic growth.

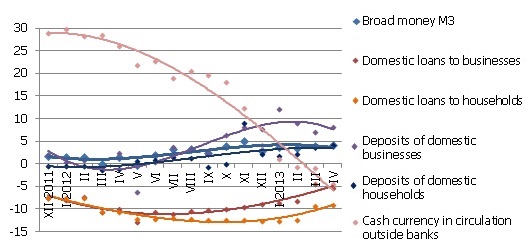

Monetary aggregate M3 which reflects the amount of cash and non-cash instruments in the economy, increased by 0.7% in April, recording a 4.2% rise year-on-year. Domestic overnight deposits and deposits redeemable at notice posted an increase whereas deposits with an agreed maturity of up to two years continued on a downward trend. With economic agents increasingly preferring bank accounts when dealing with their settlements and savings, the amount of currency in circulation shrank by 2.9% over the month, recording a 4.5% year-on-year drop at the end of April.

Chart. Annual change of some monetary aggregates (%)

Source: Bank of Latvia

In April domestic household deposits expanded by 22.9 million lats, with the stable situation in the financial sector and the growing household income (on account of moderating unemployment) contributing to the increase. The sustained domestic demand and positive economic growth also ensured a considerable pick-up in corporate deposits (plus 42.9 million lats); however, the increase in deposits was hindered by the repayment of loans as well as higher expenditure on purchases of import goods in March and slower income growth from exports.

In April, with the repayment of short-term loans persisting, loans granted to non-financial corporations contracted by 0.7% and household loan portfolio shrank by 0.5% as a result of further repayment of loans for house purchase. Consequently, the annual rate of decrease in loans granted to households improved to 9.1%, while the annual drop in loans to non-financial corporations stood at 5.4%.

The slight rise in money supply in April suggests that the impact of the external demand developments could gradually become more pronounced in the coming months and, along with a fall in demand for cash, cause a decline in the aggregate money supply. Nevertheless, the persisting increase in household deposits points to stable domestic demand and suggests a positive contribution to money supply, reducing the impact of the above negative factors. Looking at a short-term horizon, lending growth cannot be expected yet; however, corporate lending growth is likely to resume next year, although the household loan portfolio will obviously still continue on a downward trend.

Textual error

«… …»