A moderate rise in money supply continues

Total money supply grew slightly in June, as a result of a rise in household deposits and a slight rise in demand for cash currency. Under the impact of the repayment of a large loan granted some time ago for real estate, total domestic loan portfolio of credit institutions was reduced.

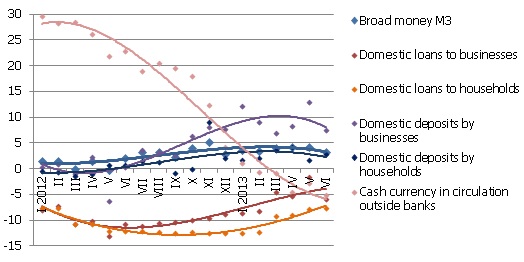

Money indicator M3, which characterizes the cash and noncash amount of money in the economy, in June rose by 0.5% and its annual growth rate was at 3.3%. Just as in previous months, overnight deposits and deposits redeemable at notice grew but deposits with an agreed maturity of up to 2 years dropped. In June, for the first time in this year, seasonal factors – vacations and Midsummer holidays – caused the demand for cash currency to grow slightly, yet this growth was much slower than in June of previous year. The overall trend – the drop in cash currency amount as euro introduction approaches – thus continued and the amount of cash currency in circulation at the end of June lagged behind the level a year ago by 5.2%.

Illustration. Year-on-year changes in some money indicators (%)

Source: Bank of Latvia

Domestic deposits by households in June grew by 35.4 mil. lats, whereas business deposits dropped by 18.5 mil. lats. A pronounced rise in settlement account balances continued both in the business and household sector as it was promoted by the determined progress toward the euro and the rising income levels.

The total balance of domestic loans dropped by 1.9% in June, including the balance of loans granted to businesses by 2.8% and the household loan portfolio by 0.7%. Since the bulk of the total drop in loans was accounted for by the above one-off large loan repayment, the drop in the total loan portfolio did not signal negative changes in the loan market. The annual rate of drop in the business loan portfolio in June was at 5.3%, and that in the household loan portfolio at 7.7%.

The stability in money supply points to a sustained growth of the Latvian economy. Despite the fact that the external environment has not improved, domestic consumption continues to grow, ensuring a corresponding level of money supply. Money supply is expected to remain stable in the future as well, however, a pronounced drop in the demand for cash currency will continue as a result of the final decision to invite Latvia to participate in the euro area. In the area of lending, barring the impact of some large one-off transactions or possible structural changes, we can expect further stabilizing and a moderate rise in lending to businesses.

Textual error

«… …»